Question: Topic 8: Cost Accumulation Systems Question 1 D & E Sdn. Bhd. manufactures a single product and uses normal costing system. The company calculated its

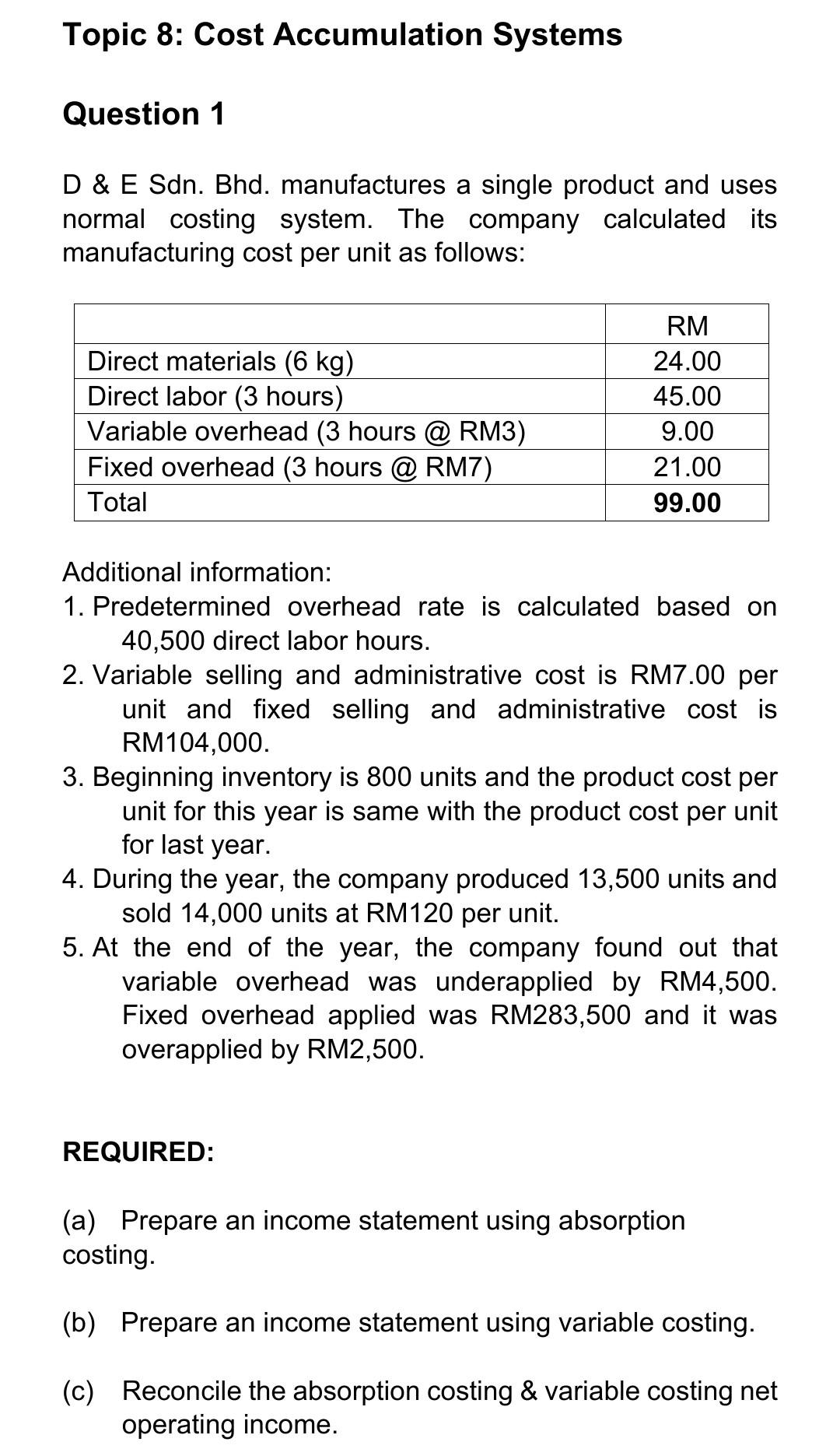

Topic 8: Cost Accumulation Systems Question 1 D & E Sdn. Bhd. manufactures a single product and uses normal costing system. The company calculated its manufacturing cost per unit as follows: Direct materials (6 kg) Direct labor (3 hours) Variable overhead (3 hours @ RM3) Fixed overhead (3 hours @ RM7) Total RM 24.00 45.00 9.00 21.00 99.00 Additional information: 1. Predetermined overhead rate is calculated based on 40,500 direct labor hours. 2. Variable selling and administrative cost is RM7.00 per unit and fixed selling and administrative cost is RM104,000. 3. Beginning inventory is 800 units and the product cost per unit for this year is same with the product cost per unit for last year. 4. During the year, the company produced 13,500 units and sold 14,000 units at RM120 per unit. 5. At the end of the year, the company found out that variable overhead was underapplied by RM4,500. Fixed overhead applied was RM283,500 and it was overapplied by RM2,500. REQUIRED: (a) Prepare an income statement using absorption costing. (b) Prepare an income statement using variable costing. (c) Reconcile the absorption costing & variable costing net operating income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts