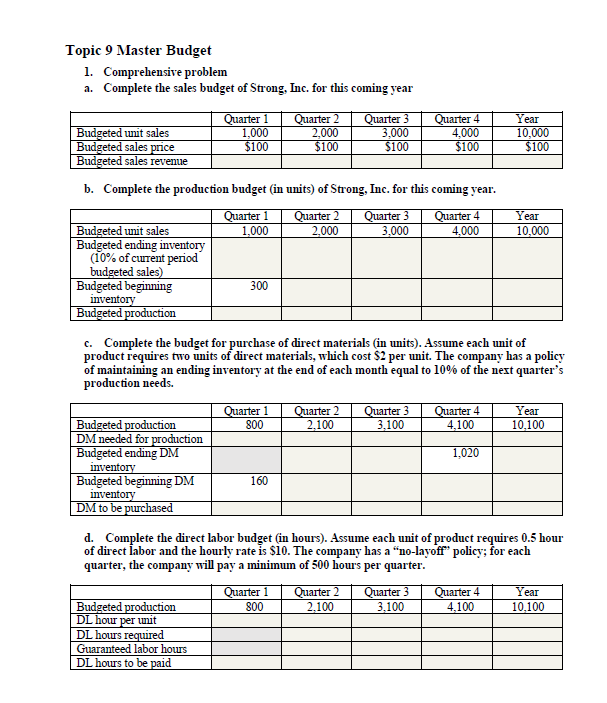

Question: Topic 9 Master Budget 1. Comprehensive problem a. Complete the sales budget of Strong. Inc. for this coming year Quarter 1 Quarter 2 Quarter 3

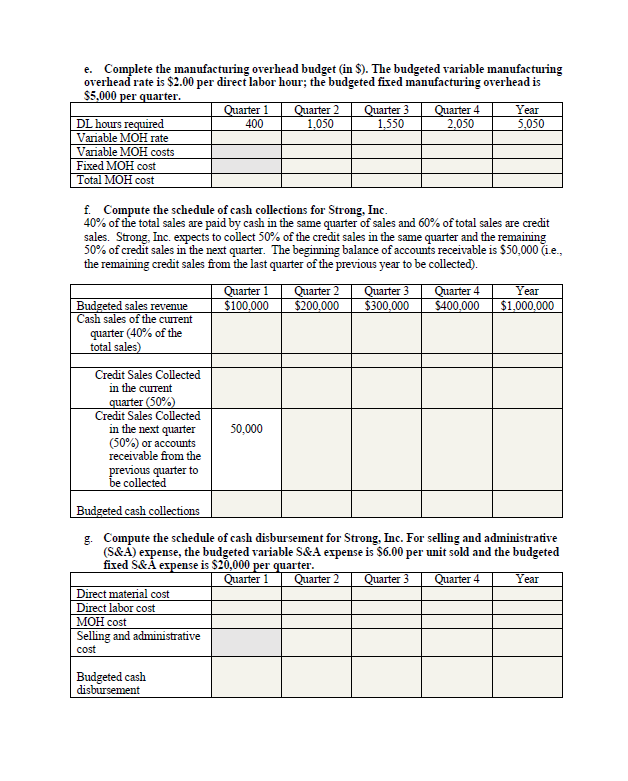

Topic 9 Master Budget 1. Comprehensive problem a. Complete the sales budget of Strong. Inc. for this coming year Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year Budgeted unit sales 1,000 2,000 3.000 4,000 10,000 Budgeted sales price $100 $100 $100 $100 $100 Budgeted sales revenue b. Complete the production budget (in units) of Strong, Inc. for this coming year. Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year Budgeted unit sales 1,000 2,000 3.000 4,000 10,000 Budgeted ending inventory (10% of current period budgeted sales) Budgeted beginning 300 inventory Budgeted production c. Complete the budget for purchase of direct materials (in units). Assume each unit of product requires two units of direct materials, which cost $2 per unit. The company has a policy of maintaining an ending inventory at the end of each month equal to 10% of the next quarter's production needs. Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year Budgeted production 300 2.100 3,100 4,100 10,100 DM needed for production Budgeted ending DM 1.020 inventory Budgeted beginning DM 160 inventory DM to be purchased d. Complete the direct labor budget (in hours). Assume each unit of product requires 0.5 hour of direct labor and the hourly rate is $10. The company has a "no-layoff" policy; for each quarter, the company will pay a minimum of 500 hours per quarter. Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year Budgeted production 300 2.100 3.100 4,100 10,100 DL hour per unit DL hours required Guaranteed labor hours DL hours to be paide. Complete the manufacturing overhead budget (in $). The budgeted variable manufacturing overhead rate is $2.00 per direct labor hour; the budgeted fixed manufacturing overhead is $5.000 per quarter. Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year DL hours required 400 1,050 1,550 2,050 5,050 Variable MOH rate Variable MOH costs Fixed MOH cost Total MOH cost f. Compute the schedule of cash collections for Strong, Inc. 40% of the total sales are paid by cash in the same quarter of sales and 60% of total sales are credit sales. Strong, Inc. expects to collect 50% of the credit sales in the same quarter and the remaining 50% of credit sales in the next quarter. The beginning balance of accounts receivable is $30,000 (i.e., the remaining credit sales from the last quarter of the previous year to be collected). Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year Budgeted sales revenue $100.000 $200,000 $300,000 $400,000 $1,000,000 Cash sales of the current quarter (40% of the total sales) Credit Sales Collected in the current quarter (50%) Credit Sales Collected in the next quarter 50,000 (50%) or accounts receivable from the previous quarter to be collected Budgeted cash collections g. Compute the schedule of cash disbursement for Strong, Inc. For selling and administrative (S&A) expense, the budgeted variable S&A expense is $6.00 per unit sold and the budgeted fixed S&A expense is $20,000 per quarter. Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year Direct material cost Direct labor cost MOH cost Selling and administrative cost Budgeted cash disbursement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts