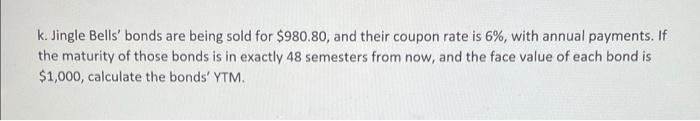

Question: Topic: BOND AND STOCK VALUATION solve by hand, using a financial calculator or excel. k. Jingle Bells' bonds are being sold for $980.80, and their

k. Jingle Bells' bonds are being sold for $980.80, and their coupon rate is 6%, with annual payments. If the maturity of those bonds is in exactly 48 semesters from now, and the face value of each bond is $1,000, calculate the bonds' YTM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts