Question: topic: capital investment decision b. analysis includes net present value Rector Company Rector Company is considering the purchase of a new machine. It's invoice price

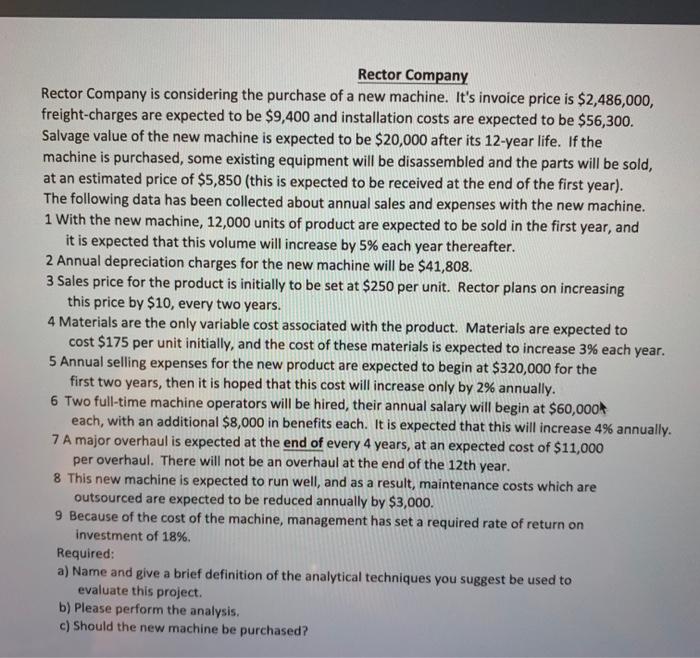

Rector Company Rector Company is considering the purchase of a new machine. It's invoice price is $2,486,000, freight-charges are expected to be $9,400 and installation costs are expected to be $56,300. Salvage value of the new machine is expected to be $20,000 after its 12-year life. If the machine is purchased, some existing equipment will be disassembled and the parts will be sold, at an estimated price of $5,850 (this is expected to be received at the end of the first year). The following data has been collected about annual sales and expenses with the new machine. 1 With the new machine, 12,000 units of product are expected to be sold in the first year, and it is expected that this volume will increase by 5% each year thereafter. 2 Annual depreciation charges for the new machine will be $41,808. 3 Sales price for the product is initially to be set at $250 per unit. Rector plans on increasing this price by $10, every two years. 4 Materials are the only variable cost associated with the product. Materials are expected to cost $175 per unit initially, and the cost of these materials is expected to increase 3% each year. 5 Annual selling expenses for the new product are expected to begin at $320,000 for the first two years, then it is hoped that this cost will increase only by 2% annually. 6 Two full-time machine operators will be hired, their annual salary will begin at $60,000* each, with an additional $8,000 in benefits each. It is expected that this will increase 4% annually. 7 A major overhaul is expected at the end of every 4 years, at an expected cost of $11,000 per overhaul. There will not be an overhaul at the end of the 12th year. 8 This new machine is expected to run well, and as a result, maintenance costs which are outsourced are expected to be reduced annually by $3,000. 9 Because of the cost of the machine, management has set a required rate of return on investment of 18% Required: a) Name and give a brief definition of the analytical techniques you suggest be used to evaluate this project. b) Please perform the analysis. c) Should the new machine be purchased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts