Question: Topic Corporate Finance. Please answer multiple choice question: Which of the following is True? a) In a Modigliani Miller setting, the return of levered equity

Topic Corporate Finance. Please answer multiple choice question:

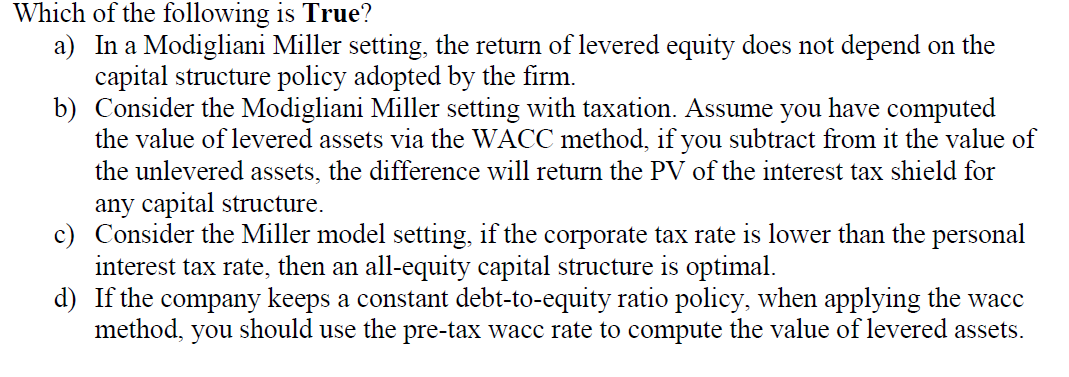

Which of the following is True? a) In a Modigliani Miller setting, the return of levered equity does not depend on the capital structure policy adopted by the firm. b) Consider the Modigliani Miller setting with taxation. Assume you have computed the value of levered assets via the WACC method, if you subtract from it the value of the unlevered assets, the difference will return the PV of the interest tax shield for any capital structure. c) Consider the Miller model setting, if the corporate tax rate is lower than the personal interest tax rate, then an all-equity capital structure is optimal. d) If the company keeps a constant debt-to-equity ratio policy, when applying the wacc method, you should use the pre-tax wacc rate to compute the value of levered assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts