Topic: Corporate Liquidation

need solutions please

Answers:

Problem 4: 1.D 2.A 3.A 4.B Problem 5: 1.C 2.A 3.D

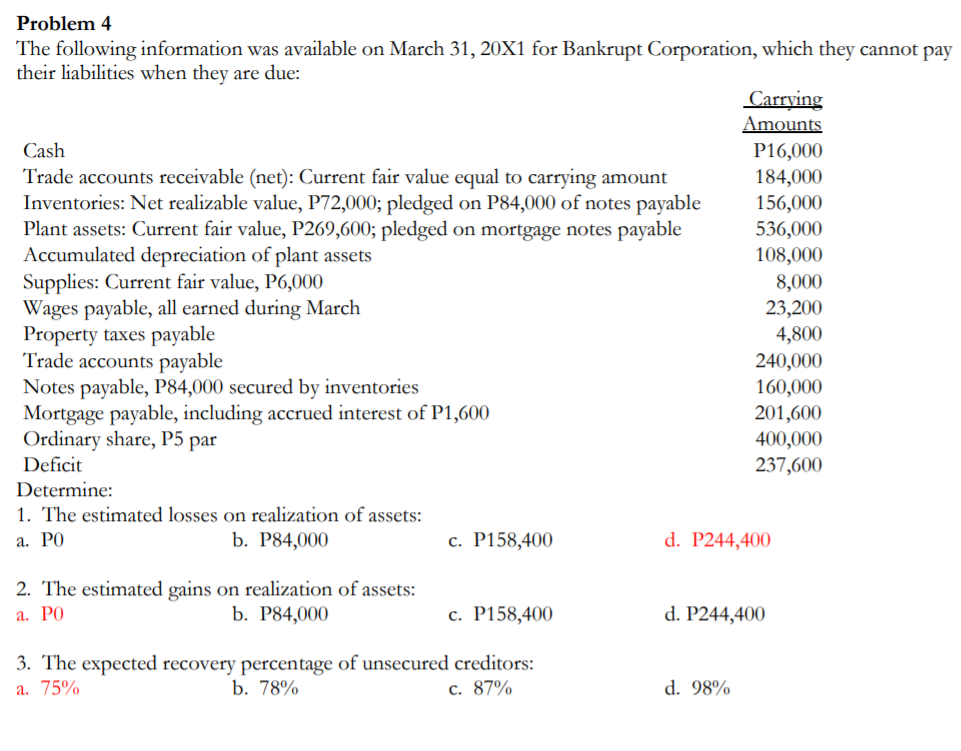

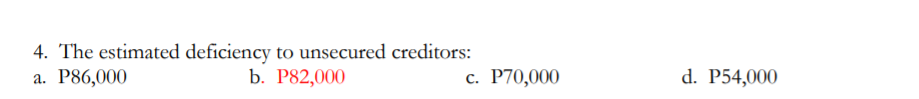

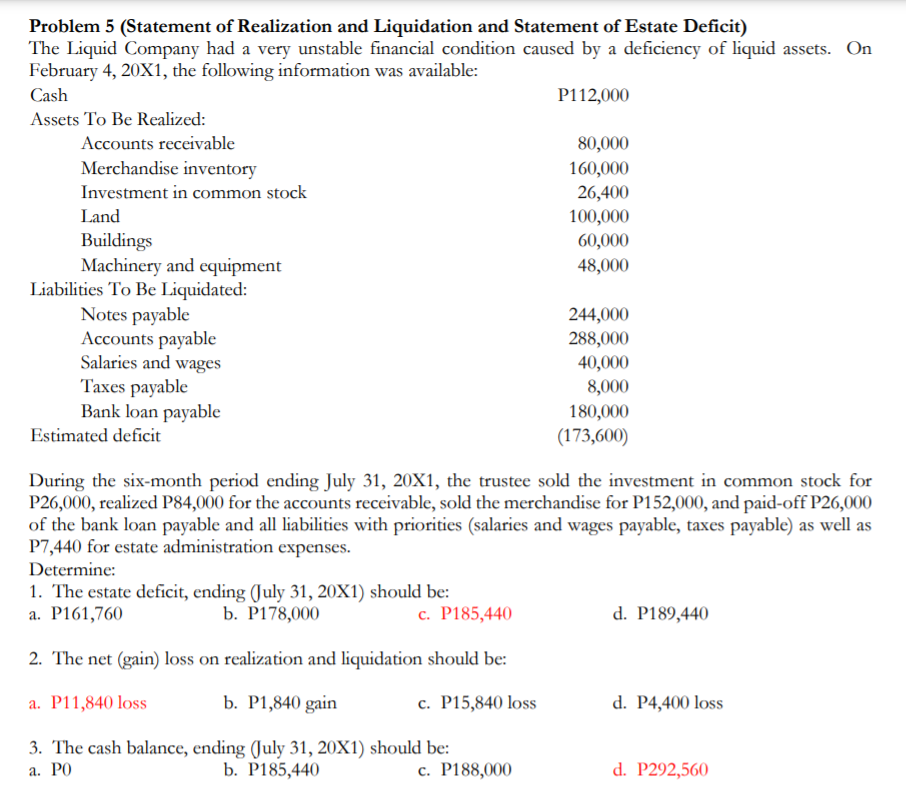

Problem 4 The following information was available on March 31, 20X1 for Bankrupt Corporation, which they cannot pay their liabilities when they are due: Liam AM Cash P16,000 Trade accounts receivable (net): Current fair value equal to carrying amount 184,000 Inventories: Net realizable value, 1372000; pledged on P84,000 of notes payable 156,000 Plant assets: Current fair value, P269,600; pledged on mortgage notes payable 536,000 Accumulated depreciation of plant assets 108,000 Supplies: Current fair value, P6,000 8,000 Wages payable, all earned during March 23,200 Property taxes payable 4,800 Trade accounts payable 240,000 Notes payable, P84,000 secured by inventories 160,000 Mortgage payable, including accrued interest of P1,600 201,600 Ordinary share, P5 par 400,000 Decit 237,600 Determine: 1. The estimated losses on realization of assets: a. P0 b. P84,000 c. P158,400 d. P244,40{'l 2. The estimated gains on realization of assets: 3.. P0 b. P84,000 c. P158,400 d. P244,400 3. The expected recovery percentage of unsecured creditors: a. 75" n b. 78% c. 87% d. 98% \fProblem 5 (Statement of Realization and Liquidation and Statement of Estate Decit) The Liquid Company had a very unstable nancial condition caused by a deciency of liquid assets. On February 4, 20XI, the following information was available: Cash P112,000 Assets To Be Realized: Accounts receivable 30,000 Merchandise inventory 160,000 Investment in common stock 26,400 Land 100.000 Buildings 60,000 Machinery and equipment 48,000 liabilities To Be liquidated: Notes payable 244,000 Accounts payable 288,000 Salaries and wages 40,000 Taxes payable 8,000 Bank loan payable 180,000 Estimated decit (1 73,600) During the six-month period ending july 31, 20X1, the trustee sold the investment in common stock for P26,000, realized P84,000 for the accounts receivable, sold the merchandise for P1 52,000, and paid-off P26,000 of the bank loan payable and all liabilities with priorities (salaries and wages payable, taxes payable) as well as P1340 for estate administration expenses. Determine: 1. The estate decit, ending Only 31, 203(1) should be: a. P161,760 b. P178,000 c. P185,440 d. P1895440 2. The net (gain) loss on realization and liquidation should be: a. 101,840 loss: b. 131,840 gain c. P15,840 loss d. P4,400 loss 3. The cash balance, ending Only 31, 201(1) should be: a. P0 b. P185,440 c. P188,000 d. P292560