Question: Topic G Exercises Chapter 1 8 Equity Valuation Models Exercise Problem # 1 The market consensus is that SuperSmart Corporation has ROE = 1 5

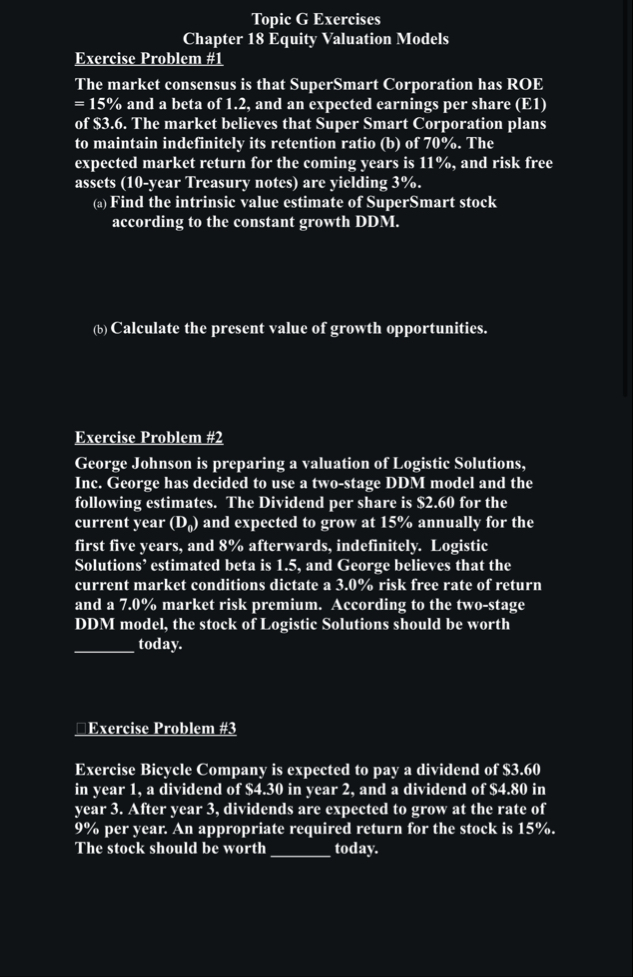

Topic G Exercises

Chapter Equity Valuation Models

Exercise Problem #

The market consensus is that SuperSmart Corporation has ROE and a beta of and an expected earnings per share E of $ The market believes that Super Smart Corporation plans to maintain indefinitely its retention ratio b of The expected market return for the coming years is and risk free assets year Treasury notes are yielding

a Find the intrinsic value estimate of SuperSmart stock according to the constant growth DDM

b Calculate the present value of growth opportunities.

Exercise Problem #

George Johnson is preparing a valuation of Logistic Solutions, Inc. George has decided to use a twostage DDM model and the following estimates. The Dividend per share is $ for the current year and expected to grow at annually for the first five years, and afterwards, indefinitely. Logistic Solutions' estimated beta is and George believes that the current market conditions dictate a risk free rate of return and a market risk premium. According to the twostage DDM model, the stock of Logistic Solutions should be worth today.

Exercise Problem #

Exercise Bicycle Company is expected to pay a dividend of $ in year a dividend of $ in year and a dividend of $ in year After year dividends are expected to grow at the rate of per year. An appropriate required return for the stock is The stock should be worth today.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock