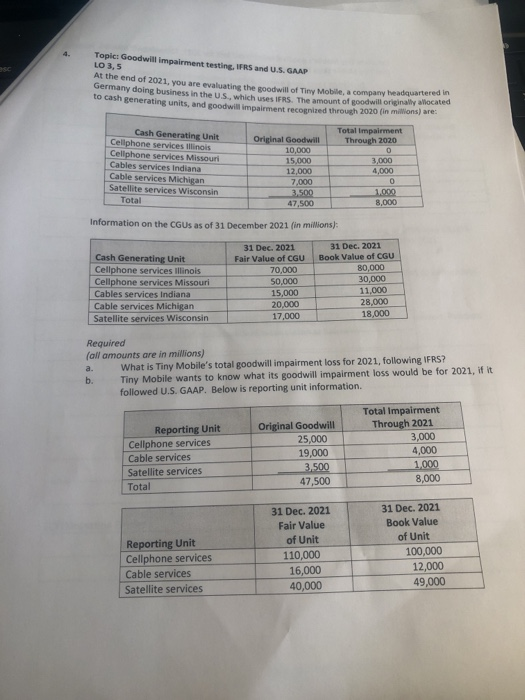

Question: Topic: Goodwill impairment testing, IFRS and U.S. GAAP LO 3,5 at the end of 2021. you are evaluating the goodwill of Tiny Mobile, a company

Topic: Goodwill impairment testing, IFRS and U.S. GAAP LO 3,5 at the end of 2021. you are evaluating the goodwill of Tiny Mobile, a company headquartered wermany doing business in the US, which uses IRS The amount of goodwill originally allocated to cash generating units, and goodwill impairment recognised through 2020 m onore Total Impairment Through 2020 Cash Generating Unit Cellphone services in Cellphone services Missouri Cables services Indiana Cable services Michigan Satellite services Wisconsin Total Original Goodwill 10,000 15.000 12,000 4,000 2.000 3.500 47,500 8,000 Information on the CGUs as of 31 December 2021 in millions Cash Generating Unit Cellphone services Illinois Cellphone services Missouri Cables services Indiana Cable services Michigan Satellite services Wisconsin 31 Dec. 2021 Fair Value of CGU 70,000 50,000 15.000 20,000 17,000 31 Dec. 2021 Book Value of CGU 80,000 30,000 11.000 28,000 18,000 Required (all amounts are in millions) a. What is Tiny Mobile's total goodwill impairment loss for 2021, following IFRS? Tiny Mobile wants to know what its goodwill impairment loss would be for 2021, if it followed U.S. GAAP. Below is reporting unit information b. Tiny Reporting Unit Cellphone services Cable services Satellite services Total Original Goodwill 25,000 19,000 3.500 47,500 Total Impairment Through 2021 3,000 4,000 1.000 8,000 Reporting Unit Cellphone services Cable services Satellite services 31 Dec. 2021 Fair Value of Unit 110,000 16,000 40,000 31 Dec. 2021 Book Value of Unit 100,000 12,000 49,000 Calculate Tiny Mobile's goodwill impairment loss for 2021, following U.S. GAAP. Assume that Tiny Mobile skips the qualitative evaluation of goodwill. ANS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts