Question: Topic: Intercompany Inventories Transaction Upstream Exercise with Amortization Question: Sky Corp. acquired 80% of Ocean Inc. on 1/1/2017 for $400 when Ocean's equity consisted of

Topic: Intercompany Inventories Transaction

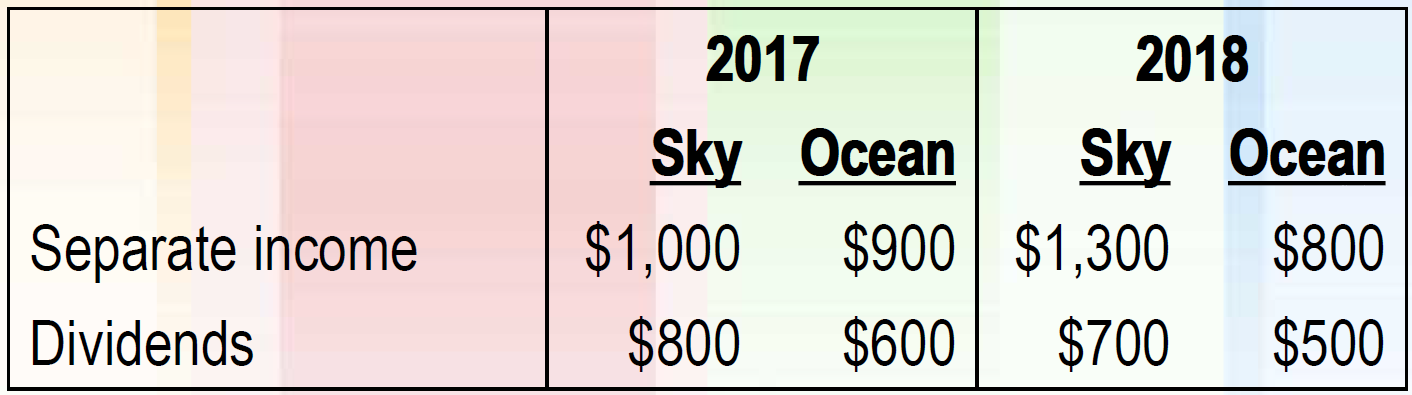

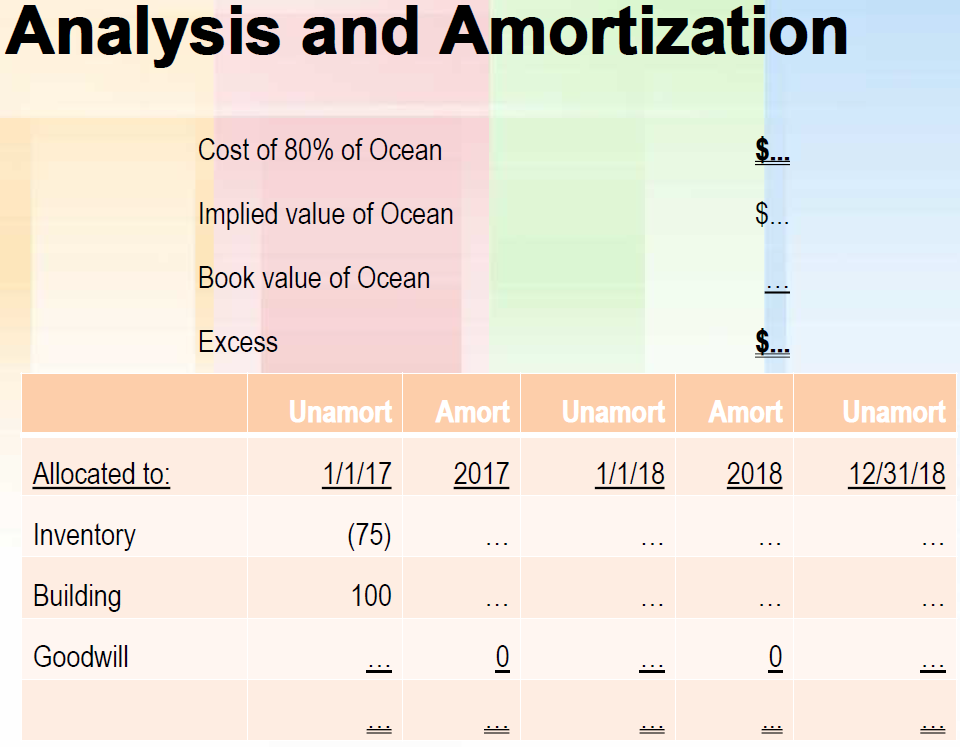

Upstream Exercise with Amortization Question: Sky Corp. acquired 80% of Ocean Inc. on 1/1/2017 for $400 when Ocean's equity consisted of $100 capital stock and $200 retained earnings. Ocean's inventory was overstated by $75 and building, with a 10-year life, was understated by $100. Any excess is goodwill.

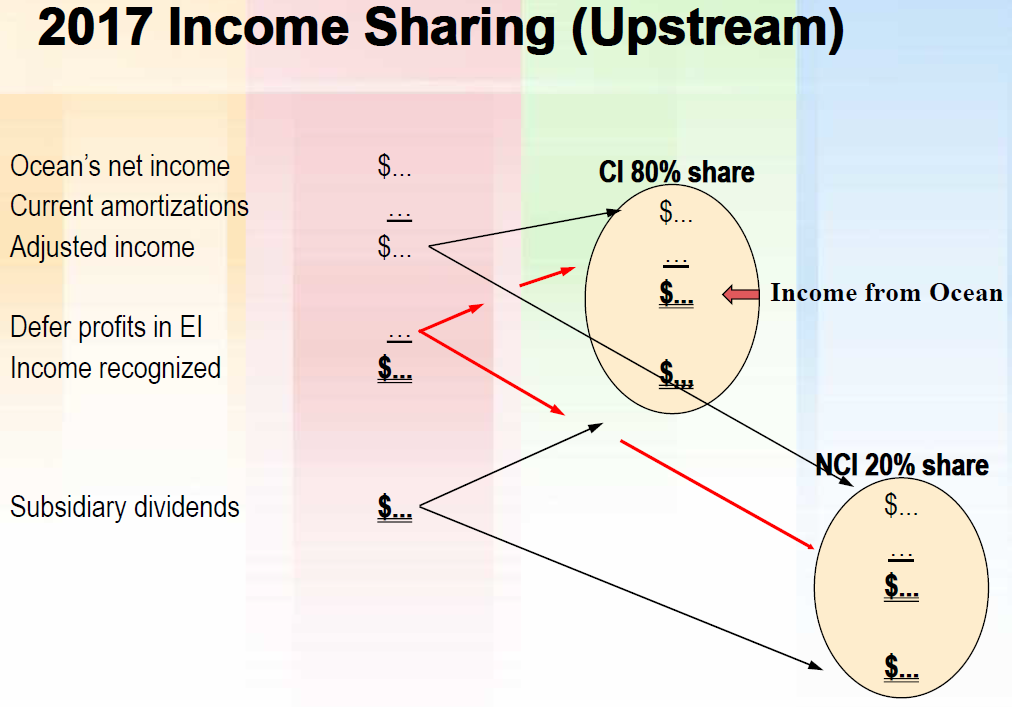

During 2017, Ocean sold all its goods available from beginning of the year for $1,000 to Sky at a 20% markup. $480 of these goods were in Skys ending inventory. In 2018, Ocean sold goods for $1,500 to Sky at a gross profit of 25% and Sky still had $200 on hand at the end of the year.

Instruction:

Please provide the income sharing scheme in the second year and the relevant journal entries in the book of parent only and for consolidation purpose. You may replicate the template that are provided below, or adjust it as necessary along with the supporting calculation, and written explanation.

1. Analysis and Amortization

2. 2017 Income Sharing (Upstream)

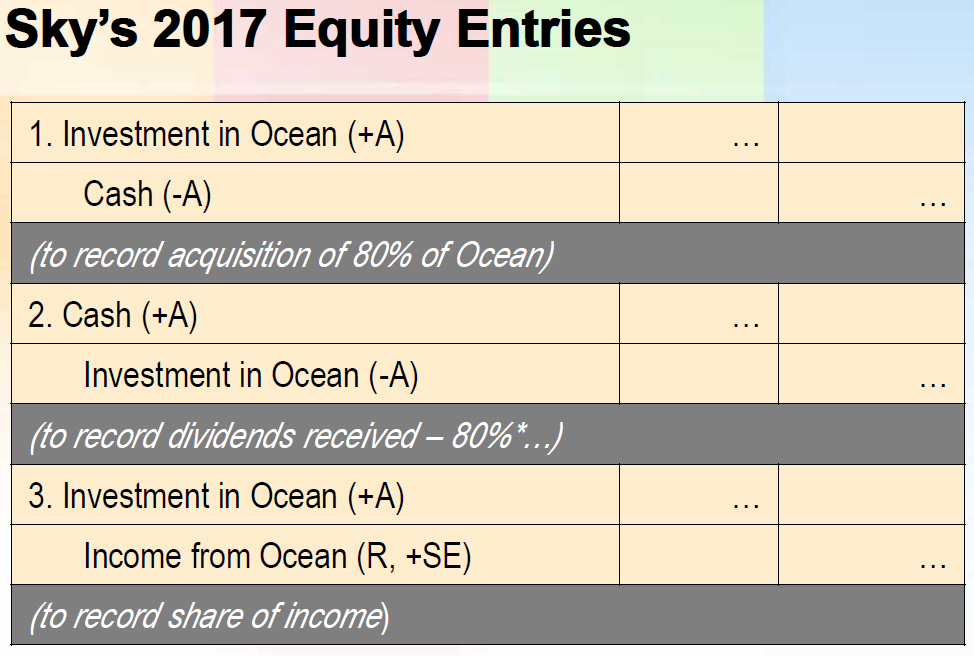

3. Sky's 2017 Equity Entries

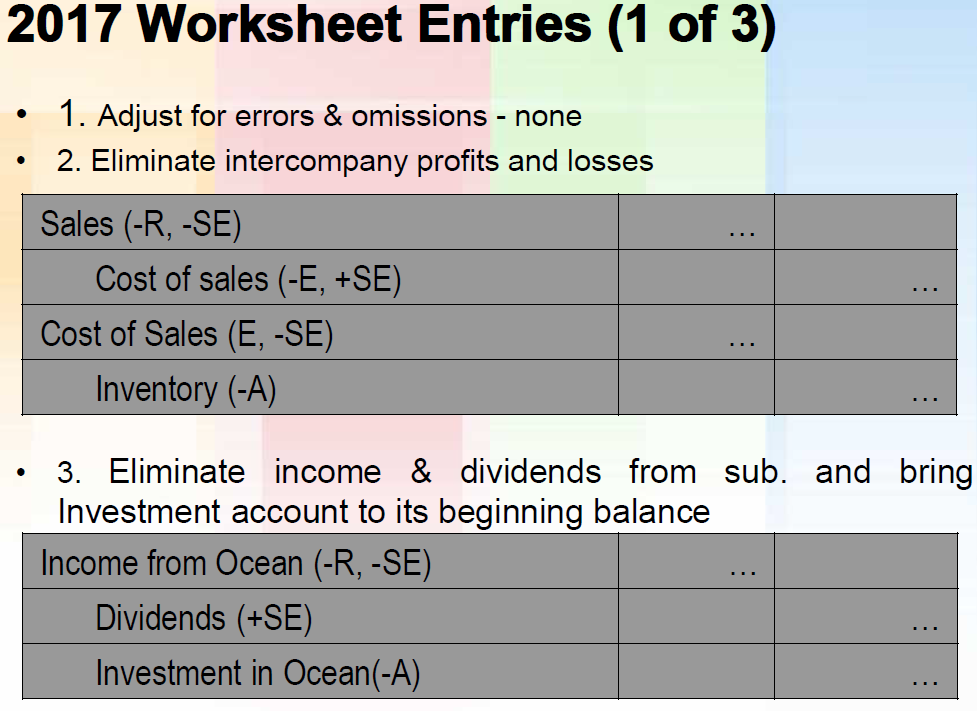

4. 2017 Worksheet Entries (1 of 3)

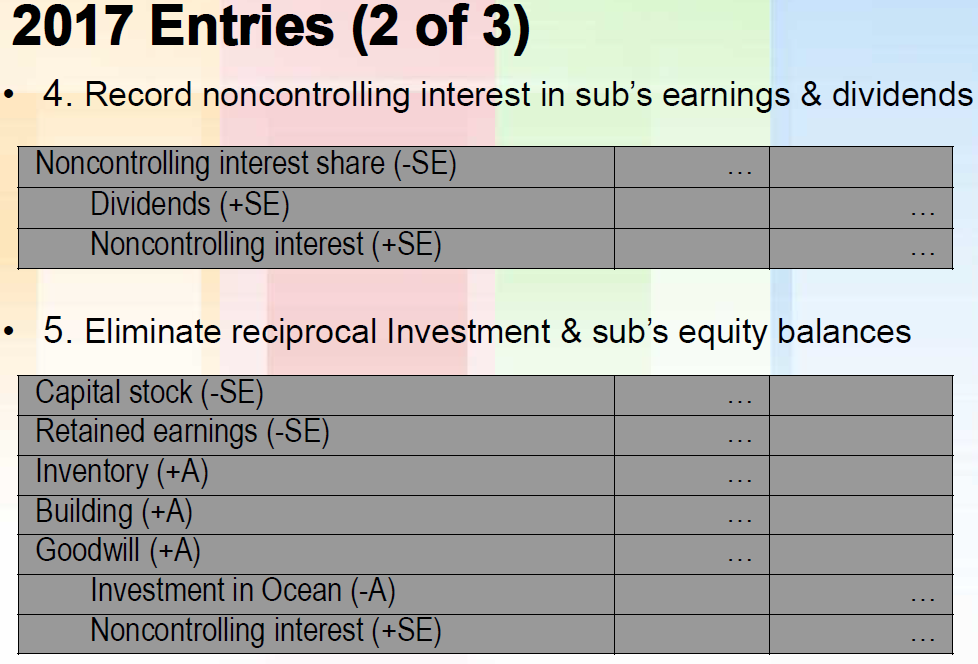

5. 2017 Worksheet Entries (2 of 3)

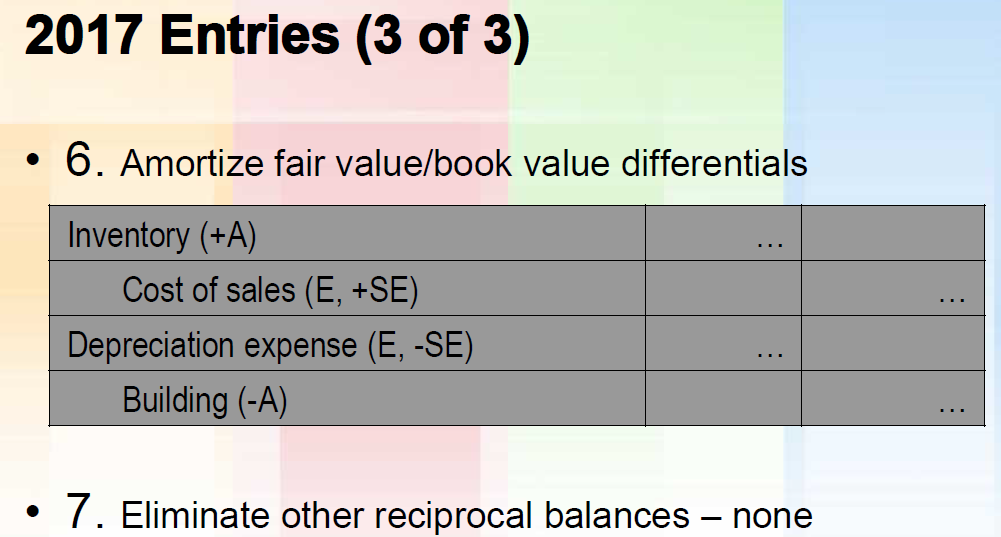

6. 2017 Worksheet Entries (3 of 3)

2017 2018 Separate income Dividends Sky Ocean Sky Ocean $1,000 $900 $1,300 $800 $800 $600 $700 $500 Analysis and Amortization Cost of 80% of Ocean $... Implied value of Ocean $... Book value of Ocean ... Excess $... Unamort Amort Unamort Amort Unamort Allocated to: 1/1/17 2017 1/1/18 2018 12/31/18 Inventory (75) Building 100 ... Goodwill lo lo --- . ... ... ... : . 2017 Income Sharing (Upstream) $... Ocean's net income Current amortizations Adjusted income CI 80% share $... :: $... $... Income from Ocean . Defer profits in El Income recognized NI 20% share $... Subsidiary dividends $... - Sky's 2017 Equity Entries ... 1. Investment in Ocean (+A) Cash (-A) (to record acquisition of 80% of Ocean) 2. Cash (+A) Investment in Ocean (-A) (to record dividends received 80%*...) 3. Investment in Ocean (+A) Income from Ocean (R, +SE) (to record share of income) 2017 Worksheet Entries (1 of 3) 1. Adjust for errors & omissions - none 2. Eliminate intercompany profits and losses . Sales (-R, -SE) Cost of sales (-E, +SE) Cost of Sales (E, -SE) Inventory (-A) . 3. Eliminate income & dividends from sub. and bring Investment account to its beginning balance Income from Ocean (-R, -SE) Dividends (+SE) Investment in Ocean(-A) 2017 Entries (2 of 3) 4. Record noncontrolling interest in sub's earnings & dividends Noncontrolling interest share (-SE) Dividends (+SE) Noncontrolling interest (+SE) 5. Eliminate reciprocal Investment & sub's equity balances Capital stock (-SE) Retained earnings (-SE) Inventory (+A) Building (+A) Goodwill (+A) Investment in Ocean (-A) Noncontrolling interest (+SE) 2017 Entries (3 of 3) . 6. Amortize fair value/book value differentials Inventory (+A) Cost of sales (E, +SE) Depreciation expense (E, -SE) Building (-A) 7. Eliminate other reciprocal balances - none 2017 2018 Separate income Dividends Sky Ocean Sky Ocean $1,000 $900 $1,300 $800 $800 $600 $700 $500 Analysis and Amortization Cost of 80% of Ocean $... Implied value of Ocean $... Book value of Ocean ... Excess $... Unamort Amort Unamort Amort Unamort Allocated to: 1/1/17 2017 1/1/18 2018 12/31/18 Inventory (75) Building 100 ... Goodwill lo lo --- . ... ... ... : . 2017 Income Sharing (Upstream) $... Ocean's net income Current amortizations Adjusted income CI 80% share $... :: $... $... Income from Ocean . Defer profits in El Income recognized NI 20% share $... Subsidiary dividends $... - Sky's 2017 Equity Entries ... 1. Investment in Ocean (+A) Cash (-A) (to record acquisition of 80% of Ocean) 2. Cash (+A) Investment in Ocean (-A) (to record dividends received 80%*...) 3. Investment in Ocean (+A) Income from Ocean (R, +SE) (to record share of income) 2017 Worksheet Entries (1 of 3) 1. Adjust for errors & omissions - none 2. Eliminate intercompany profits and losses . Sales (-R, -SE) Cost of sales (-E, +SE) Cost of Sales (E, -SE) Inventory (-A) . 3. Eliminate income & dividends from sub. and bring Investment account to its beginning balance Income from Ocean (-R, -SE) Dividends (+SE) Investment in Ocean(-A) 2017 Entries (2 of 3) 4. Record noncontrolling interest in sub's earnings & dividends Noncontrolling interest share (-SE) Dividends (+SE) Noncontrolling interest (+SE) 5. Eliminate reciprocal Investment & sub's equity balances Capital stock (-SE) Retained earnings (-SE) Inventory (+A) Building (+A) Goodwill (+A) Investment in Ocean (-A) Noncontrolling interest (+SE) 2017 Entries (3 of 3) . 6. Amortize fair value/book value differentials Inventory (+A) Cost of sales (E, +SE) Depreciation expense (E, -SE) Building (-A) 7. Eliminate other reciprocal balances - none

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts