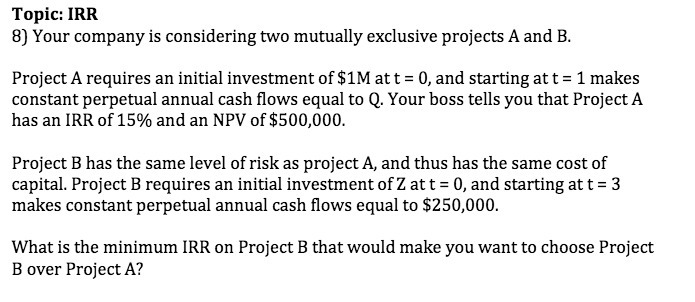

Question: Topic: IRE 8] Your company is considering two mutually exclusive projects A and B. Project A requires an initial investment of $1M at t =

![Topic: IRE 8] Your company is considering two mutually exclusive projects](https://s3.amazonaws.com/si.experts.images/answers/2024/06/6661538f30f65_4156661538f1c78d.jpg)

Topic: IRE 8] Your company is considering two mutually exclusive projects A and B. Project A requires an initial investment of $1M at t = 0, and starting at t = 1 makes constant perpetual annual cash ows equal to Q. Your boss tells you that ProjectA has an IRR of 15% and an NP'J of $500,000. Project B has the same level of risk as projectA, and thus has the same cost of capital. Project B requires an initial investment on at t = 0, and starting at t = 3 makes constant perpetual annual cash ows equal to $250,000. What is the minimum IRR on Project E that would make you want to choose Project 3 over Project A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts