Question: Topic: Islamic Accounting Please note that I will rate the question as helpful Question 1: Answer the following section. Section 2 : Table 2 shows

Topic: Islamic Accounting

Please note that I will rate the question as helpful

Question 1: Answer the following section.

Section 2 :

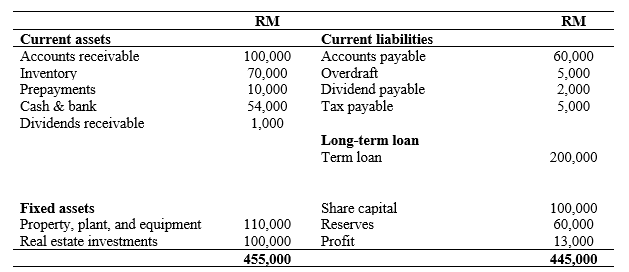

Table 2 shows the statement of financial position of AAM Company as of December 31, 2019.

The following have not been adjusted:

- Inventory includes work in progress and raw materials valued at RM10,000 and RM5,000, respectively.

- Prepayment is related to insurance and road tax.

- Included in the bank is a fixed deposit used to secure a financing facility from Bank A amounting to RM10,000.

- Within the term loan, RM25,000 is loan payable during the next year. This has not been reclassified.

- One customer was declared bankrupt. He owed RM5,000.

Required:

Calculate zakat payable using:

- The net assets method.

- The net invested funds method.

RM RM Current assets Accounts receivable Inventory Prepayments Cash & bank Dividends receivable 100,000 70,000 10,000 54,000 1,000 Current liabilities Accounts payable Overdraft Dividend payable Tax payable 60,000 5,000 2,000 5,000 Long-term loan Term loan 200,000 Fixed assets Property, plant, and equipment Real estate investments 110,000 100,000 455,000 Share capital Reserves Profit 100,000 60,000 13,000 445,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts