Question: Topic: Partnership Dissolution need solutions please Answers: 1. (1)C (2)A 2. D 3. (1)B (2)D 4. C 5 .B 6 .(1)C (2)B PROBLEMS- DISSOLUTION :CHANGES

Topic: Partnership Dissolution

need solutions please

Answers:

1. (1)C (2)A

2.D

3. (1)B (2)D

4.C

5.B

6.(1)C (2)B

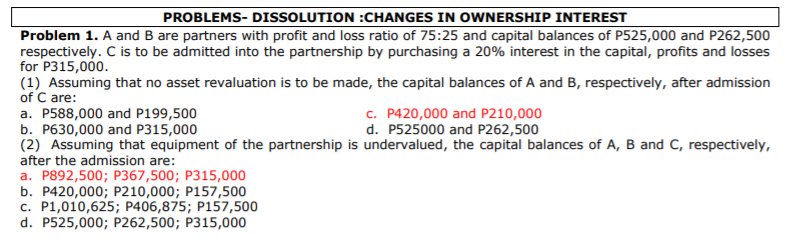

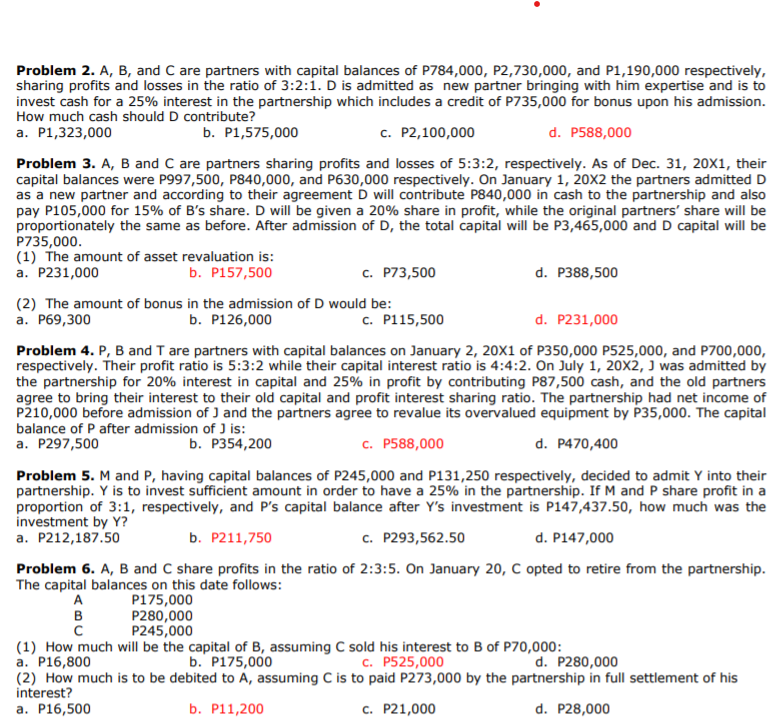

PROBLEMS- DISSOLUTION :CHANGES IN OWNERSHIP INTEREST Problem 1. A and B are partners with profit and loss ratio of 75:25 and capital balances of P525,000 and P262,500 respectively. C is to be admitted into the partnership by purchasing a 20% interest in the capital, profits and losses for P315,000. (1) Assuming that no asset revaluation is to be made, the capital balances of A and B, respectively, after admission of C are: a. P588,000 and P199,500 c. P420,000 and P210,000 b. P630,000 and P315,000 d. P525000 and P262,500 (2) Assuming that equipment of the partnership is undervalued, the capital balances of A, B and C, respectively, after the admission are: a. P892,500; P367,500; P315,000 b. P420,000; P210,000; P157,500 C. P1,010,625; P406,875; P157,500 d. P525,000; P262,500; P315,000Problem 2. A, B, and C are partners with capital balances of \"84.000, P2330300. and P1.190.000 respectively, sharing prots and losses in the ratio of 3:2:1. D is admitted as new partner bringing with him eXpertise and is to invest cash for a 25% interest in the partnership which includes a credit of P235300 for bonus upon his admission. How much cash should D contribute? a. P1,323,000 0. 01,515,000 .2. P2,100,000 d. 9533,000 Problem 3. A, B and C are partners sharing prots and losses of 5:3:2, respectively. As of Dec. 31, 20x1, their capital balances were P99?,500, P040,000, and P630,000 respectively. On January 1, 20x2 the partners admitted D as a new partner and according to their agreement 0 will contribute P040,000 in cash to the partnership and also pay \"05,000 for 15% of B's share. D will be given a 20% share in. prot, while the original partners' share will be proportiOnately the same as before. Alter admission of D, the total capital will be 8,465,000 and D capital will be P735000. (1} The amount of asset revaluation is: a. P231,000 b. P151500 c. P73,500 d. P300500 (2} The amount of bonus in the admission of D would be: a. P69,300 b. P126,000 c. P115,500 0. P2311000 Problem 4. P, B and T are partners with capital balances on January 2, 20X1 of P350,000 P525,000, and P?00,000, respecb'vely. Their pmt ratio is 5:3 :2 while their capital interest ratio is 4:4:2. On July 1, 2022, J was admitted by the parb'lership for 20% interest in capital and 25% in prot by contributing PB?,500 cash, and the old parb'lels agree to bring their interest to their old capital and prot interest sharing ratio. The partnership had net income of P210,000 before admission of] and the partners agree to revalue its overvalued equipment by P35,000. The capital balance of P after admission of J is: a. P2933500 b. P3 54,200 r;. P588,000 d. P4?0,400 Problem 5. M and P, having capital balances of P245000 and P131350 respectively, decided to- adrnit 1' into their parb'lershlp. Y is to invest sufcient amount in order to have a 25% in the partnership. If M and P share prot in a proportion of 3:1. respectively, and P's capital balance alter Y's investment is P14?,43?.50, how much was the investment by Y? a. P212,18?.50 b. P211,?50 c. \"93,562.50 d. P141000 Problem 6. A, 0 and C share profits in the ratio of 2:3:5. On January 20, C opted to retire from the partnership. The capital balances on this date follows: A \"5,000 B P200,000 C P245,000 (1} How much will be the capital of B, assuming C sold his Interest to B of \"0,000: a. \"6,800 b. P175000 c. P525,000 d. P200,000 (2} How much is to be debited to A, assuming C Is to paid P211000 by the partnership In full setdement of his Interest? a. P16,500 b. P1 1,200 c. P21,000 d. PZB,000