Question: Topic: Partnership Dissolution need solutions please Answers: 7.C 8.D 9.A 10.B 11.(1)C (2)B Problem 7. On December 30, 20X1, the statement of financial position of

Topic: Partnership Dissolution

need solutions please

Answers: 7.C 8.D 9.A 10.B 11.(1)C (2)B

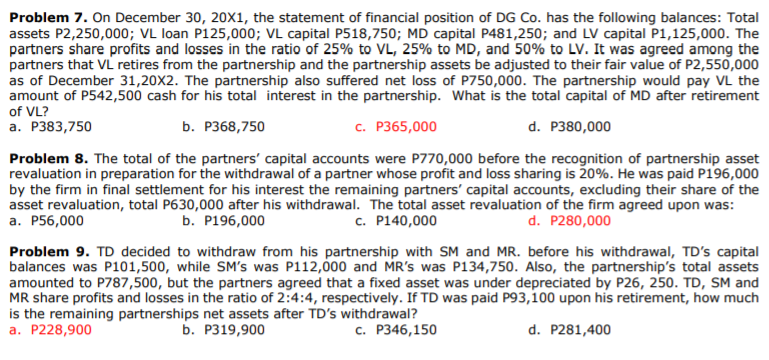

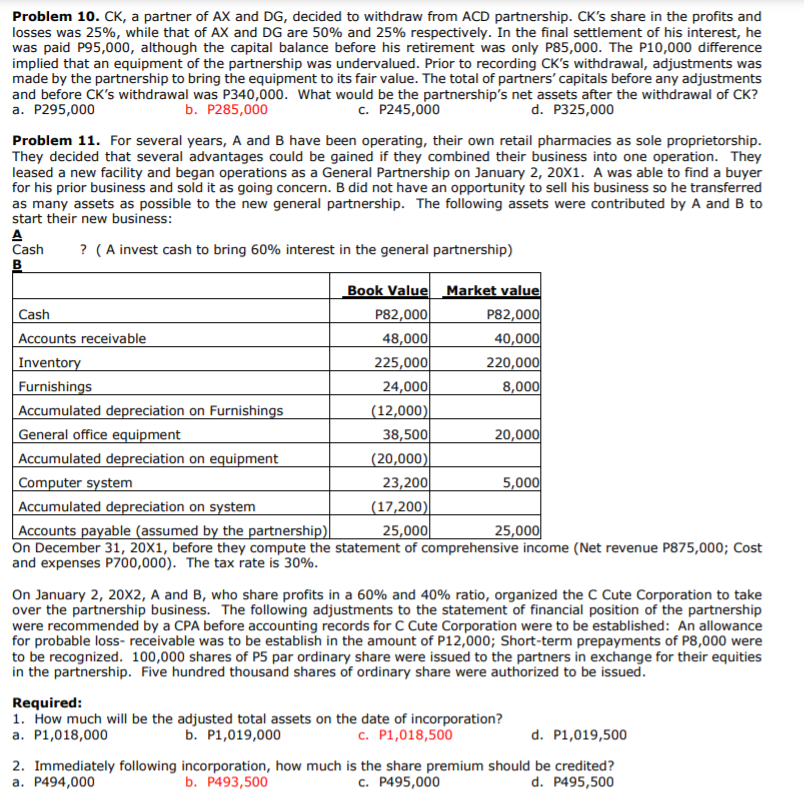

Problem 7. On December 30, 20X1, the statement of financial position of DG Co. has the following balances: Total assets P2,250,000; VL loan P125,000; VL capital P518,750; MD capital P481,250; and LV capital P1, 125,000. The partners share profits and losses in the ratio of 25% to VL, 25% to MD, and 50% to LV. It was agreed among the partners that VL retires from the partnership and the partnership assets be adjusted to their fair value of P2,550,000 as of December 31,20X2. The partnership also suffered net loss of P750,000. The partnership would pay VL the amount of P542,500 cash for his total interest in the partnership. What is the total capital of MD after retirement of VL? a. P383,750 b. P368,750 C. P365,000 d. P380,000 Problem 8. The total of the partners' capital accounts were P770,000 before the recognition of partnership asset revaluation in preparation for the withdrawal of a partner whose profit and loss sharing is 20%. He was paid P196,000 by the firm in final settlement for his interest the remaining partners' capital accounts, excluding their share of the asset revaluation, total P630,000 after his withdrawal. The total asset revaluation of the firm agreed upon was: a. P56,000 b. P196,000 c. P140,000 d. P280,000 Problem 9. TD decided to withdraw from his partnership with SM and MR. before his withdrawal, TD's capital balances was P101,500, while SM's was P112,000 and MR's was P134,750. Also, the partnership's total assets amounted to P787,500, but the partners agreed that a fixed asset was under depreciated by P26, 250. TD, SM and MR share profits and losses in the ratio of 2:4:4, respectively. If TD was paid P93,100 upon his retirement, how much is the remaining partnerships net assets after TD's withdrawal? a. P228,900 b. P319,900 C. P346,150 d. P281,400Problem 10. CK, a partner of AX and DG, decided to withdraw from ACD partnership. CK's share in the profits and losses was 25%, while that of AX and DG are 50% and 25% respectively. In the final settlement of his interest, he was paid P95,000, although the capital balance before his retirement was only P85,000. The P10,000 difference implied that an equipment of the partnership was undervalued. Prior to recording CK's withdrawal, adjustments was made by the partnership to bring the equipment to its fair value. The total of partners' capitals before any adjustments and before CK's withdrawal was P340,000. What would be the partnership's net assets after the withdrawal of CK? a. P295,000 b. P285,000 c. P245,000 d. P325,000 Problem 11. For several years, A and B have been operating, their own retail pharmacies as sole proprietorship. They decided that several advantages could be gained if they combined their business into one operation. They leased a new facility and began operations as a General Partnership on January 2, 20X1. A was able to find a buyer for his prior business and sold it as going concern. B did not have an opportunity to sell his business so he transferred as many assets as possible to the new general partnership. The following assets were contributed by A and B to start their new business: A Cash ? ( A invest cash to bring 60% interest in the general partnership) Book Value Market value Cash P82,000 P82,000 Accounts receivable 48,000 40,000 Inventory 225,000 220,000 Furnishings 24,000 8,000 Accumulated depreciation on Furnishings (12,000) General office equipment 38,500 20,000 Accumulated depreciation on equipment (20,000 Computer system 23,200 5,000 Accumulated depreciation on system (17,200) Accounts payable (assumed by the partnership) 25,000 25,000 On December 31, 20X1, before they compute the statement of comprehensive income (Net revenue P875,000; Cost and expenses P700,000). The tax rate is 30%. On January 2, 20X2, A and B, who share profits in a 60% and 40% ratio, organized the C Cute Corporation to take over the partnership business. The following adjustments to the statement of financial position of the partnership were recommended by a CPA before accounting records for C Cute Corporation were to be established: An allowance for probable loss- receivable was to be establish in the amount of P12,000; Short-term prepayments of P8,000 were to be recognized. 100,000 shares of P5 par ordinary share were issued to the partners in exchange for their equities in the partnership. Five hundred thousand shares of ordinary share were authorized to be issued. Required: 1. How much will be the adjusted total assets on the date of incorporation? a. P1,018,000 b. P1, 019,000 c. P1,018,500 d. P1,019,500 2. Immediately following incorporation, how much is the share premium should be credited? a. P494,000 b. P493,500 C. P495,000 d. P495,500