Question: Topic: Partnership Formation need solutions please Answers: 1.B 2.A 3.C 4.B 5.D PROBLEMS-FORMATION OF PARTNERSHIP Problem 1. A and B decided to form a partnership

Topic: Partnership Formation

need solutions please

Answers: 1.B 2.A 3.C 4.B 5.D

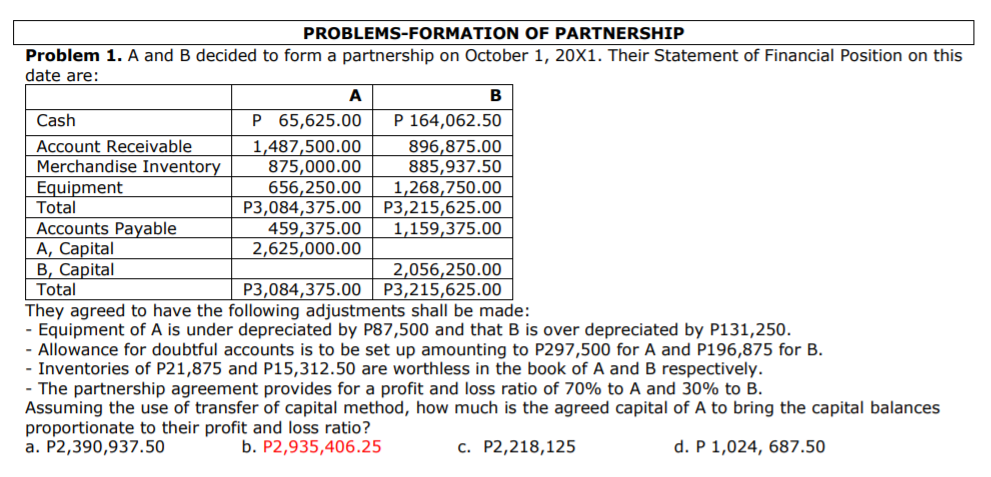

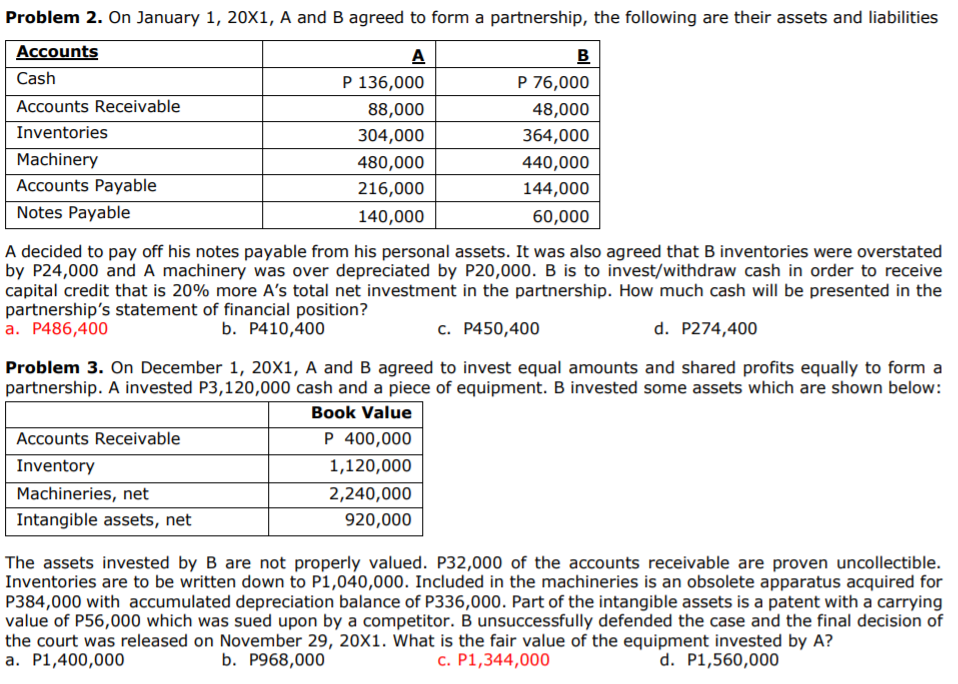

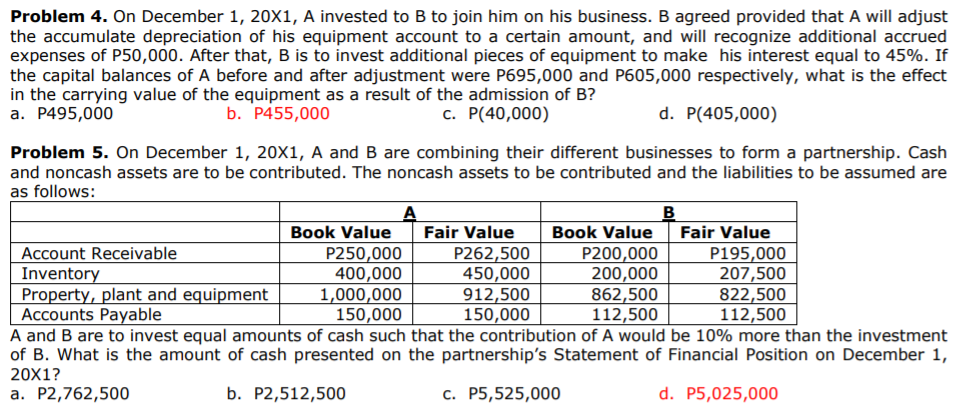

PROBLEMS-FORMATION OF PARTNERSHIP Problem 1. A and B decided to form a partnership on October 1, 20X1. Their Statement of Financial Position on this date are: Merchandiselnventory 875,000.00I 885,937.50 Equipment 650,250.00 135835000 Total p3,084,375.00 P3,215,625.00 Accounts Pa able awe-ital _ ' They agreed to have the following adjustments shall be made: - Equipment of A is under depreciated by P87,500 and that B is over depreciated by P131,250. - Allowance for doubtful accounts is to be set up amounting to P297500 for A and P196,875 for B. - Inventories of P21,875 and P15,312.50 are worthless in the book of A and B respectively. - The partnership agreement provides for a prot and loss ratio of 70% to A and 30% to 8. Assuming the use of transfer of capital method, how much is the agreed capital of A to bring the capital balances proportionate to their prot and loss ratio? a. P2,390,937.50 b. P2,935,406.25 c. P2,218.125 d. P 1,024, 687.50 | 'i l 3 Cash | P 65,625.00 P 164,062.50 Account Receivable I 1,487,500.00 896,875.00 | Problem 2. On January 1, 20X1, A and B agreed to form a partnership, the following are their assets and liabilities mm A 5 Cash P 136,000 P 76,000 Accounts Receivable | 88,000 48,000 Inventories | 304,000 364,000 Machinery | 480,000 440:000 Accounts Payable | 216,000 144,000 Notes Payable | 140,000 l50,000 A decided to pay off his notes payable from his personal assets. It was also agreed that B inventories were overstated by P24,000 and A machinery was over depreciated by P20,000. B is to investfwithdraw cash in order to receive capital credit that is 20% more A's total net investment in the partnership. How much cash will be presented in the partnership's statement of nancial position? a. P486,400 b. P410,400 c. P450,400 d. P274,400 Problem 3. On December 1, 20X1, A and B agreed to invest equal amounts and shared prots equally to form a partnership. A invested P3,120,000 cash and a piece of equipment. 3 invested some assets which are shown below: mum Accounts Receivable P 400,000 1.120.000 Machineries, net 2,240,000 Intangible assets, net 920,000 The assets invested by B are not properly valued. P32,000 of the accounts receivabie are proven unoollectible. Inventories are to be written down to P1,040,000. Included In the machineries is an obsolete apparatus acquired for P384,000 with accumulated depreciation balance of P336,000. Part of the intangible assets is a patent with a carrying value of P56,000 which was sued upon by a competitor. B unsuccessfully defended the case and the nal decision of the court was released on November 29, mm. What is the fair value of the equipment invested by A? a. P1,400,000 b. P968,000 c. P1,344,000 d. P1,560,000 Problem 4. On December 1, 20X1, A invested to B to join him on his business. B agreed provided that A will adjust the accumulate depreciation of his equipment account to a certain amount, and will recognize additional accrued expenses of P50,000. After that, B is to invest additional pieces of equipment to make his interest equal to 45%. If the capital balances of A before and after adjustment were P695300 and P605,000 respectively, what is the effect in the carrying value of the equipment as a result of the admission of B? a. P495,000 b. P455,000 c. P(40,000) d. P(405,000) Problem 5. On December 1, 201(1, A and B are combining their different businesses to form a partnership. Cash and noncash assets are to be contributed. The noncash assets to be contributed and the liabilities to be assumed are as follows: | | A B I I Book Value Fair Vatue Book Value Fair Value I Account Receivable I P250,000 P262,500 P200,000 P195,000 Invento 400,000 450,000 200,000 207,500 Property, plant and equipment 1,000,000 912,500 362,500 822,500 | Accounts Payable I 150,000 150,000 112,500 112,500 A and B are to invest equal amounts of cash such that the contribution ofA would be 10% more than the investment of B. What is the amount of cash presented on the partnership's Statement of Financial Position on December 1, ZDXI? a. P2,?62,500 b. P2,512,500 c. P5,525,000 d. P5,025,000