Question: Topic: Responsibility Accounting and Budgeting Primary Source: Text Chapter 12 - Cases 12.42 and 12.43 have a similar learning focus to this assignment. Background to

Topic: Responsibility Accounting and Budgeting Primary Source: Text Chapter 12 - Cases 12.42 and 12.43 have a similar learning focus to this assignment.

Background to topic: Performance measurement systems for the basis for communicating and coordinating the efforts of management in achieving corporate goals, monitoring, and measuring performance and controlling the operations of the organisation. The budget mechanism is the basis for forming the financial plan for each organisation and this task will require students to develop the skills required to consider how varying economic and budget assumptions will impact on the financial outcome for a company. The measures included in the budget often provide the basis for measuring the performance of individual divisions and for the corporate group as a whole. Task details: it to produce a report suitable for presentation in a professional organisational setting and conforming to the academic standards of referencing peer reviewed articles. financial data along with budget assumption information is given relating to the desired budgetary assumptions relating to future inflationary trends, planned divisional changes and specific performance measures to be adapted to each group's budget. You'll will apply the parameters given and create a divisional budget plan. Budget assumptions: Each group will be allocated an initial set of budget assumptions in relation to the expected operational and economic changes that will impact on the company's operation over coming financial year at the divisional level. The group are to consider these assumptions and apply these when setting the budget amounts with reference to the performance measures for that division/department of the company.

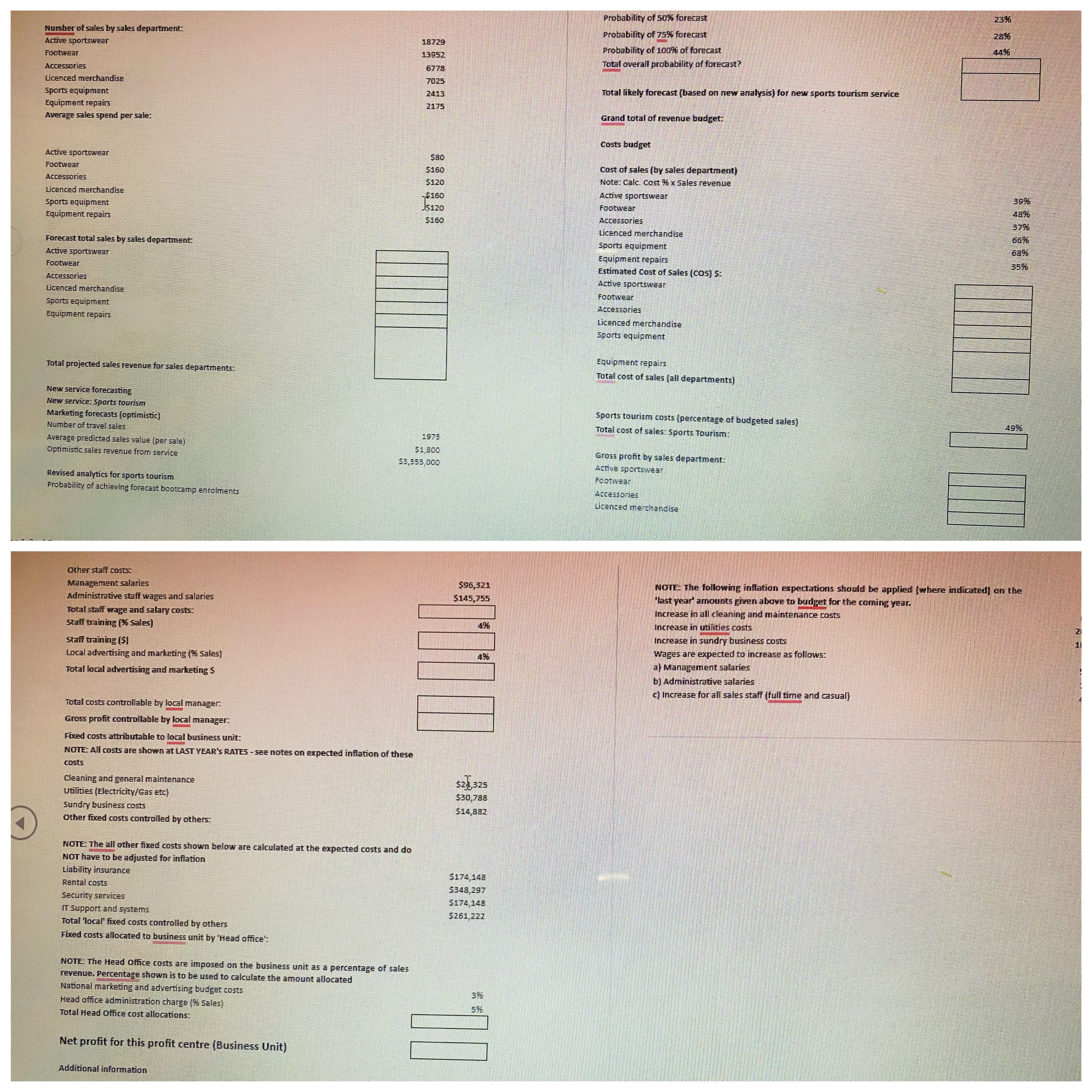

Probability of 50%% forecast 23% Number of sales by sales department: Probability of 759% forecast 28% Active sportswear 18729 Footwear 13952 Probability of 1009% of forecast Accessories 6778 Total overall probability of forecast? Licenced merchandise 7025 sports equipment 2413 Total likely forecast (based on new analysis) for new sports tourism service Equipment repairs 2175 Average sales spend per sale: Grand total of revenue budget: Costs budget Active sportswear ootwear $150 cost of sales (by sales department) Accessories $120 Note: Calc. Cost % x Sales revenue Licenced merchandise -$160 Active sportswear sports equipment 15120 Footwear Equipment repairs $160 Accessories Licenced merchandise Forecast total sales by sales department Sports equipment Active sportswear Footwear Equipment repairs Accessories Estimated cost of Sales (Cos) $: Licenced merchandise Active sportswear Sports equipment Footwear Equipment repairs Accessories Licenced merchandise sports equipment Total projected sales revenue for sales departments: Equipment repairs Total cost of sales (all departments) New service forecasting New service: Sports tourism Marketing forecasts (optimistic) sports tourism costs (percentage of budgeted sales) Number of travel sales Average predicted sales value (per sale) 1975 otal cost of sales: sports Tourism: c sales revenue from service $1, 800 $3,555,000 Gross profit by sales department Active sportswear Revised analytics for sports tourism Footwear probability of achieving forecast bootcamp enrolments Accessories Licenced merchandise Other staff costs: Management salaries $96,32 NOTE: The following inflation expectations should be applied (who Administrative staff wages and salaries $145,75 last year amounts given above to budget for the coming year. Total staff wage and salary costs: Increase in all cleaning and maintenance costs staff training (%% sales) Increase in utilities costs staff training ($) Increase in sundry business costs ocal advertising and marketing ($% Sales) Wages are expected to increase as follows: Total local advertising and marketing $ al Management salaries b) Administrative salaries c) Increase for all sales staff (full time and casual] Total costs controllable by local manager. Gross profit controllable by local manager: Fixed costs attributable to local business unit: NOTE: All costs are shown at LAST YEAR'S RATES - see notes on expected inflation of these costs Cleaning and general maintenance Utilities (Electricity/Gas etc) $28,325 $30,788 Sundry business costs $14 , 882 fixed costs controlled by others: NOTE: The all other fixed costs shown below are calculated at the expected costs and do NOT have to be adjusted for inflation iability insurance Rental costs $174,148 $348,297 Security services IT Support and systems $174,148 $261,222 Total 'local' fixed costs controlled by others Fixed costs allocated to business unit by 'Head office's NOTE: The Head office costs are imposed on the business unit as a percentage of sales revenue. Percentage shown is to be used to calculate the amount allocated National marketing and advertising budget costs Head office administration charge (9% sales) Total Head Office cost allocations: Net profit for this profit centre (Business Unit) Additional information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts