Question: TopicVenture capital The last question has option ea and d in the Startup Financing Cycle known as the i-Cu rve when is the Valley of

TopicVenture capital The last question has option ea and d

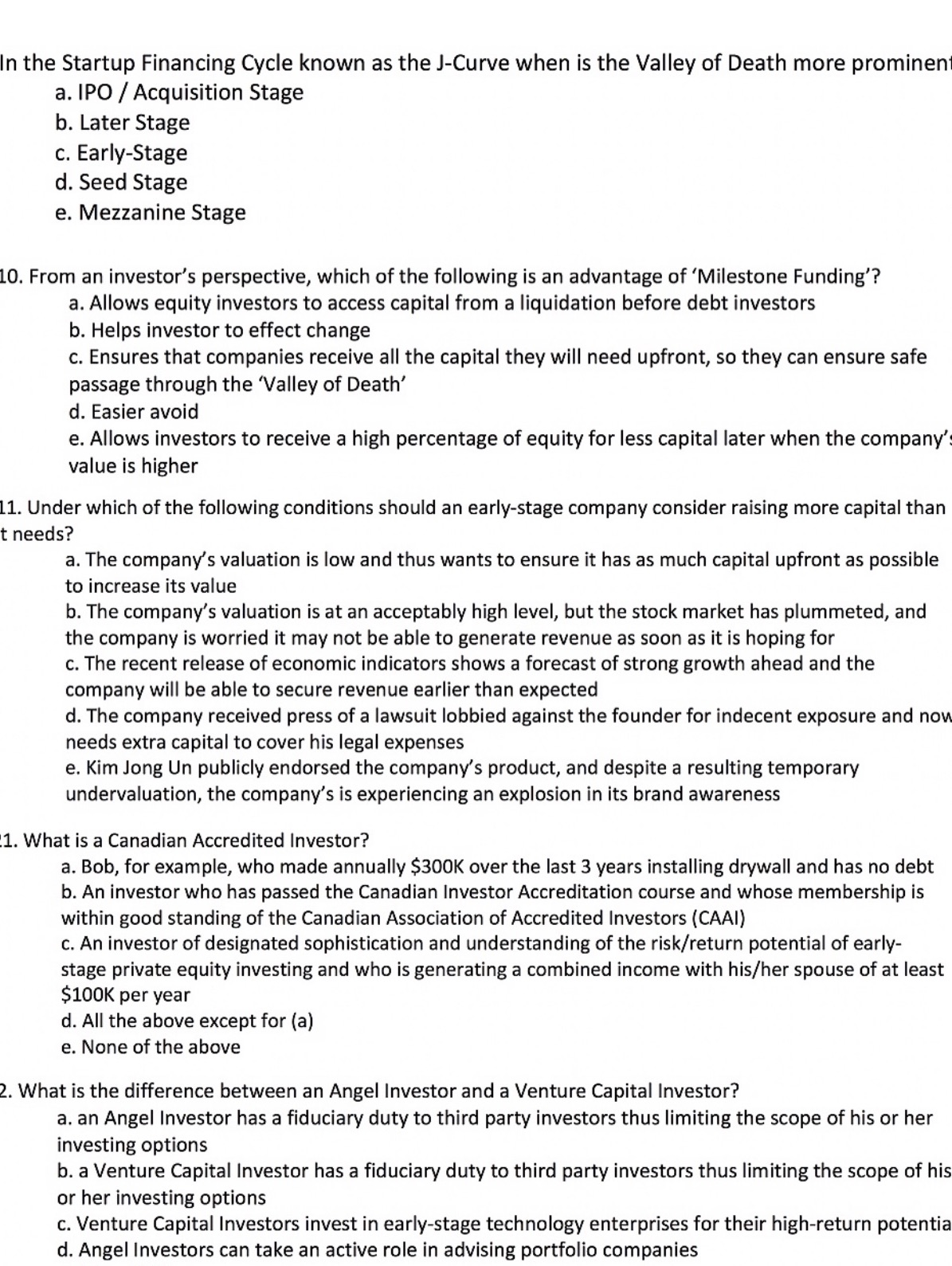

in the Startup Financing Cycle known as the i-Cu rve when is the Valley of Death more promineni a. IPO / Acquisition Stage b. Later Stage c. Early-Stage d. Seed Stage e. Mezzanine Stage 10. From an investor's perspective, which of the following is an advantage of 'Milestone Funding'? a. Allows equity investors to access capital from a liquidation before debt investors b. Helps investor to effect change c. Ensures that companies receive all the capital they will need upfront, so they can ensure safe passage through the 'Valley of Death' d. Easier avoid e. Allows investors to receive a high percentage of equity for less capital later when the company': value is higher 11. Under which of the following conditions should an early-stage company consider raising more capital than t needs? a. The company's valuation is low and thus wants to ensure it has as much capital upfront as possible to increase its value b. The company's valuation is at an acceptably high level, but the stock market has plummeted, and the company is worried it may not be able to generate revenue as soon as it is hoping for c. The recent release of economic indicators shows a forecast of strong growth ahead and the company will be able to secure revenue earlier than expected d. The company received press of a lawsuit lobbied against the founder for indecent exposure and non needs extra capital to cover his legal expenses e. Kim Jong Un publicly endorsed the company's product, and despite a resulting temporary undervaiuatlon, the company's is experiencing an explosion in Its brand awareness '.1. What is a Canadian Accredited Investor? a. Bob, for example, who made annually $300K over the last 3 years installing drywall and has no debt b. An investor who has passed the Canadian investor Accreditation course and whose membership is within good standing of the Canadian Association of Accredited Investors (CAAI) c. An investor of designated sophistication and understanding of the risk/return potential of early- stage private equity investing and who is generating a combined income with his/her spouse of at least $100K per year d. All the above except for (a) e. None of the above 2. What is the difference between an Angel Investor and a Venture Capital Investor? a. an Angel Investor has a fiduciary duty to third party investors thus limiting the scope of his or her investing options b. a Venture Capital investor has a duciary duty to third party investors thus limiting the scope of his or her investing options c. Venture Capital Investors invest in ea rly-stage technology enterprises for their high-retu rn potentia d. Angel Investors can take an active role in advising portfolio companies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts