Question: Top-Ten Inc. is considering replacing its existing machine that is used to produce musical CDs. This existing machine was purchase 3 years ago at a

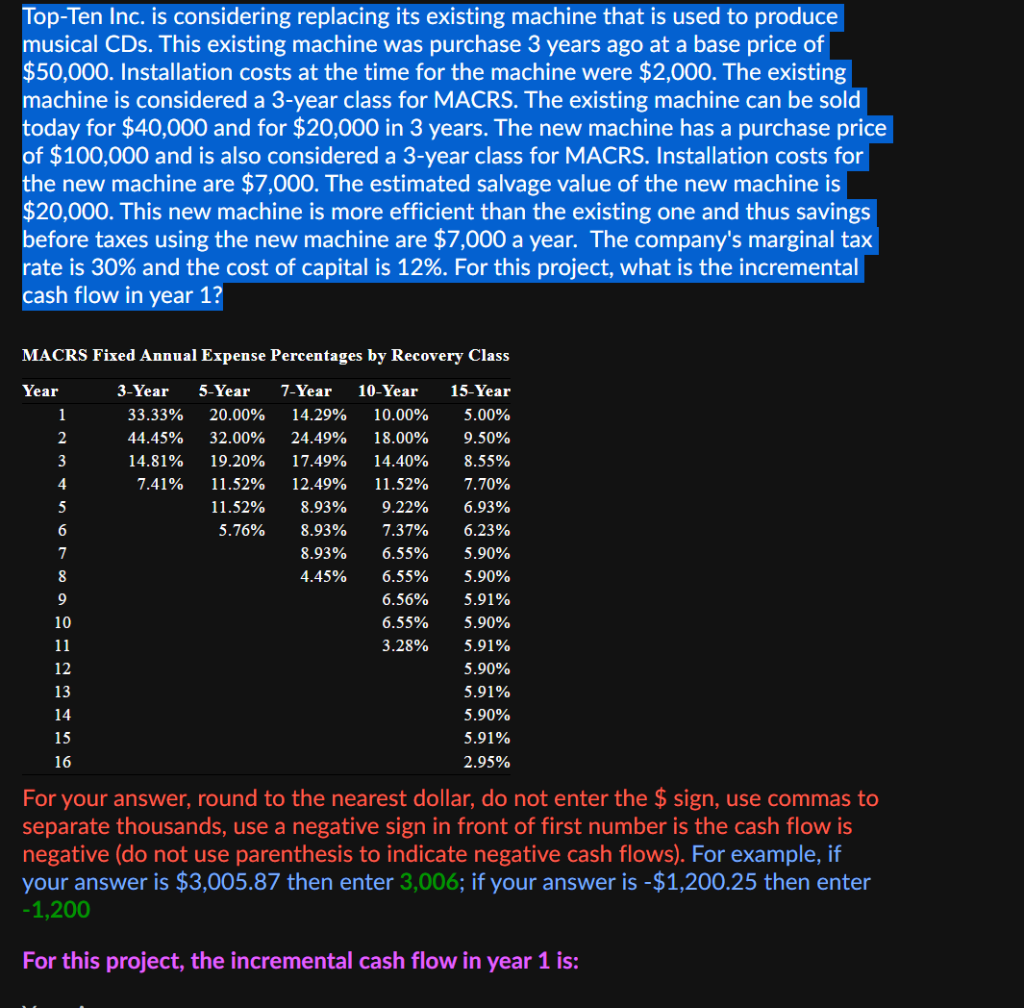

Top-Ten Inc. is considering replacing its existing machine that is used to produce musical CDs. This existing machine was purchase 3 years ago at a base price of $50,000. Installation costs at the time for the machine were $2,000. The existing machine is considered a 3-year class for MACRS. The existing machine can be sold today for $40,000 and for $20,000 in 3 years. The new machine has a purchase price of $100,000 and is also considered a 3-year class for MACRS. Installation costs for the new machine are $7,000. The estimated salvage value of the new machine is $20,000. This new machine is more efficient than the existing one and thus savings before taxes using the new machine are $7,000 a year. The company's marginal tax rate is 30% and the cost of capital is 12%. For this project, what is the incremental cash flow in year 1? MACRS Fixed Annual Expense Percentages by Recovery Class Year 1 2 3-Year 33.33% 44.45% 14.81% 7.41% 3 4 5 5-Year 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% 7-Year 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 10-Year 10.00% 18.00% 14.40% 11.52% 9.22% 7.37% 6.55% 6.55% 6.56% 6.55% 3.28% 6 8.93% 7 8 9 4.45% 15-Year 5.00% 9.50% 8.55% 7.70% 6.93% 6.23% 5.90% 5.90% 5.91% 5.90% 5.91% 5.90% 5.91% 5.90% 5.91% 2.95% 10 11 12 13 14 15 16 For your answer, round to the nearest dollar, do not enter the $ sign, use commas to separate thousands, use a negative sign in front of first number is the cash flow is negative (do not use parenthesis to indicate negative cash flows). For example, if your answer is $3,005.87 then enter 3,006; if your answer is -$1,200.25 then enter -1,200 For this project, the incremental cash flow in year 1 is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts