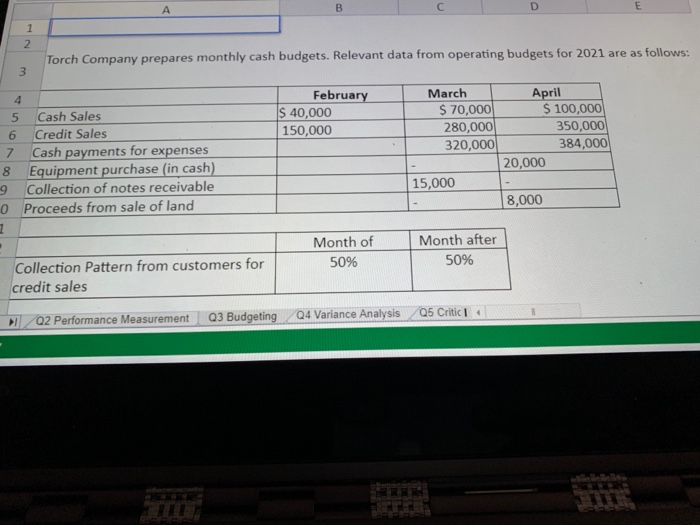

Question: Torch Company prepares monthly cash budgets. Relevant data from operating budgets for 2021 are as follows: February $ 40,000 150,000 March $ 70,000 280,000 320,000

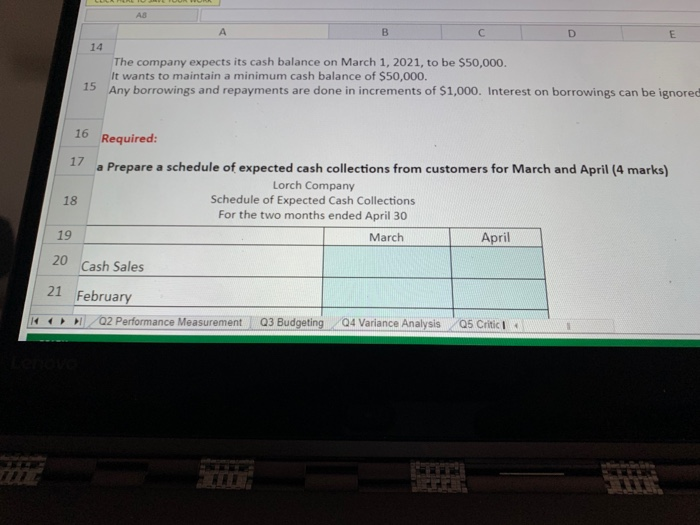

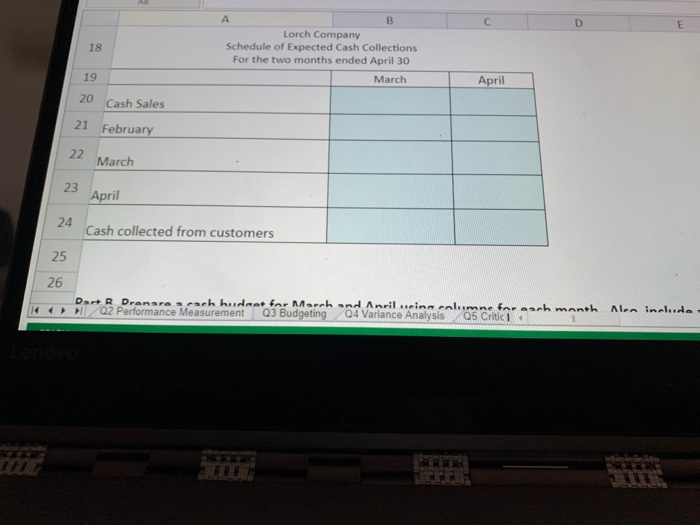

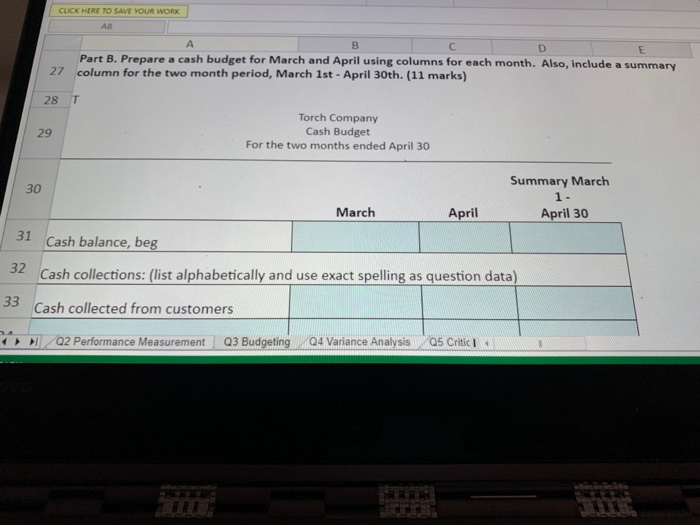

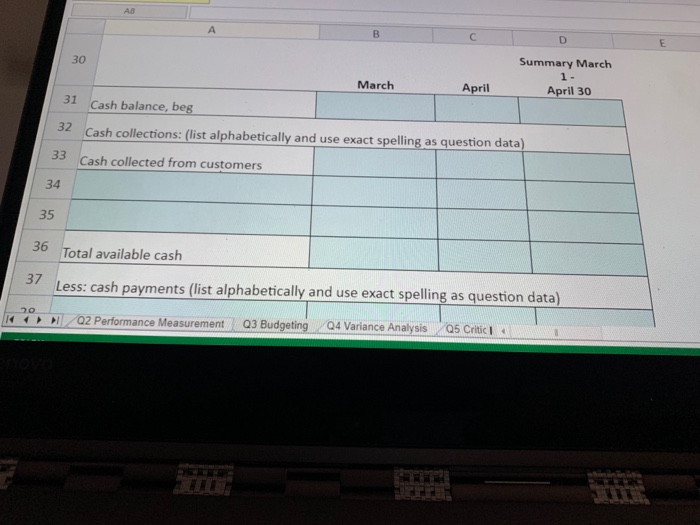

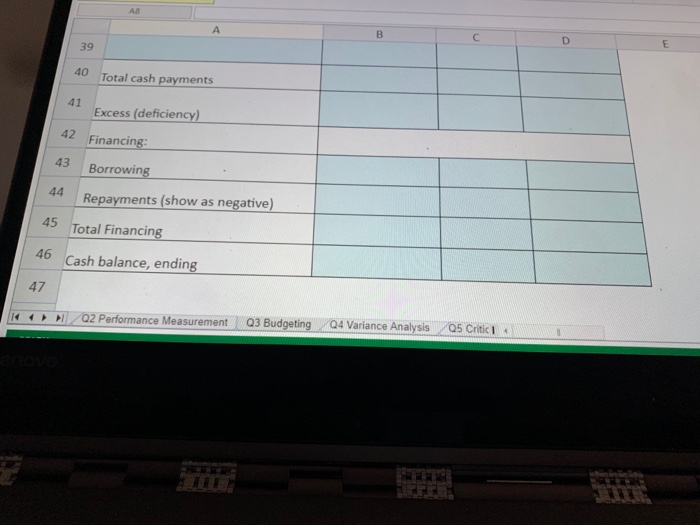

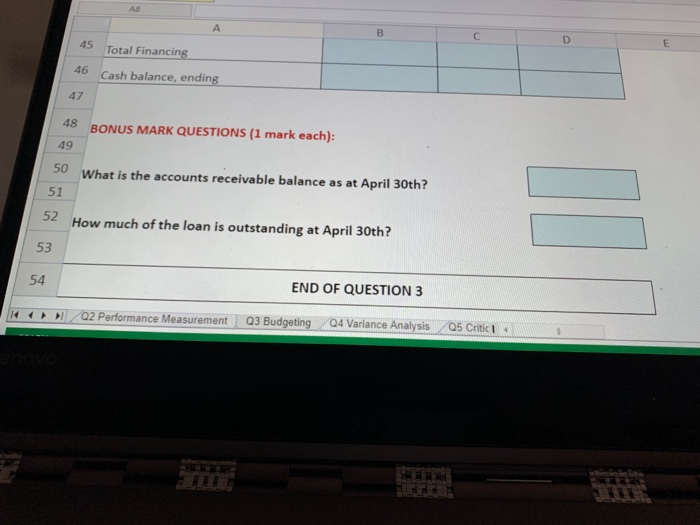

Torch Company prepares monthly cash budgets. Relevant data from operating budgets for 2021 are as follows: February $ 40,000 150,000 March $ 70,000 280,000 320,000 5 6 7 8 9 0 Cash Sales Credit Sales Cash payments for expenses Equipment purchase (in cash) Collection of notes receivable Proceeds from sale of land April $ 100,000 350,000 384,000 20,000 15,000 8,000 Month of 50% Month after 50% Collection Pattern from customers for credit sales I Q2 Performance Measurement Q3 Budgeting Q4 Variance Analysis Q5 Critic The company expects its cash balance on March 1, 2021, to be $50,000. It wants to maintain a minimum cash balance of $50,000. 15 Any borrowings and repayments are done in increments of $1,000. Interest on borrowings can be ignored 16 Required: 17 a Prepare a schedule of expected cash collections from customers for March and April (4 marks) Lorch Company Schedule of Expected Cash Collections For the two months ended April 30 March April 20 Cash Sales 21 February Q 2 Performance Measurement H Q3 Budgeting Q4 Variance Analysis 05 Critic Lorch Company Schedule of Expected Cash Collections For the two months ended April 30 March April Cash Sales 21 February March April Cash collected from customers K ( Dort R Dransrecach hunt for March and Anrileins chimne for much month Ales include Q2 Performance Measurement Q3 Budgeting Q4 Variance Analysis Q5 Critic CLICK HERE TO SAVE YOUR WORK AB Part B. Prepare a cash budget for March and April using columns for each month. Also include a summary 27 column for the two month period, March 1st - April 30th. (11 marks) Torch Company Cash Budget For the two months ended April 30 Summary March March April April 30 Cash balance, beg 32 Cash collections: (list alphabetically and use exact spelling as question data) 33 Cash collected from customers 02 Performance Measurement Q3 Budgeting Q4 Variance Analysis Q5 Critic Summary March 1- April 30 March April Cash balance, beg Cash collections: (list alphabetically and use exact spelling as question data) Cash collected from customers Total available cash 31 Less: cash payments (list alphabetically and use exact spelling as question data) 20 K Q 2 Performance MeasurementQ3 Budgeting Q4 Variance Analysis Q5 Critic Total cash payments payments Excess (deficiency) 42 Financing: 43 Borrowing 44 Repayments (show as negative) 45 Total Financing 46 Cash balance, ending 47 H Q 2 Performance Measurement Q3 Budgeting 04 Variance Analysis 05 Critic 45 Total Financing 46 Cash balance, ending 47 48 BONUS MARK QUESTIONS (1 mark each): 49 50 What is the accounts receivable balance as at April 30th? 51 52 How much of the loan is outstanding at April 30th? END OF QUESTION 3 N I Q2 Performance Measurement Q3 Budgeting Q4 Variance Analysis Q5 Critic

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts