Question: Torminal cash flow-Replacement decision Ruseall Industries is considering replacing a fully depreclatod machine that has a temaining isetul ife of 10 years with a newec,

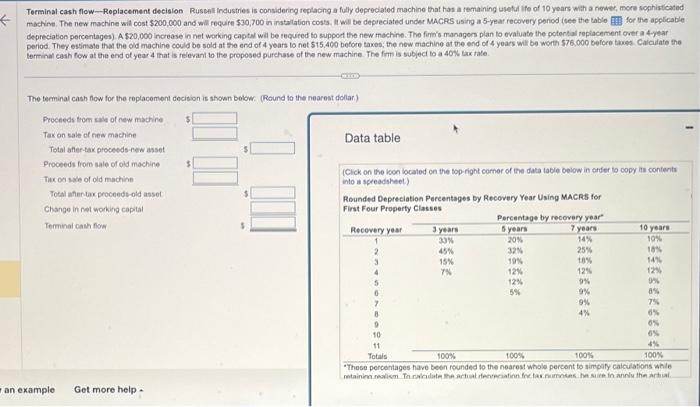

Torminal cash flow-Replacement decision Ruseall Industries is considering replacing a fully depreclatod machine that has a temaining isetul ife of 10 years with a newec, more sophisticated mochine. The new machine wil cost $200,000 and will fequire $30,700 in instalation costs. ll will be depreciated under Macers using a 5 -jear recovery poriod itee the table applicable depreciaton percentages) A $20,000 increase in net working captal will be requred to suppoct the new machine. The fire's managers plan to evaluate the potortal roplacement over a 4 year period. They essimale that the old mechine could be sold at the end of 4 years to net 515.400 before taxes; the new machine at the end of 4 years will be worth 576 , oog before taxp. Calailate the terminal cash fow at the end of year 4 that is relevant to the proposed purchase of the new machine. The fim is subjed to a 40% tax tate. The teminal cash fow for the replacemvent docision is shown below. (Round io the nearest dollar) Data table (Cick on the kon localed on the bop-ight corner of the data tadie below in erder to copy its contents into i spreadsheet) Rounded Depreciation Pereentages by Recovery Year Using MACRs for Firet Enur Prnnertv Clakese 1 "These percentages have been rounded to the neareat whole percent to simplfy caicialsons weile

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts