Question: Toshiba Inc. is considering replacing a machine. These are the data for both the used and new machine. Used machine: the machine was purchased

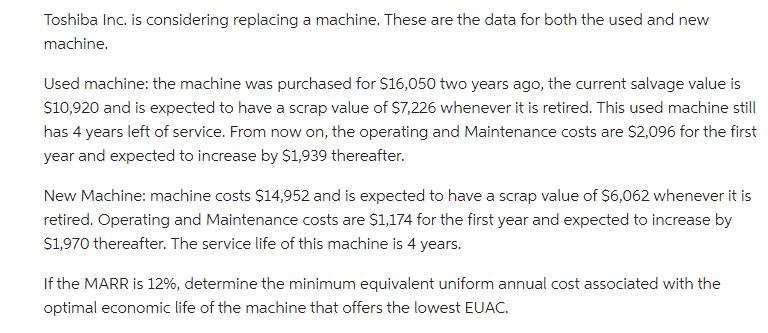

Toshiba Inc. is considering replacing a machine. These are the data for both the used and new machine. Used machine: the machine was purchased for $16,050 two years ago, the current salvage value is $10,920 and is expected to have a scrap value of $7,226 whenever it is retired. This used machine still has 4 years left of service. From now on, the operating and Maintenance costs are $2,096 for the first year and expected to increase by $1,939 thereafter. New Machine: machine costs $14,952 and is expected to have a scrap value of $6,062 whenever it is retired. Operating and Maintenance costs are $1,174 for the first year and expected to increase by $1,970 thereafter. The service life of this machine is 4 years. If the MARR is 12%, determine the minimum equivalent uniform annual cost associated with the optimal economic life of the machine that offers the lowest EUAC.

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

The detailed ... View full answer

Get step-by-step solutions from verified subject matter experts