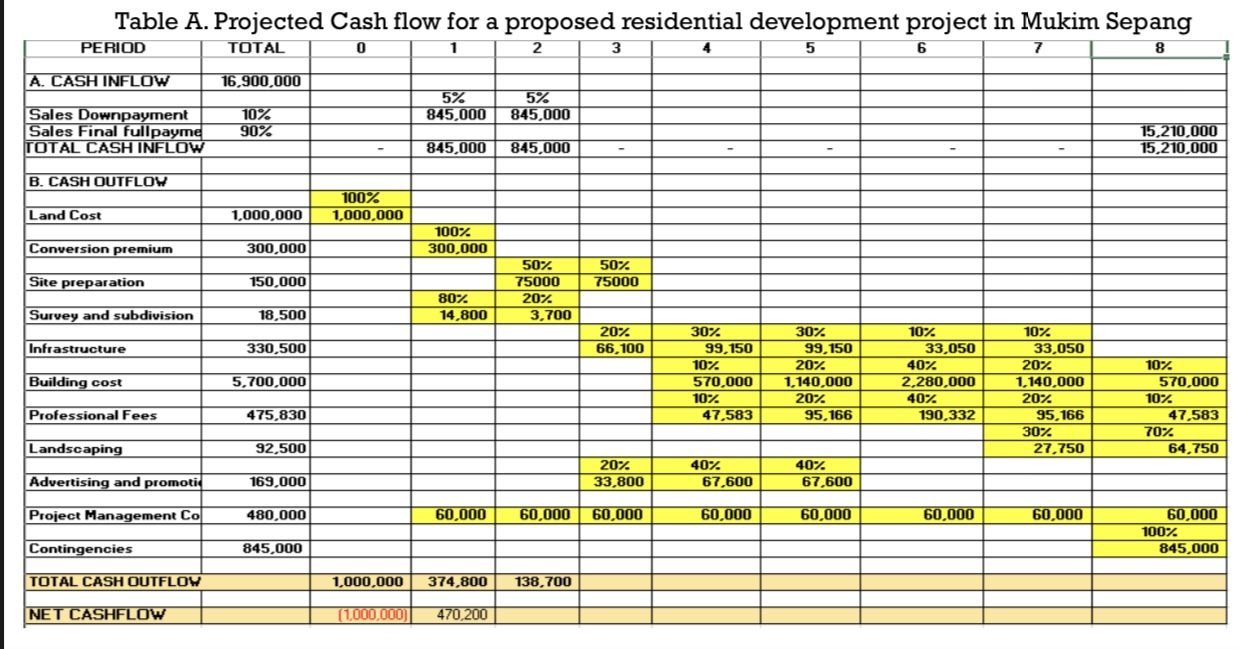

Question: TOTAL 0 Table A. Projected Cash flow for a proposed residential development project in Mukim Sepang PERIOD 1 2 3 5 6 7 8

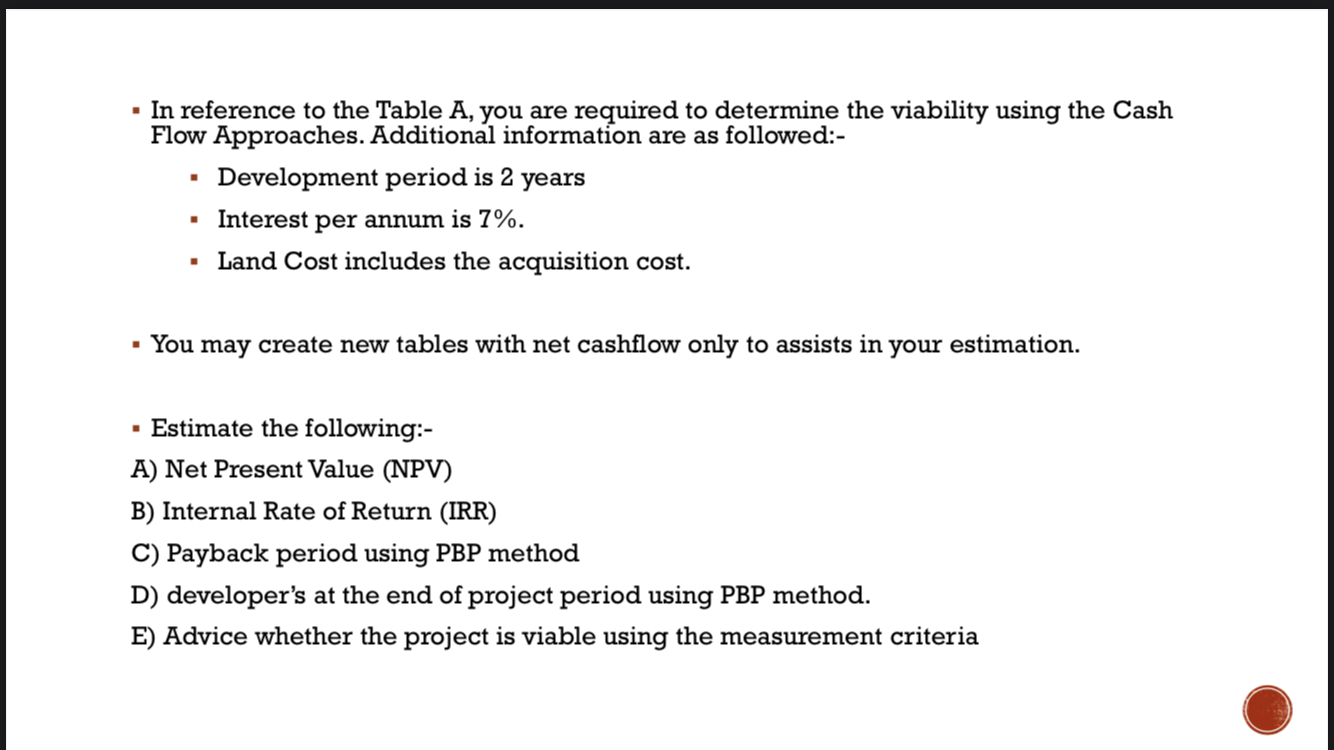

TOTAL 0 Table A. Projected Cash flow for a proposed residential development project in Mukim Sepang PERIOD 1 2 3 5 6 7 8 A. CASH INFLOW 16,900,000 Sales Downpayment 10% Sales Final fullpayme 90% TOTAL CASH INFLOW 5% 5% 845,000 845,000 845,000 845,000 15,210,000 15,210,000 B. CASH OUTFLOW 100% Land Cost 1,000,000 1,000,000 Conversion premium 300,000 100% 300,000 Site preparation 150,000 Survey and subdivision 18,500 80% 14,800 50% 75000 20% 50% 75000 3,700 Infrastructure 330,500 20% 66,100 30% 99,150 Building cost 5,700,000 10% 570,000 10% Professional Fees 475,830 47,583 30% 99,150 20% 1,140,000 20% 95,166 10% 10% 33,050 33,050 40% 2,280,000 40% 20% 1,140,000 20% 10% 570,000 10% 190,332 95,166 47,583 30% 70% Landscaping 92,500 27,750 64,750 Advertising and promoti 169,000 Project Management Co 480,000 Contingencies 845,000 20% 33,800 40% 67,600 40% 67,600 60,000 60,000 60,000 60,000 60,000 60,000 60,000 60,000 100% 845,000 TOTAL CASH OUTFLOW 1,000,000 374,800 138,700 NET CASHFLOW (1,000,000) 470,200 In reference to the Table A, you are required to determine the viability using the Cash Flow Approaches. Additional information are as followed:- Development period is 2 years Interest per annum is 7%. Land Cost includes the acquisition cost. You may create new tables with net cashflow only to assists in your estimation. Estimate the following:- A) Net Present Value (NPV) B) Internal Rate of Return (IRR) C) Payback period using PBP method D) developer's at the end of project period using PBP method. E) Advice whether the project is viable using the measurement criteria

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts