Question: Total 100 Scoring: 2 points per item. Perfect Score: 20 I. When the allowance method is used, the balance of a customer's account is transferred

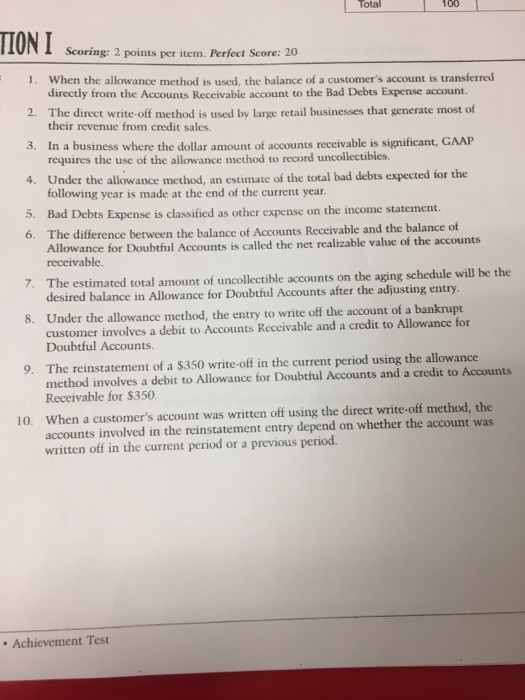

Total 100 Scoring: 2 points per item. Perfect Score: 20 I. When the allowance method is used, the balance of a customer's account is transferred directly from the Accounts Receivable account to the Bad Debts Expense account. The direct write-off method is used by large retail businesses that generate most of their revenue from credit sales. 2. 3. In a business where the dollar amount of accounts receivable is significant, GAA requires the use of the ailowance method to record uncollectibies. Under the allowance method, an estimate of the total bad debts expected for the following year is made at the end of the current year Bad Debts Expense is classified as other expense on the income statement. 4. 5. The difference between the balance of Accounts Receivable and the balance of Allowance for Doubtful Accounts is called the net realizable value of the accounts receivable. 6. The estimated total amount of uncollectible accounts on the aging schedule will be the desired balance in Allowance for Doubtful Accounts after the adjusting entry. 7. Under the allowance method, the entry to write off the account of a bankrupt customer involves a debit to Accounts Receivable and a credit to Allowance for Doubtful Accounts. 8. The reinstatement of a $350 write-off in the current period using the allowance method involves a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable for $350. 9. 10. When a customer's account was written off using the direct write-off method, the accounts involved in the reinstatement entry depend on whether the account was written off in the current period or a previous period. . Achicvement Test

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts