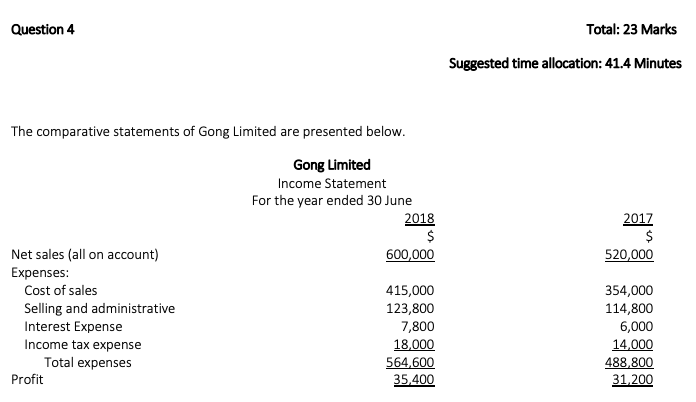

Question: Total: 23 Marks Question 4 Suggested time allocation: 414 Minutes The comparative statements of Gong Limited are presented below. Gong Limited Income Statement For the

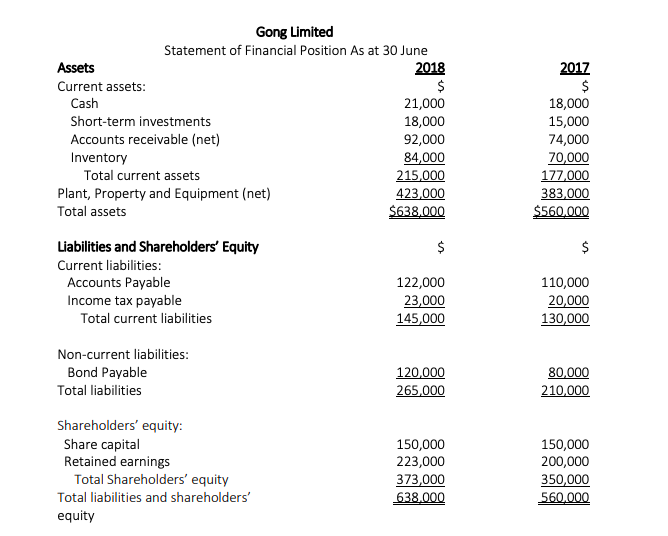

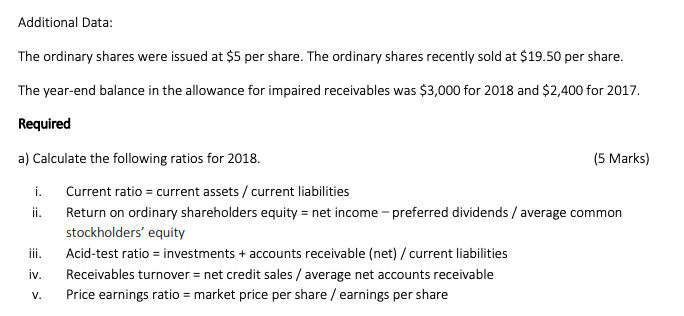

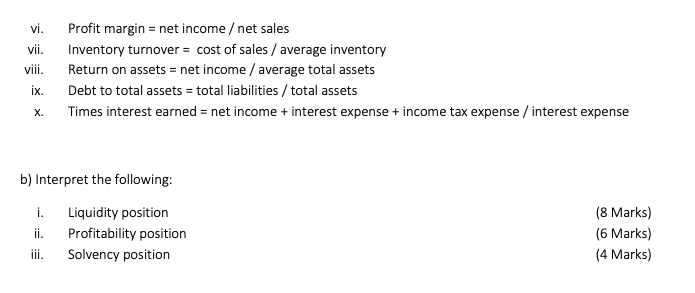

Total: 23 Marks Question 4 Suggested time allocation: 414 Minutes The comparative statements of Gong Limited are presented below. Gong Limited Income Statement For the year ended 30 June 2018 $ 600,000 2017 Net sales (all on account) Expenses: Cost of sales 520,000 415,000 123,800 354,000 114,800 6,000 14,000 488,800 31,200 Selling and administrative Interest Expense Income tax expense Total expenses Profit 7,800 18,000 564,600 35,400 Gong Limited Statement of Financial Position As at 30 June Assets 2018 2017 Current assets: 21,000 18,000 92,000 84,000 215,000 423.000 $638.000 18,000 15,000 Cash Short-term investments Accounts receivable (net) 74,000 70,000 177,000 383,000 $560.000 Inventory Total current assets Plant, Property and Equipment (net) Total assets Liabilities and Shareholders' Equity Current liabilities: Accounts Payable Income tax payable 122,000 23,000 145,000 110,000 20,000 130,000 Total current liabilities Non-current liabilities: Bond Payable 120,000 265,000 80,000 210,000 Total liabilities Shareholders' equity: Share capital Retained earnings Total Shareholders' equity 150,000 223,000 373,000 150,000 200,000 350,000 Total liabilities and shareholders' 638.000 560,000 equity Additional Data: The ordinary shares were issued at $5 per share. The ordinary shares recently sold at $19.50 per share. The year-end balance in the allowance for impaired receivables was $3,000 for 2018 and $2,400 for 2017. W Required a) Calculate the following ratios for 2018. (5 Marks) Current ratio current assets / current liabilities Return on ordinary shareholders equity net income-preferred dividends average common stockholders' equity i. Acid-test ratio investments accounts receivable (net) / current liabilities iii + iv Receivables turnover net credit sales average net accounts receivable Price earnings ratio market price per share / earnings per share V. Profit margin = net incomeet sales vi Inventory turnover cost of sales/average inventory Return on assets = net income / average total assets Debt to total assets = total liabilities / total assets vii viii ix Times interest earned net income interest expense income tax expense interest expense + X. b) Interpret the following: i. Liquidity position (8 Marks) Profitability position (6 Marks) (4 Marks) Solvency position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts