Question: Total 28 points. 7 points each part. Do not worry about perfectly clear debits vs. credits on the journal entries -- as long as it

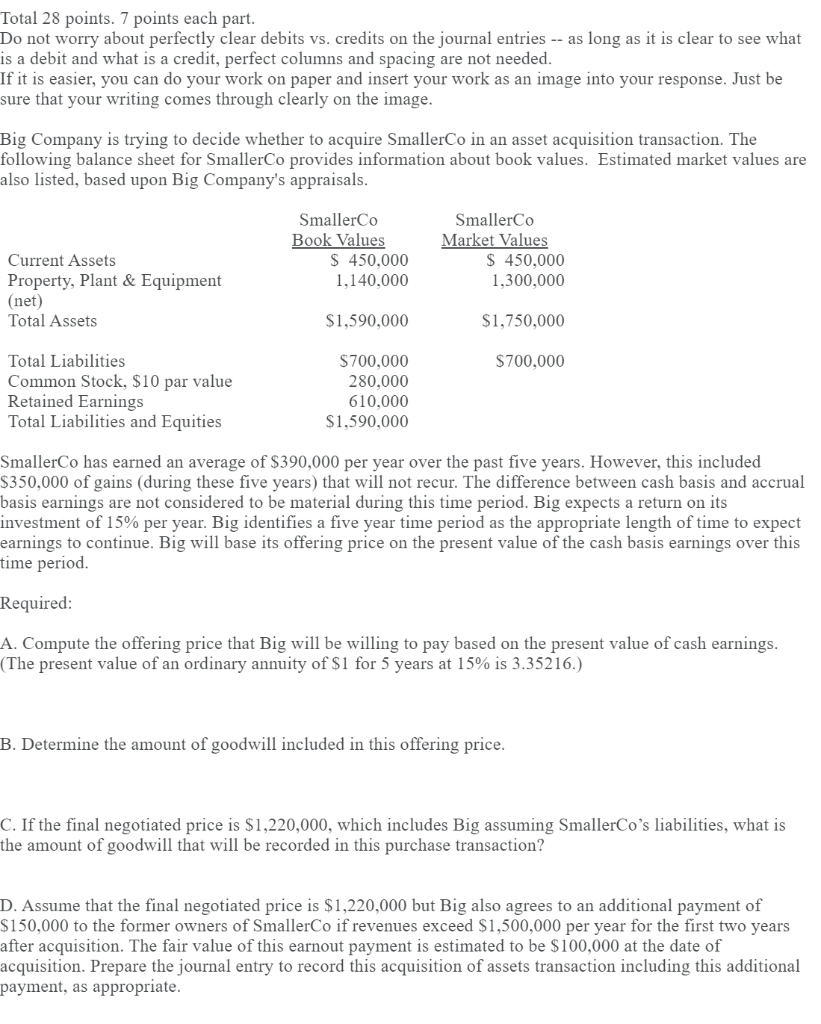

Total 28 points. 7 points each part. Do not worry about perfectly clear debits vs. credits on the journal entries -- as long as it is clear to see what is a debit and what is a credit, perfect columns and spacing are not needed. If it is easier, you can do your work on paper and insert your work as an image into your response. Just be sure that your writing comes through clearly on the image. Big Company is trying to decide whether to acquire SmallerCo in an asset acquisition transaction. The following balance sheet for SmallerCo provides information about book values. Estimated market values are also listed, based upon Big Company's appraisals. SmallerCo Book Values $ 450,000 1,140,000 SmallerCo Market Values $ 450,000 1,300,000 Current Assets Property, Plant & Equipment (net) Total Assets $1,590,000 $1,750,000 $700,000 Total Liabilities Common Stock, $10 par value Retained Earnings Total Liabilities and Equities $700,000 280,000 610,000 $1,590,000 SmallerCo has earned an average of $390,000 per year over the past five years. However, this included $350,000 of gains (during these five years) that will not recur. The difference between cash basis and accrual basis earnings are not considered to be material during this time period. Big expects a return on its investment of 15% per year. Big identifies a five year time period as the appropriate length of time to expect earnings to continue. Big will base its offering price on the present value of the cash basis earnings over this time period. Required: A. Compute the offering price that Big will be willing to pay based on the present value of cash earnings. (The present value of an ordinary annuity of $1 for 5 years at 15% is 3.35216.) B. Determine the amount of goodwill included in this offering price. C. If the final negotiated price is $1,220,000, which includes Big assuming SmallerCo's liabilities, what is the amount of goodwill that will be recorded in this purchase transaction? D. Assume that the final negotiated price is $1,220,000 but Big also agrees to an additional payment of $150,000 to the former owners of SmallerCo if revenues exceed $1,500,000 per year for the first two years after acquisition. The fair value of this earnout payment is estimated to be $100,000 at the date of acquisition. Prepare the journal entry to record this acquisition of assets transaction including this additional payment, as appropriate. Total 28 points. 7 points each part. Do not worry about perfectly clear debits vs. credits on the journal entries -- as long as it is clear to see what is a debit and what is a credit, perfect columns and spacing are not needed. If it is easier, you can do your work on paper and insert your work as an image into your response. Just be sure that your writing comes through clearly on the image. Big Company is trying to decide whether to acquire SmallerCo in an asset acquisition transaction. The following balance sheet for SmallerCo provides information about book values. Estimated market values are also listed, based upon Big Company's appraisals. SmallerCo Book Values $ 450,000 1,140,000 SmallerCo Market Values $ 450,000 1,300,000 Current Assets Property, Plant & Equipment (net) Total Assets $1,590,000 $1,750,000 $700,000 Total Liabilities Common Stock, $10 par value Retained Earnings Total Liabilities and Equities $700,000 280,000 610,000 $1,590,000 SmallerCo has earned an average of $390,000 per year over the past five years. However, this included $350,000 of gains (during these five years) that will not recur. The difference between cash basis and accrual basis earnings are not considered to be material during this time period. Big expects a return on its investment of 15% per year. Big identifies a five year time period as the appropriate length of time to expect earnings to continue. Big will base its offering price on the present value of the cash basis earnings over this time period. Required: A. Compute the offering price that Big will be willing to pay based on the present value of cash earnings. (The present value of an ordinary annuity of $1 for 5 years at 15% is 3.35216.) B. Determine the amount of goodwill included in this offering price. C. If the final negotiated price is $1,220,000, which includes Big assuming SmallerCo's liabilities, what is the amount of goodwill that will be recorded in this purchase transaction? D. Assume that the final negotiated price is $1,220,000 but Big also agrees to an additional payment of $150,000 to the former owners of SmallerCo if revenues exceed $1,500,000 per year for the first two years after acquisition. The fair value of this earnout payment is estimated to be $100,000 at the date of acquisition. Prepare the journal entry to record this acquisition of assets transaction including this additional payment, as appropriate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts