Question: (Total: 37 marks) Question 1: Please answer the questions based on below case study ABC Limited leases an asset (as lessee) on 1st January 2016,

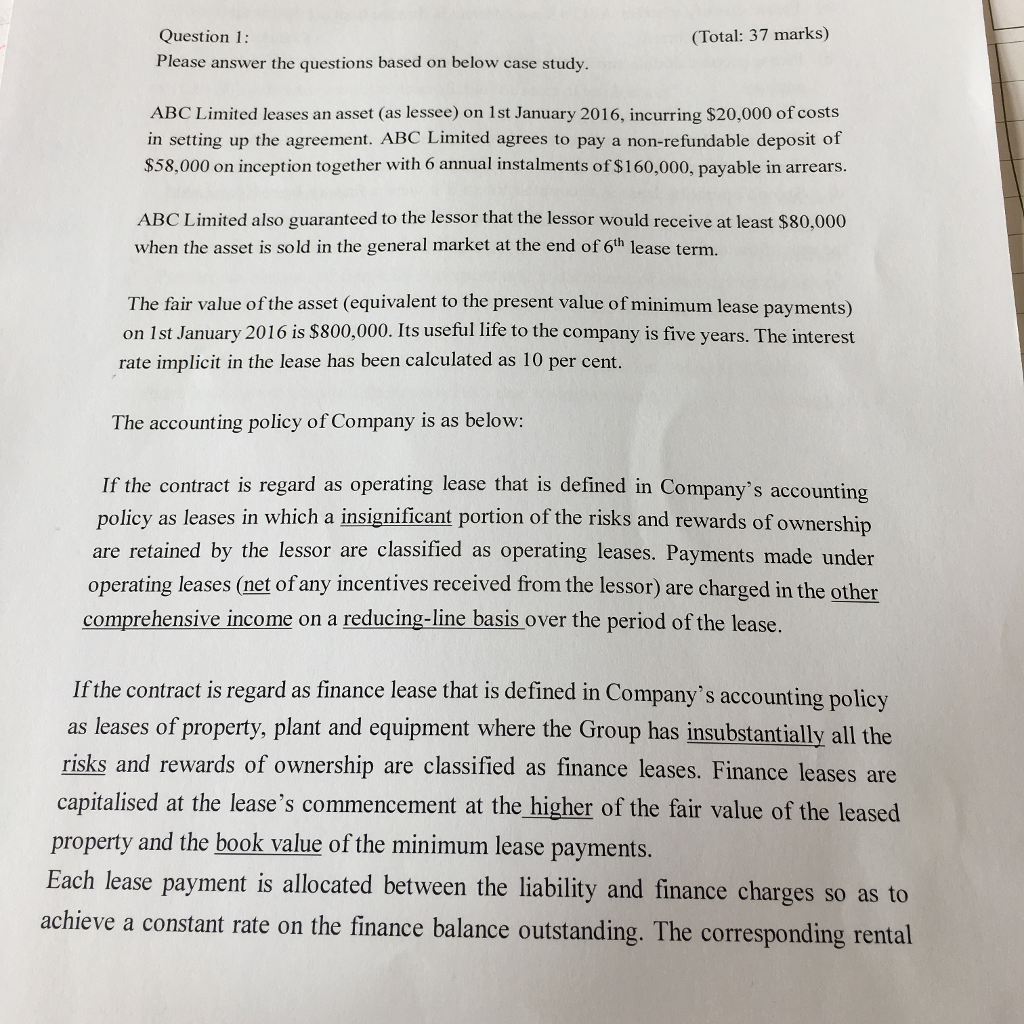

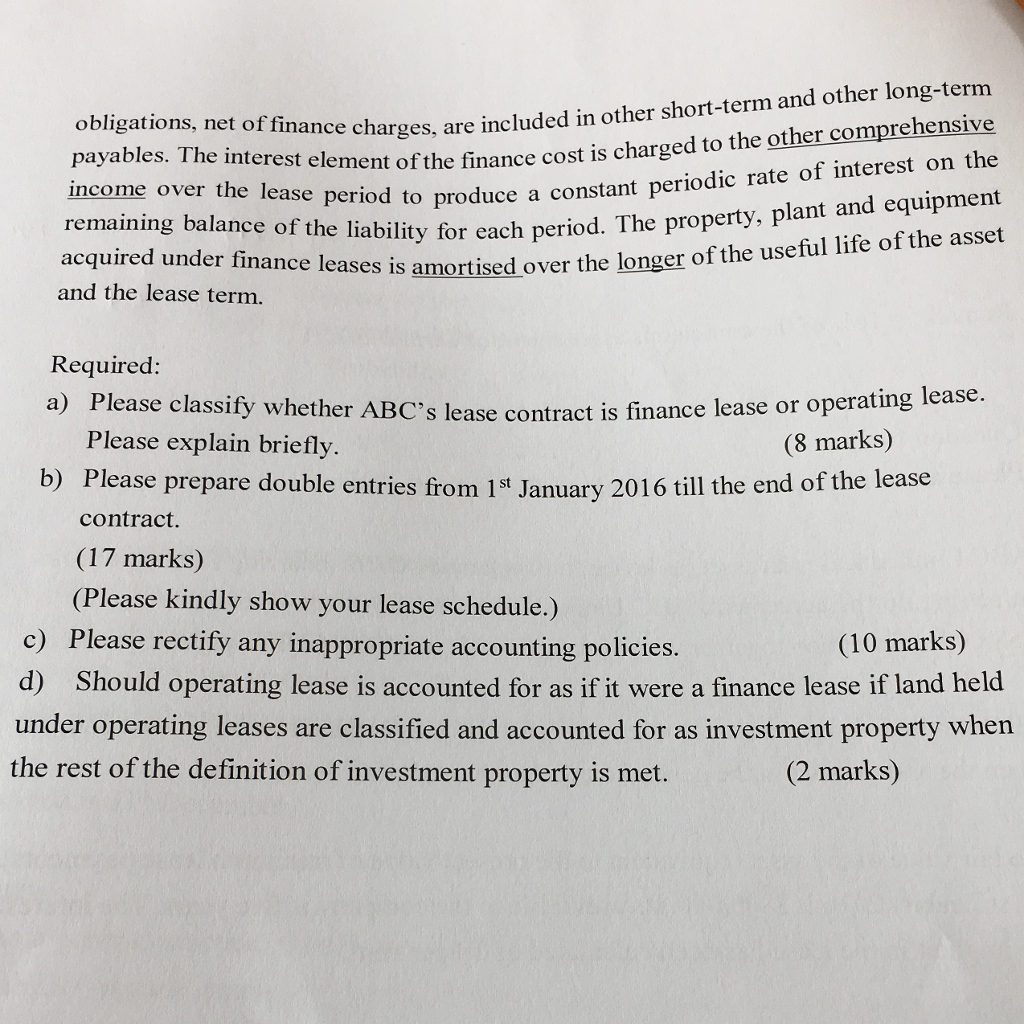

(Total: 37 marks) Question 1: Please answer the questions based on below case study ABC Limited leases an asset (as lessee) on 1st January 2016, incurring $20,000 of costs in setting up the agreement. ABC Limited agrees to pay a non-refundable deposit of $58,000 on inception together with 6 annual instalments of $160,000, payable in arrears. ABC Limited also guaranteed to the lessor that the lessor would receive at least $80.000 when the asset is sold in the general market at the end of 6th lease term. The fair value of the asset (equivalent to the present value ofminimum lease payments on 1st January 2016 is S800,000. Its useful life to the company is five years. The interest rate implicit in the lease has been calculated as 10 per cent. The accounting policy of Company is as below If the contract is regard as operating lease that is defined in Company's accounting policy as leases in which a insignificant portion of the risks and rewards of ownership are retained by the lessor are classified as operating leases. Payments made under operating leases (net of any incentives received from the lessor) are charged in the other comprehensive income on a reducing-line basis over the period of the lease. If the contract is regard as finance lease that is defined in Company's accounting policy as leases of property, plant and equipment where the Group has insubstantially all the risks and rewards of ownership are classified as finance leases. Finance leases are capitalised at the lease's commencement at the higher of the fair value of the leased property and the book value of the minimum lease payments Each lease payment is allocated between the liability and finance charges so as to achieve a constant rate on the finance balance outstanding. corresponding rental The

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts