Question: Total 43.85 56.03 Please provide answer in 30 mins Please provide me answers in 45 mins....Thanks Calculator Question No: 01 2021mb21967 Statement of Income &

Total 43.85 56.03  Please provide answer in 30 mins

Please provide answer in 30 mins

Please provide me answers in 45 mins....Thanks

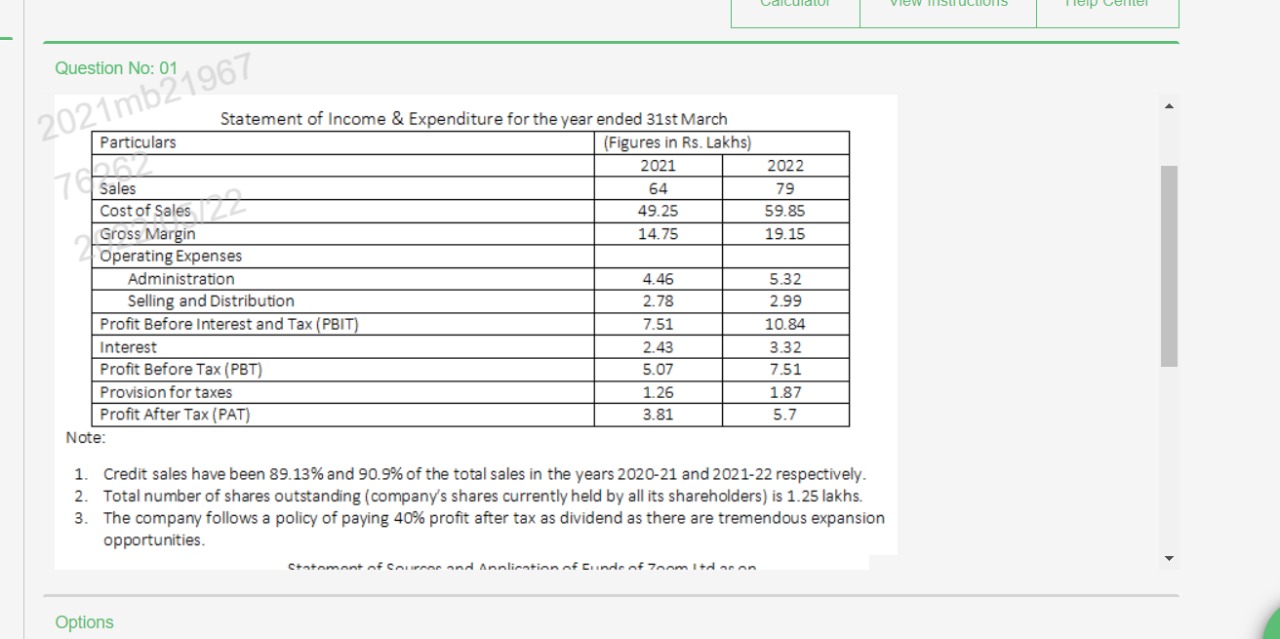

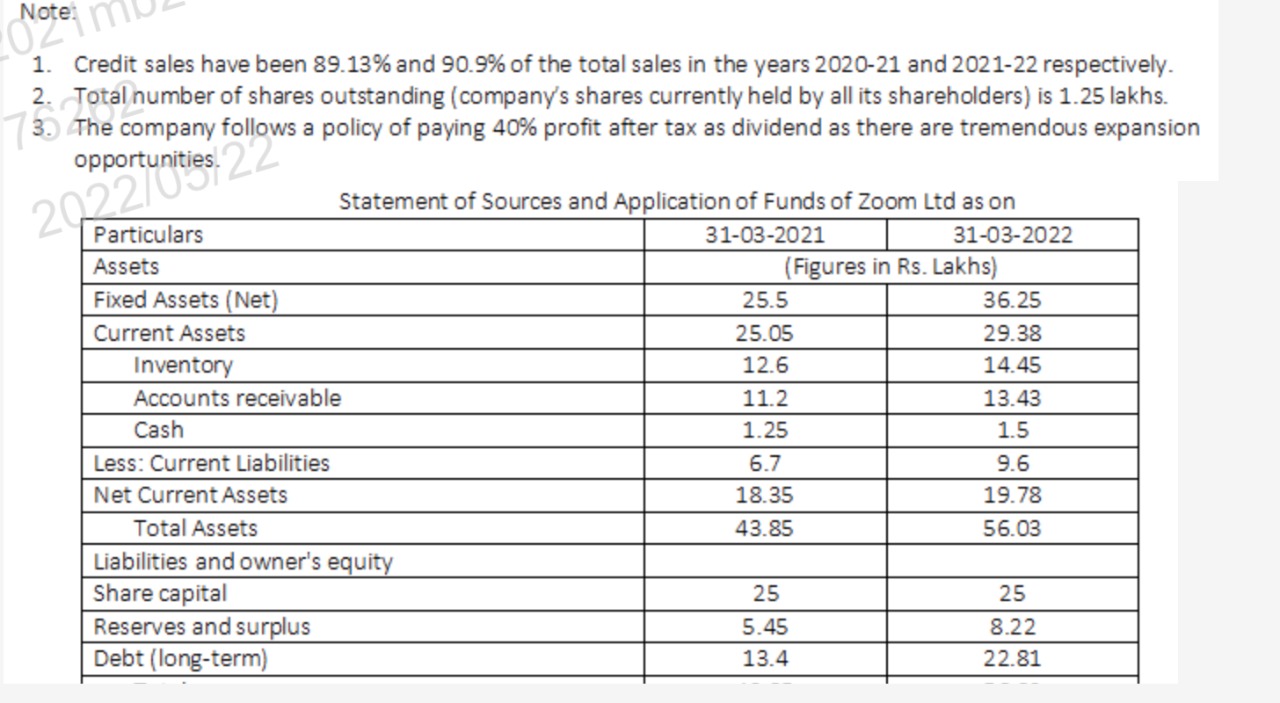

Calculator Question No: 01 2021mb21967 Statement of Income & Expenditure for the year ended 31st March Particulars (Figures in Rs. Lakhs) 2022 76562 Sales 2021 64 49.25 Cost of Sales les, 1:22 79 59.85 Gross Margin 14.75 19.15 Operating Expenses Administration 4.46 5.32 Selling and Distribution 2.78 2.99 Profit Before Interest and Tax (PBIT) 7.51 10.84 Interest 2.43 3.32 Profit Before Tax (PBT) 5.07 7.51 Provision for taxes 1.26 1.87 Profit After Tax (PAT) 3.81 5.7 Note: 1. Credit sales have been 89.13% and 90.9% of the total sales in the years 2020-21 and 2021-22 respectively. 2. Total number of shares outstanding (company's shares currently held by all its shareholders) is 1.25 lakhs. 3. The company follows a policy of paying 40% profit after tax as dividend as there are tremendous expansion opportunities. Statement of Sources and Application of Funds of 700m Itd con Options view mistractionS Help Center Note: 1. Credit sales have been 89.13% and 90.9% of the total sales in the years 2020-21 and 2021-22 respectively. 3. all its is 1.25 The company follows a policy of paying 40% profit after tax as dividend as there are tremendous expansion 20portunities! 22 Statement of Sources and Application of Funds of Zoom Ltd as on Particulars 31-03-2021 31-03-2022 Assets (Figures in Rs. Lakhs) Fixed Assets (Net) 25.5 36.25 Current Assets 25.05 29.38 Inventory 12.6 14.45 Accounts receivable 11.2 13.43 Cash 1.25 1.5 Less: Current Liabilities 6.7 9.6 Net Current Assets 18.35 19.78 Total Assets 43.85 56.03 Liabilities and owner's equity Share capital 25 25 Reserves and surplus 5.45 8.22 Debt (long-term) 13.4 22.81 Using ratios, analyze and interpret the liquidity and profitability position of your competitor. [Marks: 10+5]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts