Question: Total 68 marks 68 points Entity A is a local construction company, which provides construction services to different types of customers. To prepare for the

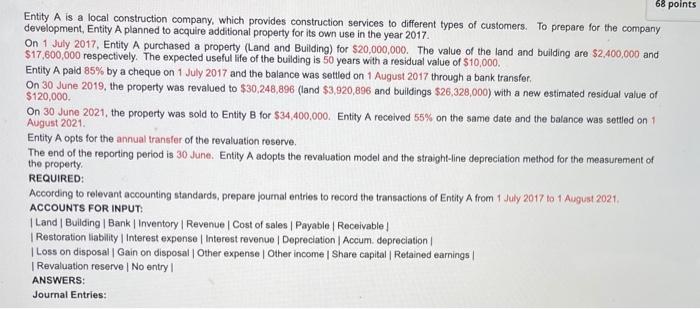

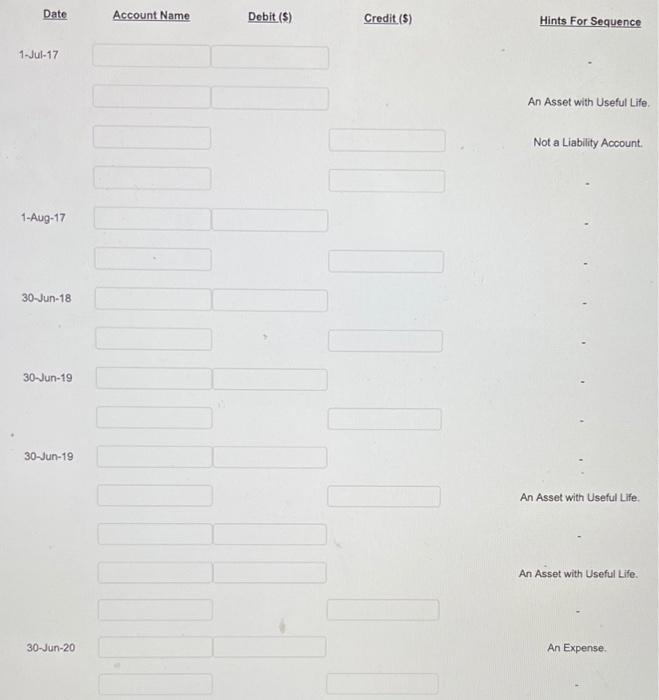

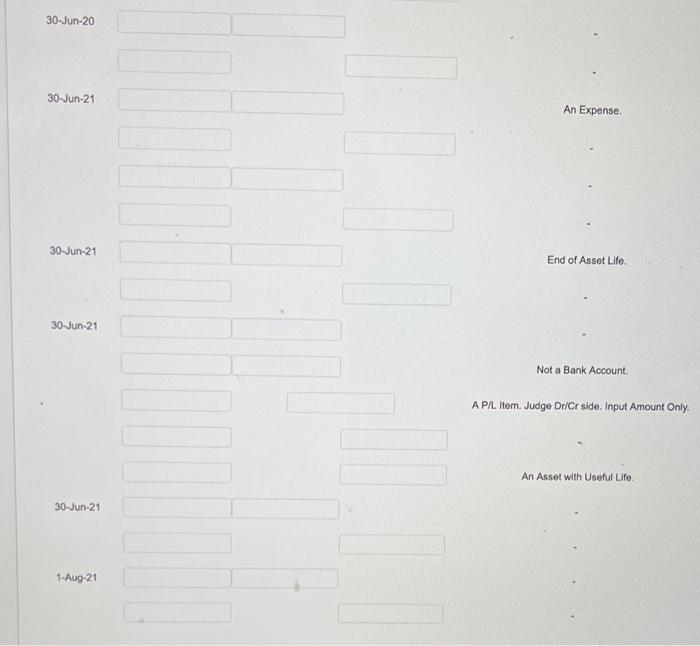

68 points Entity A is a local construction company, which provides construction services to different types of customers. To prepare for the company development, Entity A planned to acquire additional property for its own use in the year 2017 On 1 July 2017, Entity A purchased a property (Land and Building) for $20,000,000. The value of the land and building are $2,400,000 and $17,600,000 respectively. The expected useful life of the building is 50 years with a residual value of $10,000. Entity A paid 85% by a cheque on 1 July 2017 and the balance was settled on 1 August 2017 through a bank transfer On 30 June 2019, the property was revalued to $30,248,896 (land $3,920,896 and buildings $26,328,000) with a new estimated residual value of $120,000 On 30 June 2021, the property was sold to Entity for $34,400,000. Entity A received 55% on the same date and the balance was settled on 1 August 2021 Entity A opts for the annual transfer of the revaluation rosorve. The end of the reporting period is 30 June. Entity A adopts the revaluation model and the straight-line depreciation method for the measurement of the property REQUIRED: According to relevant accounting standards, prepare Journal entries to record the transactions of Entity A from 1 July 2017 to 1 August 2021 ACCOUNTS FOR INPUT: I Land Building | Bank Inventory Revenue Cost of sales | Payable | Receivable! Restoration liability Interest expense Interest revenue Depreciation Accum depreciation Loss on disposal | Gain on disposal Other expense Other income Share capital Retained earnings Revaluation reserve | No entry ANSWERS: Journal Entries: Date Account Name Debit ($) Credit (5) Hints For Sequence 1-Jul-17 An Asset with Useful Life Not a Liability Account 1-Aug-17 30-Jun-18 30-Jun-19 30-Jun-19 An Asset with Useful Life An Asset with Useful Life. 30-Jun-20 An Expense 30-Jun-20 30-Jun-21 An Expense. 30-Jun-21 End of Asset Life 30-Jun-21 Not a Bank Account A PIL.Item. Judge Dr/Cr side. Input Amount Only An Asset with Useful Life. 30-Jun-21 1-Aug-21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts