Question: Total current liabilities $7,149,557$5,921,882 Long-term liabilities Long-term debt (Note 6) Total Liabilities Stockholders' Equity Common stock (Note 7) Additional paid-in capital Retained earnings Total stockholders'

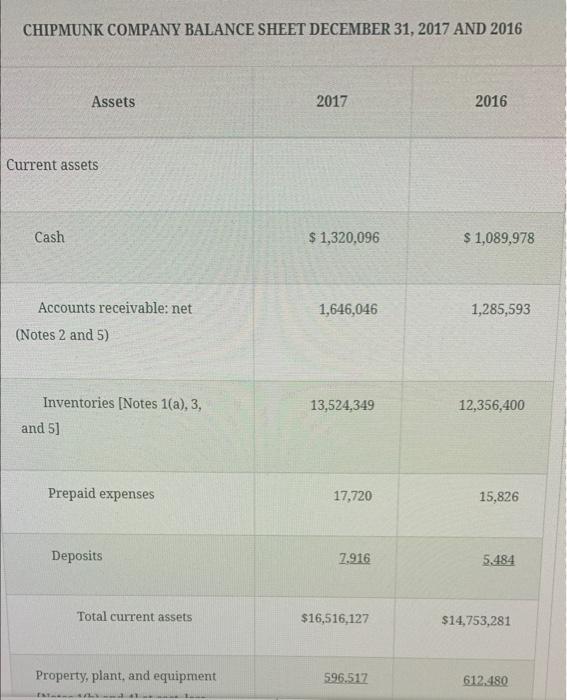

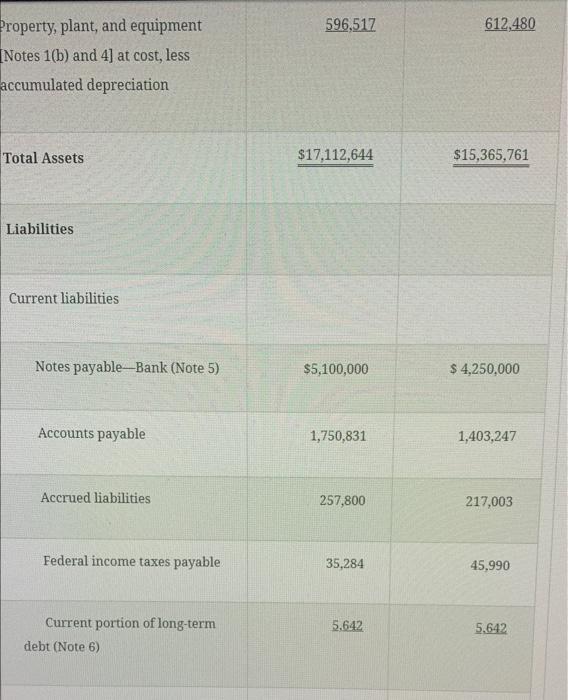

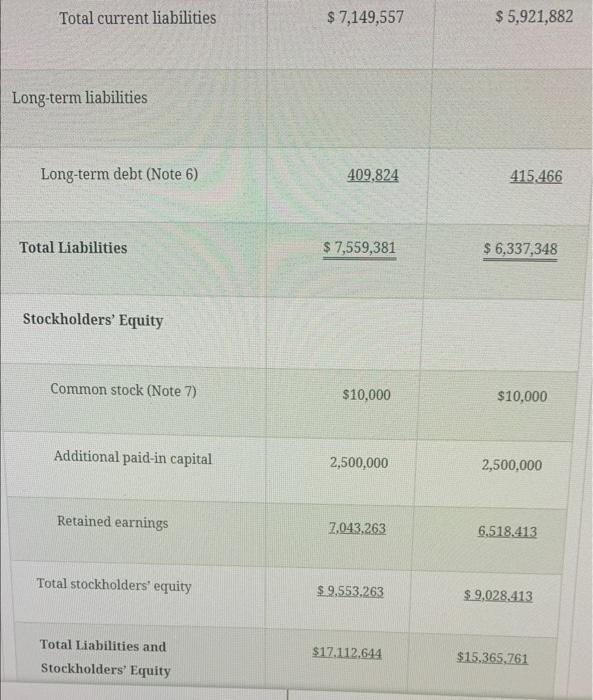

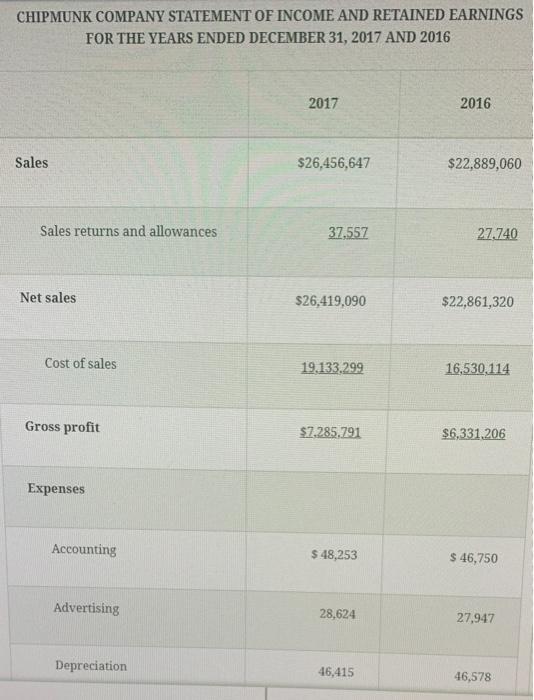

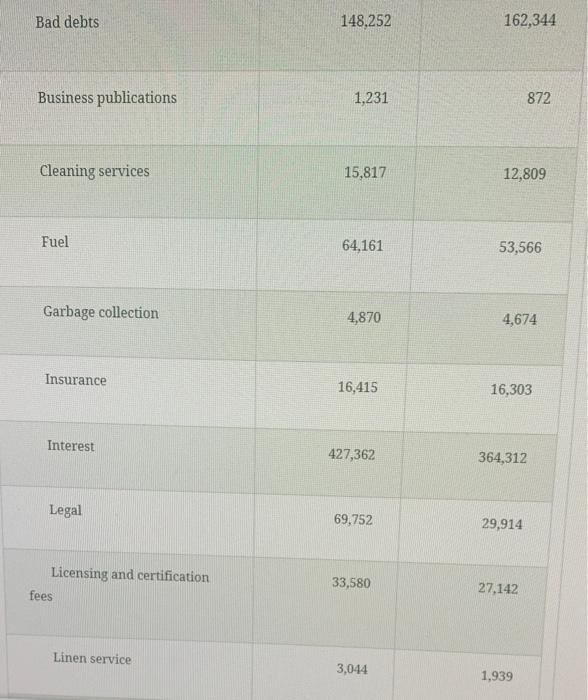

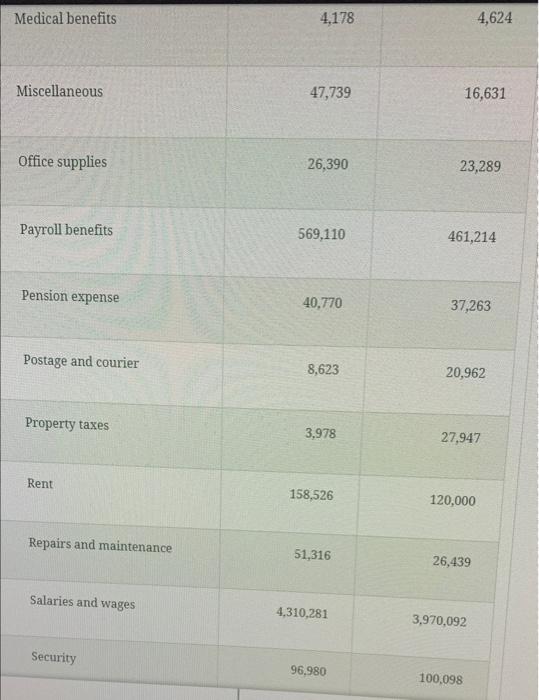

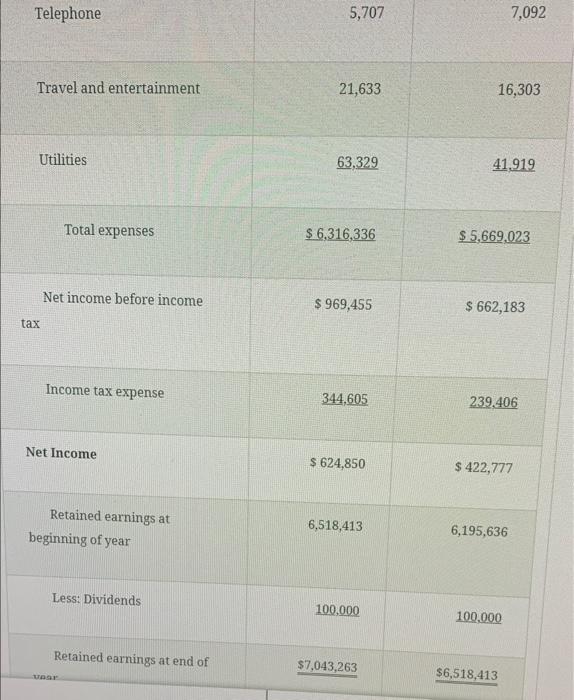

Total current liabilities $7,149,557$5,921,882 Long-term liabilities Long-term debt (Note 6) Total Liabilities Stockholders' Equity Common stock (Note 7) Additional paid-in capital Retained earnings Total stockholders' equity Total Liabilities and Stockholders' Equity 409,824 415.466 $6,337,348 $10,000 $10,000 2,500,000 2,500,000 7,043.263 6.518 .413 $9,553,263 $9,028,413 $17,112,644 $15,365,761 You are a fraud investigator who has been hired to detect financial statement fraud for the Chipmunk Company. You have been provided with the financial statements on the following pages and are now beginning your analysis of those financial statements. Please note: the balance in inventories on January 1,2016 was $11,427,937. Questions 1. Calculate the 2017 and 2016 liquidity ratios identified using the ratio analysis table below. Also calculate the change and the percentage change for the ratios and complete the table. (Formulas are given to shorten the time spent on the assignment.) 2. Analyze the Chipmunk Company's ratios for both years and compare the figures with the given industry ratios. Based on the ratios identified, where do you think fraud may have occurred? Property, plant, and equipment 596,517 612,480 [Notes 1(b) and 4] at cost, less accumulated depreciation Total Assets $17,112,644 $15,365,761 Liabilities Current liabilities Notes payable-Bank (Note 5) Accounts payable Accrued liabilities Federal income taxes payable Current portion of long-term debt (Note 6) $5,100,000 1,750,831 257,800 35,284 $4,250,000 1,403,247 217,003 5.642 5,642 CHIPMUNK COMPANY BALANCE SHEET DECEMBER 31, 2017 AND 2016 Assets 2017 2016 Current assets Cash $1,320,096 $1,089,978 Accounts receivable: net 1,646,046 1,285,593 (Notes 2 and 5) Inventories [Notes 1(a), 3 , 13,524,349 12,356,400 and 5] Prepaid expenses 17,720 15,826 Deposits 7.916 5.484 Total current assets $16,516,127 $14,753,281 Property, plant, and equipment 596.517 612,480 CHIPMUNK COMPANY STATEMENT OF INCOME AND RETAINED EARNINGS FOR THE YEARS ENDED DECEMBER 31, 2017 AND 2016 2017 $26,456,647 Sales returns and allowances Net sales Cost of sales Gross profit Expenses Accounting Advertising Depreciation 2016 $22,889,060 37,557 $26,419,090 19,133.299 $7,285.791 $22,861,320 16,530,114 $6,331,206 Medical benefits Miscellaneous 47,739 16,631 Office supplies 26,390 23,289 Payroll benefits 569,110 461,214 Pension expense 40,770 37,263 Postage and courier 8,623 20,962 Property taxes 3,97827,947 Rent 158,526 120,000 Repairs and maintenance 51,316 26,439 Salaries and wages 4,310,281 3,970,092 Security 96,980 100,098

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts