Question: Total for Question: 10 marks) Question 5 (10 marks) Consider the following information about a Current Stock Price S non-dividend paying stock. $20 40% per

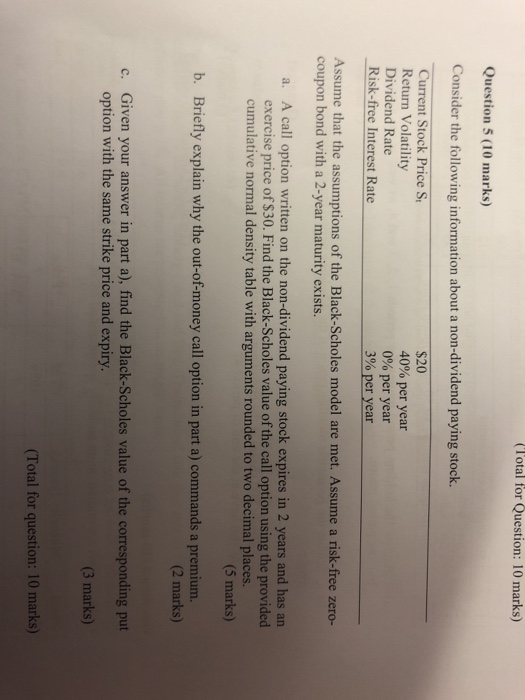

Total for Question: 10 marks) Question 5 (10 marks) Consider the following information about a Current Stock Price S non-dividend paying stock. $20 40% per year 000 per year 3% per year Return Volatility Dividend Rate Risk-free Interest Rate Assume that the assumptions of the Black-Scholes model are met. Assume a risk-free zero- coupon bond with a 2-year maturity exists. A call option written on the non-dividend paying stock expires in 2 years and has an exercise price of $30. Find the Black-Scholes value of the call option using the provided a. cumulative normal density table with arguments rounded to two decimal places. (5 marks) b. Briefly explain why the out-of-money call option in part a) commands a premium. (2 marks) c. Given your answer in part a), find the Black-Scholes value of the corresponding put option with the same strike price and expiry (3 marks) (Total for question: 10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts