Question: Total for question 620 marts Question 7 18 Say Ltd is evaluating a number of capital investment opportunities. Two of projects are shown below. PB

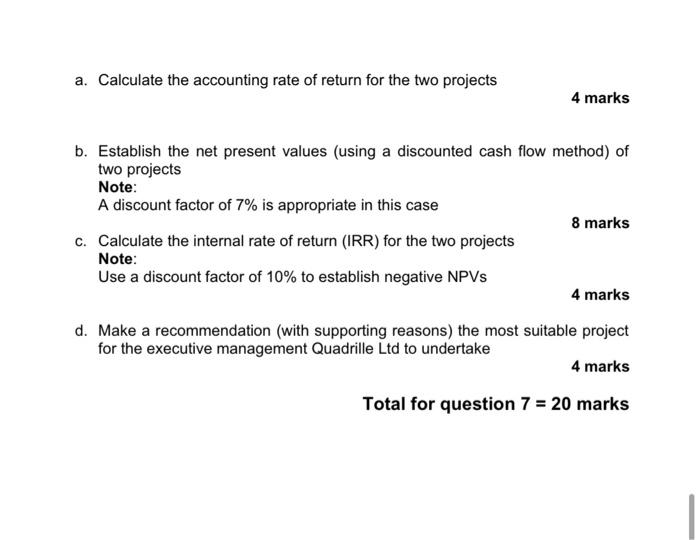

Total for question 620 marts Question 7 18 Say Ltd is evaluating a number of capital investment opportunities. Two of projects are shown below. PB Projects: Selling price per 30 40 5 Variable cost per U Pied costs per 20.000 30.000 Expected sales Year 1 Year Year 3 Year 4 Year 25 P8 Units 3,000 4,000 3.000 2.000 1.700 Units 2000 2.000 2.000 2.000 2.000 Further information Project P8 Project Ps will require an initial investment of 200.000. The investment assets are expected to have a residual value of 10.000 at the end of the projects 5 year e-cycle Project P9 Project P9 will require an initial investment of 110,000. The investments of this project will have no residual value after 5 years. Depreciation Al project assets acquired will be subject to depreciation using the stregtime method Working capital The working capital investment requirements for the two projects are: The initial working capital bevestment for project Ps is 20,000. There we be no increase to this value PS The working capital investment for project P8 is 10,000. This will 15,000 during the project's second year Al working capital investment will be returned back to cash at the end of the projects 5-year time horizons. Required 19 Calculate the accounting rate of return for the two projects a. Calculate the accounting rate of return for the two projects 4 marks b. Establish the net present values (using a discounted cash flow method) of two projects Note: A discount factor of 7% is appropriate in this case 8 marks C. Calculate the internal rate of return (IRR) for the two projects Note: Use a discount factor of 10% to establish negative NPVs 4 marks d. Make a recommendation (with supporting reasons) the most suitable project for the executive management Quadrille Ltd to undertake 4 marks Total for question 7 = 20 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts