Question: TOTAL MARKS (25 marks) QUESTION 3 a. Explain the concept of risk aversion and the state mean-variance criterion for an investor interested in portfolio D

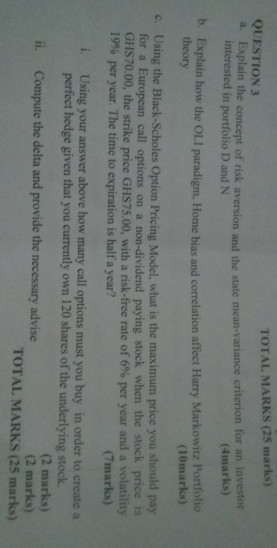

TOTAL MARKS (25 marks) QUESTION 3 a. Explain the concept of risk aversion and the state mean-variance criterion for an investor interested in portfolio D and N (4marks) Explain how the OLI paradigm, Home bias and correlation affect Harry Markowitz Portfotio theory b. (10marks) Using the Black-Scholes Option Pricing Model, what is the maximum price you should pay for a European call options on a non-dividend paying stock when the stock price is GHS 70.00, the strike price GHS75.00, with a risk-free rate of 6% per year and a volatility 19% per year. The time to expiration is half a year? c. (7marks) i. Using your answer above how many call options must you buy in order to create a perfect hedge given that you currently own 120 shares of the underlying stock i. Compute the delta and provide the necessary advise (2 marks) (2 marks) TOTAL MARKS (25 marks) TOTAL MARKS (25 marks) QUESTION 3 a. Explain the concept of risk aversion and the state mean-variance criterion for an investor interested in portfolio D and N (4marks) Explain how the OLI paradigm, Home bias and correlation affect Harry Markowitz Portfotio theory b. (10marks) Using the Black-Scholes Option Pricing Model, what is the maximum price you should pay for a European call options on a non-dividend paying stock when the stock price is GHS 70.00, the strike price GHS75.00, with a risk-free rate of 6% per year and a volatility 19% per year. The time to expiration is half a year? c. (7marks) i. Using your answer above how many call options must you buy in order to create a perfect hedge given that you currently own 120 shares of the underlying stock i. Compute the delta and provide the necessary advise (2 marks) (2 marks) TOTAL MARKS (25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts