Question: Total payroll was $ 5 0 8 , 0 0 0 , of which $ 1 0 4 , 0 0 0 is exempt from

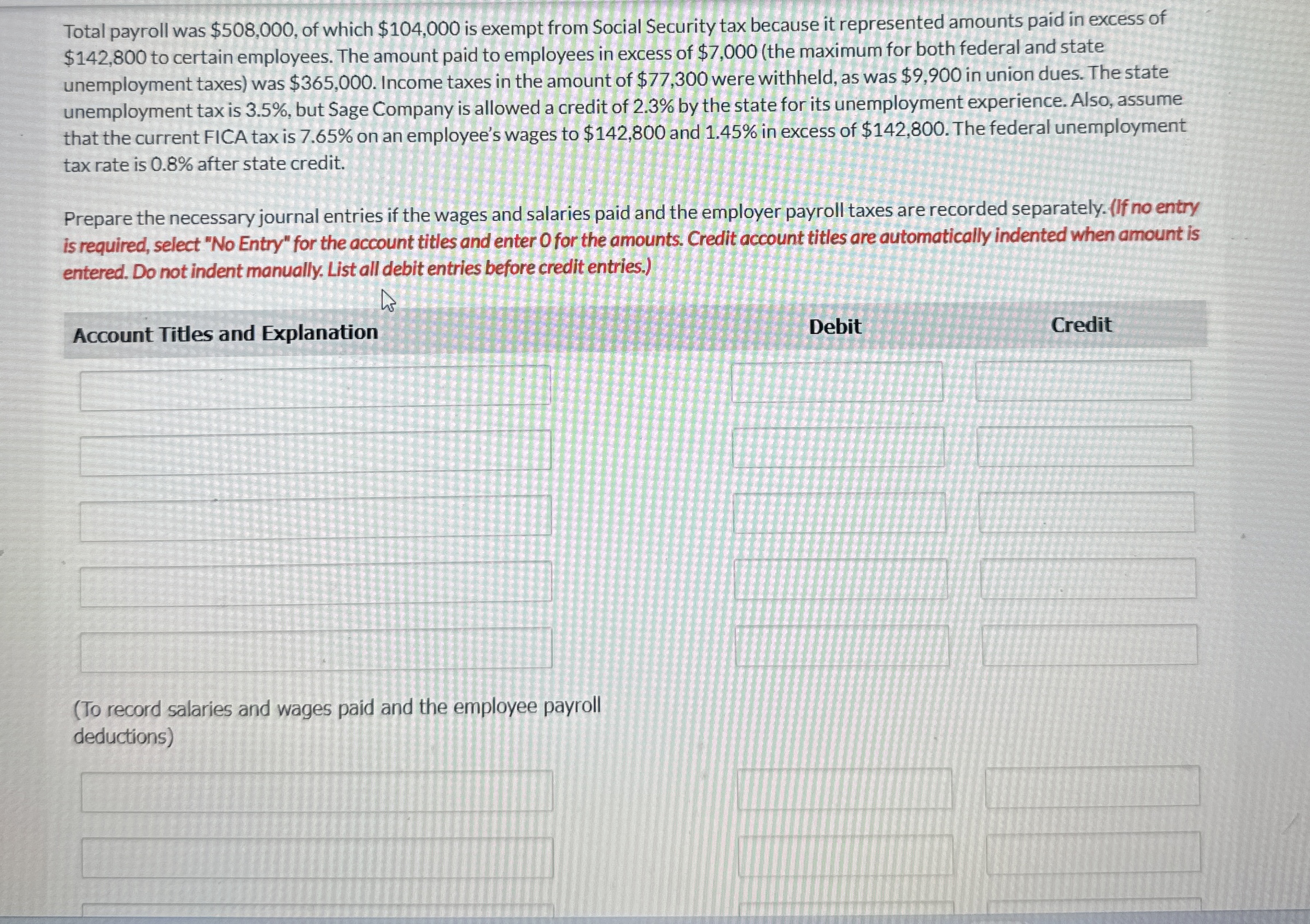

Total payroll was $ of which $ is exempt from Social Security tax because it represented amounts paid in excess of $ to certain employees. The amount paid to employees in excess of $the maximum for both federal and state unemployment taxes was $ Income taxes in the amount of $ were withheld, as was $ in union dues. The state unemployment tax is but Sage Company is allowed a credit of by the state for its unemployment experience. Also, assume that the current FICA tax is on an employee's wages to $ and in excess of $ The federal unemployment tax rate is after state credit.

Prepare the necessary journal entries if the wages and salaries paid and the employer payroll taxes are recorded separately. If no entry is required, select No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.

Account Titles and Explanation

To record salaries and wages paid and the employee payroll deductions

Debit

Credit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock