Question: Total Points: 10 Q1: (Covered Call and Protective Put) An investor buys 1 share of stock XYZ at $80 but now has a short term

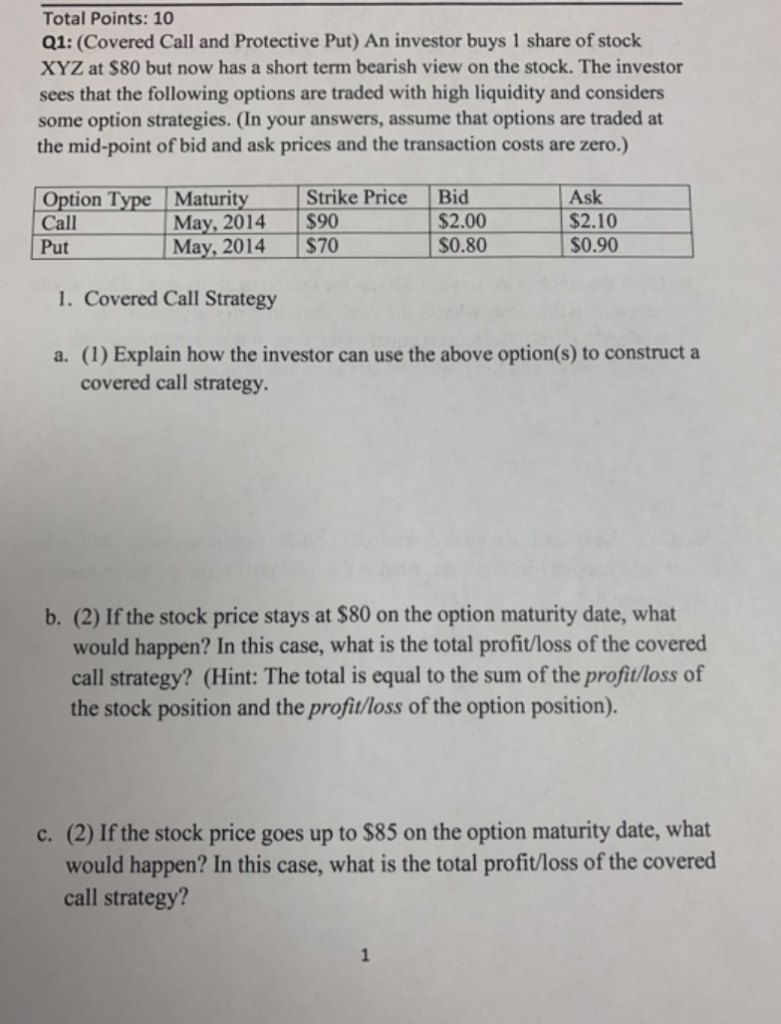

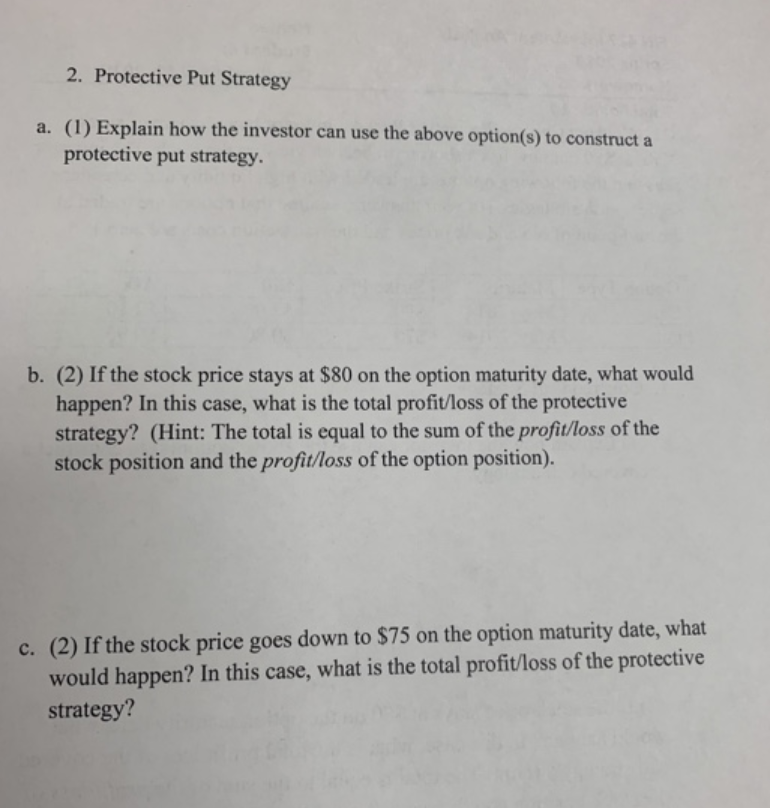

Total Points: 10 Q1: (Covered Call and Protective Put) An investor buys 1 share of stock XYZ at $80 but now has a short term bearish view on the stock. The investor sees that the following options are traded with high liquidity and considers some option strategies. (In your answers, assume that options are traded at the mid-point of bid and ask prices and the transaction costs are zero.) Option Type Maturity Strike Price Bid Ask Call Put May, 2014 $90 May, 2014 $70 $2.00 $0.80 S0.90 $2.10 1. Covered Call Strategy a. (1) Explain how the investor can use the above option(s) to construct a covered call strategy. b. (2) If the stock price stays at $80 on the option maturity date, what would happen? In this case, what is the total profit/loss of the covered call strategy? (Hint: The total is equal to the sum of the profit/loss of the stock position and the profitloss of the option position). (2) If the stock price goes up to $85 on the option maturity date, what would happen? In this case, what is the total profit/loss of the covered call strategy? c. 2. Protective Put Strategy a. (1) Explain how the investor can use the above option(s) to construct a protective put strategy b. (2) If the stock price stays at $80 on the option maturity date, what would happen? In this case, what is the total profit/loss of the protective strategy? (Hint: The total is equal to the sum of the profit/loss of the stock position and the profitloss of the option position). c. (2) If the stock price goes down to $75 on the option maturity date, what would happen? In this case, what is the total profit/loss of the protective strategy? Total Points: 10 Q1: (Covered Call and Protective Put) An investor buys 1 share of stock XYZ at $80 but now has a short term bearish view on the stock. The investor sees that the following options are traded with high liquidity and considers some option strategies. (In your answers, assume that options are traded at the mid-point of bid and ask prices and the transaction costs are zero.) Option Type Maturity Strike Price Bid Ask Call Put May, 2014 $90 May, 2014 $70 $2.00 $0.80 S0.90 $2.10 1. Covered Call Strategy a. (1) Explain how the investor can use the above option(s) to construct a covered call strategy. b. (2) If the stock price stays at $80 on the option maturity date, what would happen? In this case, what is the total profit/loss of the covered call strategy? (Hint: The total is equal to the sum of the profit/loss of the stock position and the profitloss of the option position). (2) If the stock price goes up to $85 on the option maturity date, what would happen? In this case, what is the total profit/loss of the covered call strategy? c. 2. Protective Put Strategy a. (1) Explain how the investor can use the above option(s) to construct a protective put strategy b. (2) If the stock price stays at $80 on the option maturity date, what would happen? In this case, what is the total profit/loss of the protective strategy? (Hint: The total is equal to the sum of the profit/loss of the stock position and the profitloss of the option position). c. (2) If the stock price goes down to $75 on the option maturity date, what would happen? In this case, what is the total profit/loss of the protective strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts