Question: Total points: 100 Question 1 (35 points) Suppose there are four states of nature, recession, slow growth, moderate growth and pros- perity with probability of

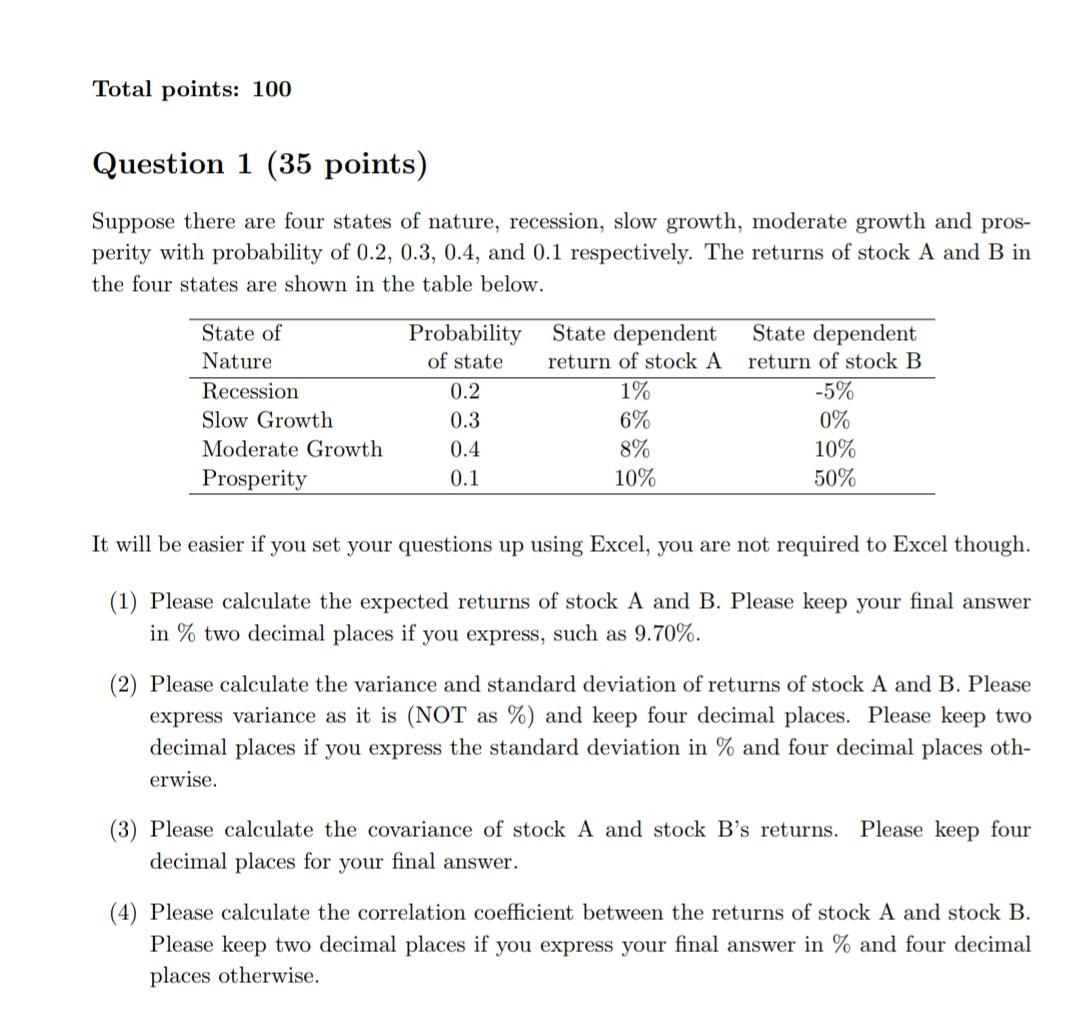

Total points: 100 Question 1 (35 points) Suppose there are four states of nature, recession, slow growth, moderate growth and pros- perity with probability of 0.2, 0.3, 0.4, and 0.1 respectively. The returns of stock A and B in the four states are shown in the table below. State of Nature Recession Slow Growth Moderate Growth Prosperity Probability of state 0.2 0.3 0.4 0.1 State dependent return of stock A 1% 6% 8% State dependent return of stock B -5% 0% 10% 50% 10% It will be easier if you set your questions up using Excel, you are not required to Excel though. (1) Please calculate the expected returns of stock A and B. Please keep your final answer in % two decimal places if you express, such as 9.70%. (2) Please calculate the variance and standard deviation of returns of stock A and B. Please express variance as it is (NOT as %) and keep four decimal places. Please keep two decimal places if you express the standard deviation in % and four decimal places oth- erwise. (3) Please calculate the covariance of stock A and stock B's returns. Please keep four decimal places for your final answer. (4) Please calculate the correlation coefficient between the returns of stock A and stock B. Please keep two decimal places if you express your final answer in % and four decimal places otherwise

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts