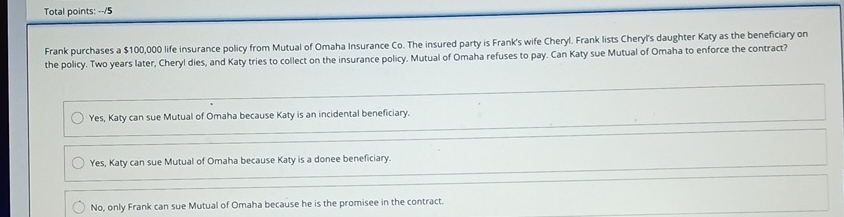

Question: Total points: - / 5 Frank purchases a $ 1 0 0 , 0 0 0 life insurance policy from Mutual of Omaha Insurance Co

Total points:

Frank purchases a $ life insurance policy from Mutual of Omaha Insurance Co The insured party is Frank's wife Cheryl. Frank lists Cheryl's daughter Katy as the beneficiary on the policy. Two years later, Cheryl dies, and Katy tries to collect on the insurance policy. Mutual of Omaha refuses to pay. Can Katy sue Mutual of Omaha to enforce the contract?

Yes, Katy can sue Mutual of Omaha because Katy is an incidental beneficiary.

Yes, Katy can sue Mutual of Omaha because Katy is a donee beneficiary.

No only Frank can sue Mutual of Omaha because he is the promisee in the contract.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock