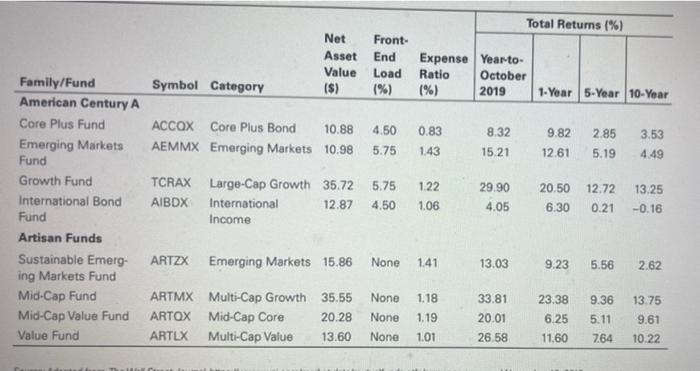

Question: Total Returns (%) Net Asset Value ($) Front- End Load (%) Expense Year-to- Ratio October (%) 2019 Symbol Category 1-Year 5-Year 10-Year 4.50 0.83 ACCOX

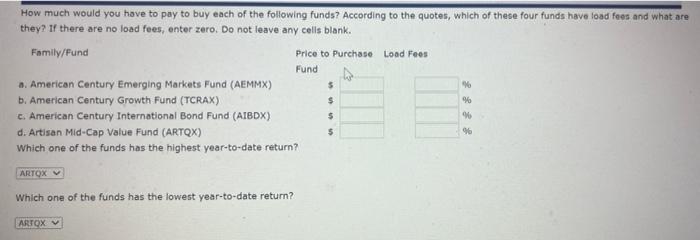

Total Returns (%) Net Asset Value ($) Front- End Load (%) Expense Year-to- Ratio October (%) 2019 Symbol Category 1-Year 5-Year 10-Year 4.50 0.83 ACCOX Core Plus Bond 10.88 AEMMX Emerging Markets 10.98 8.32 3.53 9.82 12.61 2.85 5.19 5.75 1.43 15.21 4.49 1.22 Family/Fund American Century A Core Plus Fund Emerging Markets Fund Growth Fund International Bond Fund Artisan Funds Sustainable Emerg- ing Markets Fund Mid-Cap Fund Mid-Cap Value Fund Value Fund TCRAX Large-Cap Growth 35.72 AIBDX International 12.87 Income 5.75 4.50 29.90 4.05 20.50 6.30 12.72 0.21 1.06 13.25 -0.16 ARTZX Emerging Markets 15.86 None 1.41 13.03 9.23 5.56 2.62 13.75 ARTMX Multi-Cap Growth 35.55 ARTOX Mid-Cap Core 20.28 ARTLX Multi-Cap Value 13.60 None None None 1.18 1.19 1.01 33.81 20.01 26.58 23.38 6.25 9.36 5.11 764 9.61 10.22 11.60 How much would you have to pay to buy each of the following funds? According to the quotes, which of these four funds have load foes and what are they? If there are no load fees, enter zero. Do not leave any cells blank. Family/Fund Price to purchase Load Fees Fund American Century Emerging Markets Fund (AEMMX) b. American Century Growth Fund (TCRAX) c. American Century International Bond Fund (AIBDX) d. Artisan Mid-Cap Value Fund (ARTOX) Which one of the funds has the highest year-to-date return? $ $ $ % 5 96 ARTOX Which one of the funds has the lowest year-to-date return? ARTOX

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts