Question: TP 5 - 2 8 . A wealthy taxpayer is planning to start an online business. The taxpayer expects to generate tax losses for at

TP A wealthy taxpayer is planning to start an online business. The taxpayer expects to generate tax losses for at least the first years of the business. The taxpayer also hopes to cash out of the business within years by going public or selling to another business. Discuss the pros and cons of starting out as a regular C corporation versus a sole proprietorship or some other passthrough entity In your discussion, indicate whether the following matters.

a The investor cashes out via going public or by selling to another business.

b The investor is actively involved in the operations of the business.

How might your answers to parts a and b differ if the investor is not so wealthy?TP A wealthy taxpayer is planning to start an online business. The taxpayer expects to generate tax losses for at least the first years of the business. The taxpayer also hopes to cash out of the business within years by going public or selling to another business. Discuss the pros and cons of starting out as a regular C corporation versus a sole proprietorship or some other passthrough entity In your discussion, indicate whether the following matters.

a The investor cashes out via going public or by selling to another business.

The investor is actively involved in the operations of the business.

How might your answers to parts a and b differ if the investor is not so wealthy?respond?

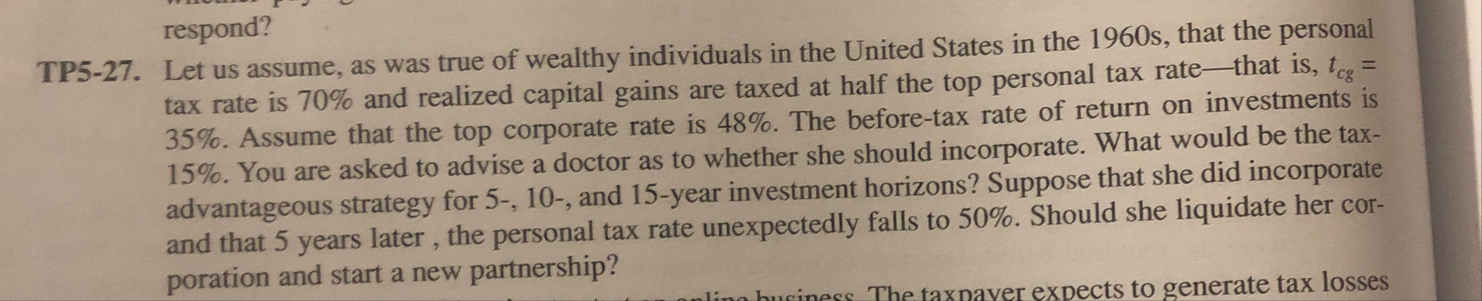

TP Let us assume, as was true of wealthy individuals in the United States in the s that the personal tax rate is and realized capital gains are taxed at half the top personal tax ratethat is Assume that the top corporate rate is The beforetax rate of return on investments is You are asked to advise a doctor as to whether she should incorporate. What would be the taxadvantageous strategy for and year investment horizons? Suppose that she did incorporate and that years later, the personal tax rate unexpectedly falls to Should she liquidate her corporation and start a new partnership?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock