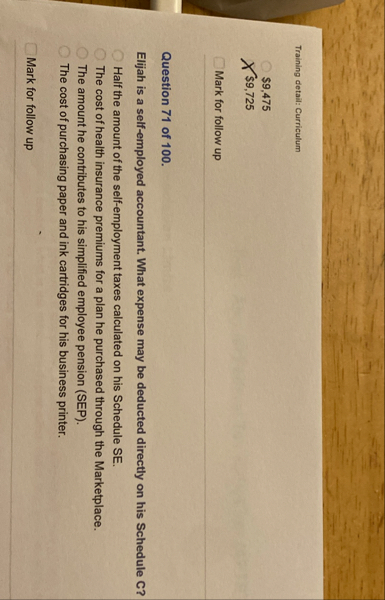

Question: Training detail: Curriculum $ 9 , 4 7 5 $ 9 , 7 2 5 Mark for follow up Question 7 1 of 1 0

Training detail: Curriculum

$

$

Mark for follow up

Question of

Elijah is a selfemployed accountant. What expense may be deducted directly on his Schedule C

Half the amount of the selfemployment taxes calculated on his Schedule SE

The cost of health insurance premiums for a plan he purchased through the Marketplace.

The amount he contributes to his simplified employee pension SEP

The cost of purchasing paper and ink cartridges for his business printer.

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock