Question: Training detail: Curriculum rea 7 / 2 7 / 2 5 , 1 0 : 0 2 PM Test - Quality and Accuracy: Income (

Training detail: Curriculum

rea

: PM

Test Quality and Accuracy: Income

Section

Question of

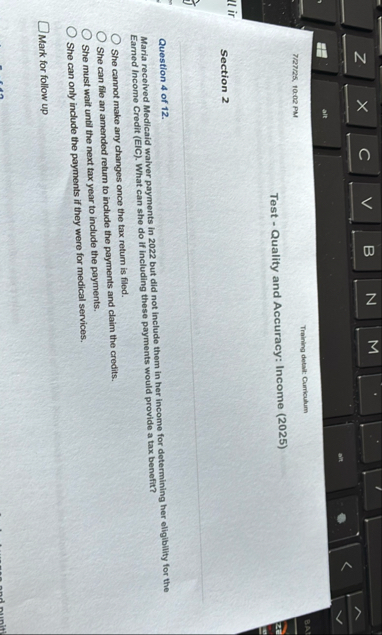

Maria received Medicaid walver payments in but did not include them in her income for determining her eligiblility for the Earned Income Credit EIC What can she do if including these payments would provide a tax benefit?

She cannot make any changes once the tax return is filed.

She can file an amended return to include the payments and claim the credits.

She must wait until the next tax year to include the payments.

She can only include the payments if they were for medical services.

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock