Question: Training detail: Currieulum 8 / 3 / 2 5 , 4 : 4 2 PM Test - Quality and Accuracy: Income ( 2 0 2

Training detail: Currieulum

: PM

Test Quality and Accuracy: Income

Section

Question of

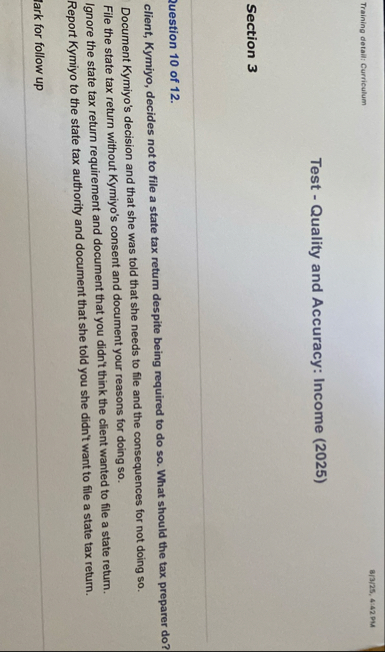

client, Kymiyo, decides not to file a state tax return despite being required to do so What should the tax preparer do

Document Kymiyo's decision and that she was told that she needs to file and the consequences for not doing so

File the state tax return without Kymiyo's consent and document your reasons for doing so

Ignore the state tax return requirement and document that you didn't think the client wanted to file a state return.

Report Kymiyo to the state tax authority and document that she told you she didn't want to file a state tax return.

lark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock