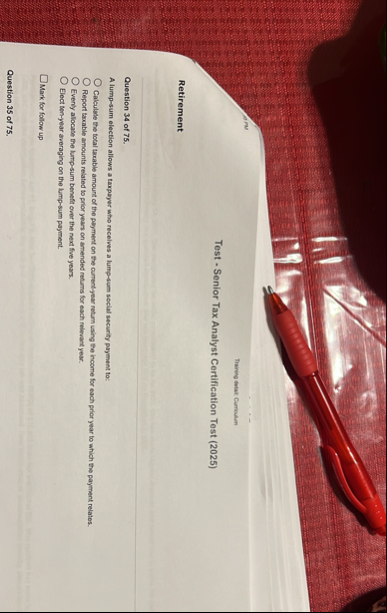

Question: Training setal Currobam Test - Senior Tax Analyst Certification Test ( 2 0 2 5 ) Retirement Question 3 4 of 7 5 . A

Training setal Currobam

Test Senior Tax Analyst Certification Test

Retirement

Question of

A lumpsum election allows a taxpayer who recelves a lumpsum social security payment to:

Calculate the total taxable amount of the puyment on the currentyear return using the income for each prior year to which the payment relates.

Report taxable amounts related to prior years on amended returns for each relevant year.

Evenly allocate the lumpsum benefit over the next five years.

Elect tenyear averaging on the lumpsum payment.

Mark for follow up

Question of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock