Question: Tranches Create a thread and answer the following question: Go to slide 17, compare the three tranches of the same debt. The yield (return) for

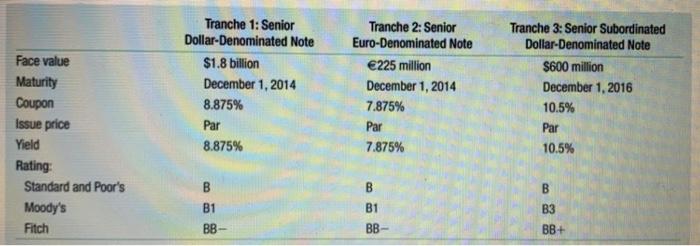

Tranches Create a thread and answer the following question: Go to slide 17, compare the three tranches of the same debt. The yield (return) for these three tranches are different. What are the observable differences between these three tranches that might justify the differences in yield (return) Face value Maturity Coupon Issue price Yield Rating: Standard and Poor's Moody's Fitch Tranche 1: Senior Dollar-Denominated Note $1.8 billion December 1, 2014 8.875% Par 8.875% Tranche 2: Senior Euro-Denominated Note 225 million December 1, 2014 7.875% Par 7.875% Tranche 3: Senior Subordinated Dollar-Denominated Note $600 million December 1, 2016 10.5% Par 10.5% B B B1 BB- B1 BB B B3 BB+

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts