Question: (Transaction Exposure) Trident - A U.S.-based company, has concluded a sale of telecommunications equipment to Regency (U.K.). A total payment of 2,000,000 is due in

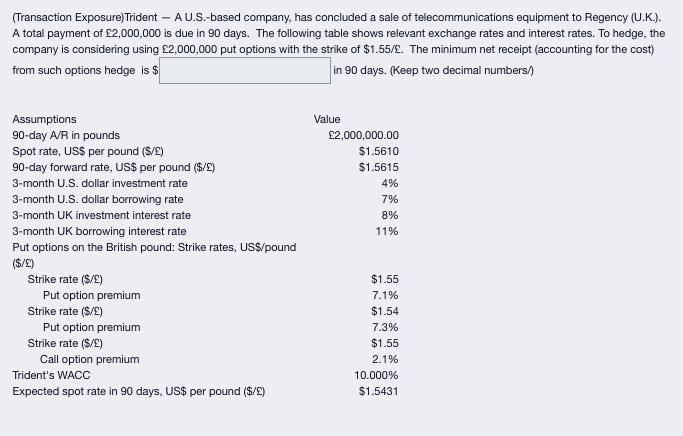

(Transaction Exposure) Trident - A U.S.-based company, has concluded a sale of telecommunications equipment to Regency (U.K.). A total payment of 2,000,000 is due in 90 days. The following table shows relevant exchange rates and interest rates. To hedge, the company is considering using 2,000,000 put options with the strike of $1.55/. The minimum net receipt (accounting for the cost) from such options hedge is $ in 90 days. (Keep two decimal numbers/) Value 2,000,000.00 $1.5610 $1.5615 4% 7% 8% 11% Assumptions 90-day A/R in pounds Spot rate, US$ per pound (5/2) 90-day forward rate, US$ per pound ($/L) 3-month U.S. dollar investment rate 3-month U.S. dollar borrowing rate 3-month UK investment interest rate 3-month UK borrowing interest rate Put options on the British pound: Strike rates, US$/pound ($/L) Strike rate (S/L) Put option premium Strike rate (S/L) Put option premium Strike rate ($/) Call option premium Trident's WACC Expected spot rate in 90 days, US$ per pound ($/L) $1.55 7.1% $1.54 7.3% $1.55 2.1% 10.000% $1.5431

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts