Question: Transactions between January 1 , 2 0 2 0 , and December 3 1 , 2 0 2 3 , and their records i n

Transactions between January and December and their records the ledger were follows:

July

Truckno. was traded for a larger one The agreed purchase price value was $ Monty paid the automobile dealer $ cash the transaction. The entry was a debit Vehicles and a credit Cash, $

Jan.

Truckno. was sold for $ cash. The entry was a debit Cash and a credit Vehicles, $

July

A new truck was acquired for $ cash and was charged that amount the Vehicles account. truck was not retired.

July

Truck was badly damaged accident that was sold scrap for $ cash. Monty received $ from the insurance company. The entry made the bookkeeper was a debit Cash, $; and credits Gain Disposal Vehicles, $; and Vehicles, $

Entries for depreciation were made the close each year follows: $;$;$; and $

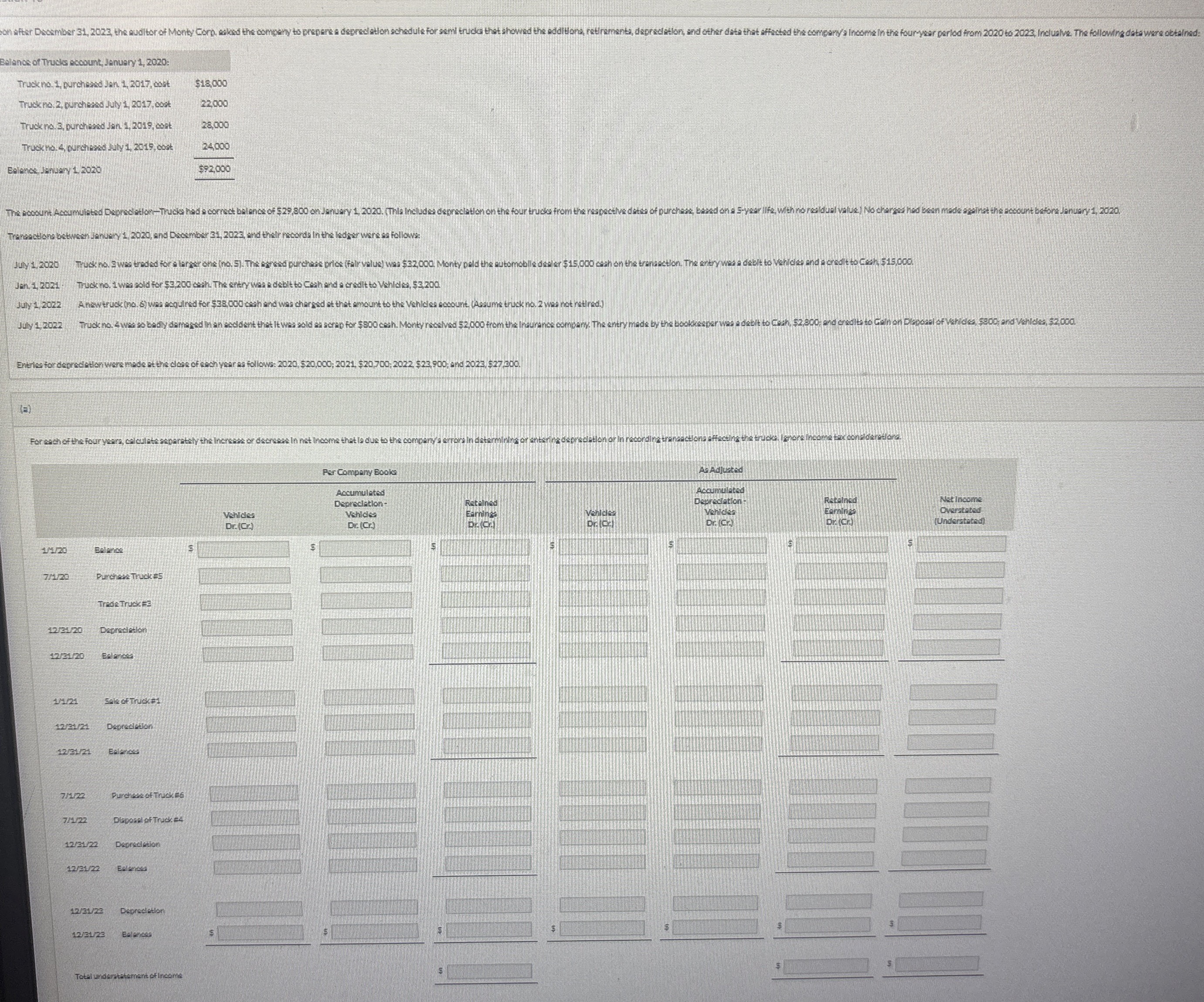

For each the four years, calculate separately the increase decrease net income that due the company's errors determining entering depreciation recording transactions affecting the trucks. Ignore income tax considerations.

Transactions between January and December and their records the ledger were follows:

July

Truckno. was traded for a larger one The agreed purchase price value was $ Monty paid the automobile dealer $ cash the transaction. The entry was a debit Vehicles and a credit Cash, $

Jan.

Truckno. was sold for $ cash. The entry was a debit Cash and a credit Vehicles, $

July

A new truck was acquired for $ cash and was charged that amount the Vehicles account. truck was not retired.

July

Truck was badly damaged accident that was sold scrap for $ cash. Monty received $ from the insurance company. The entry made the bookkeeper was a debit Cash, $; and credits Gain Disposal Vehicles, $; and Vehicles, $

Entries for depreciation were made the close each year follows: $;$;$; and $

For each the four years, calculate separately the increase decrease net income that due the company's errors determining entering depreciation recording transactions affecting the trucks. Ignore income tax considerations. obtained:

Transactions between January and December and their records the ledger were follows:

Jan. Truck was sold for $ cash. The entry was a debit Cash and a credit Vehicles, $

July A new truck was acquired for $ cash and was charged that amount the Vehicles account. truck was not retired.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock