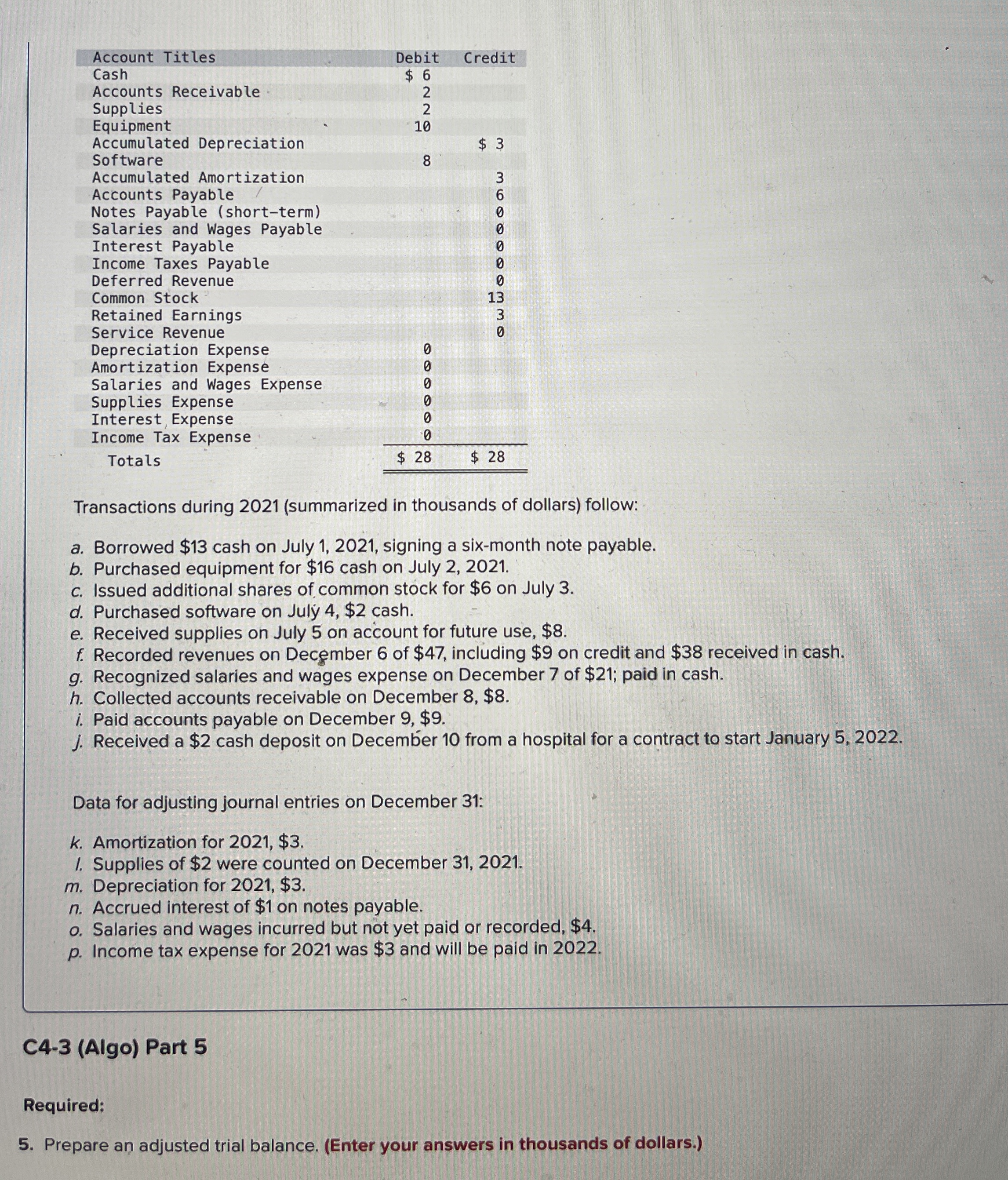

Question: Transactions during 2 0 2 1 ( summarized in thousands of dollars ) follow: a . Borrowed $ 1 3 cash on July 1 ,

Transactions during summarized in thousands of dollars follow:

a Borrowed $ cash on July signing a sixmonth note payable.

b Purchased equipment for $ cash on July

c Issued additional shares of common stock for $ on July

d Purchased software on July $ cash.

e Received supplies on July on account for future use, $

f Recorded revenues on December of $ including $ on credit and $ received in cash.

g Recognized salaries and wages expense on December of $; paid in cash.

h Collected accounts receivable on December $

i Paid accounts payable on December $

J Received a $ cash deposit on December from a hospital for a contract to start January

Data for adjusting journal entries on December :

k Amortization for $

I. Supplies of $ were counted on December

m Depreciation for $

n Accrued interest of $ on notes payable.

o Salaries and wages incurred but not yet paid or recorded, $

p Income tax expense for was $ and will be paid in

Prepare an adjusted trial balance. Enter your answers in thousands of dollars.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock