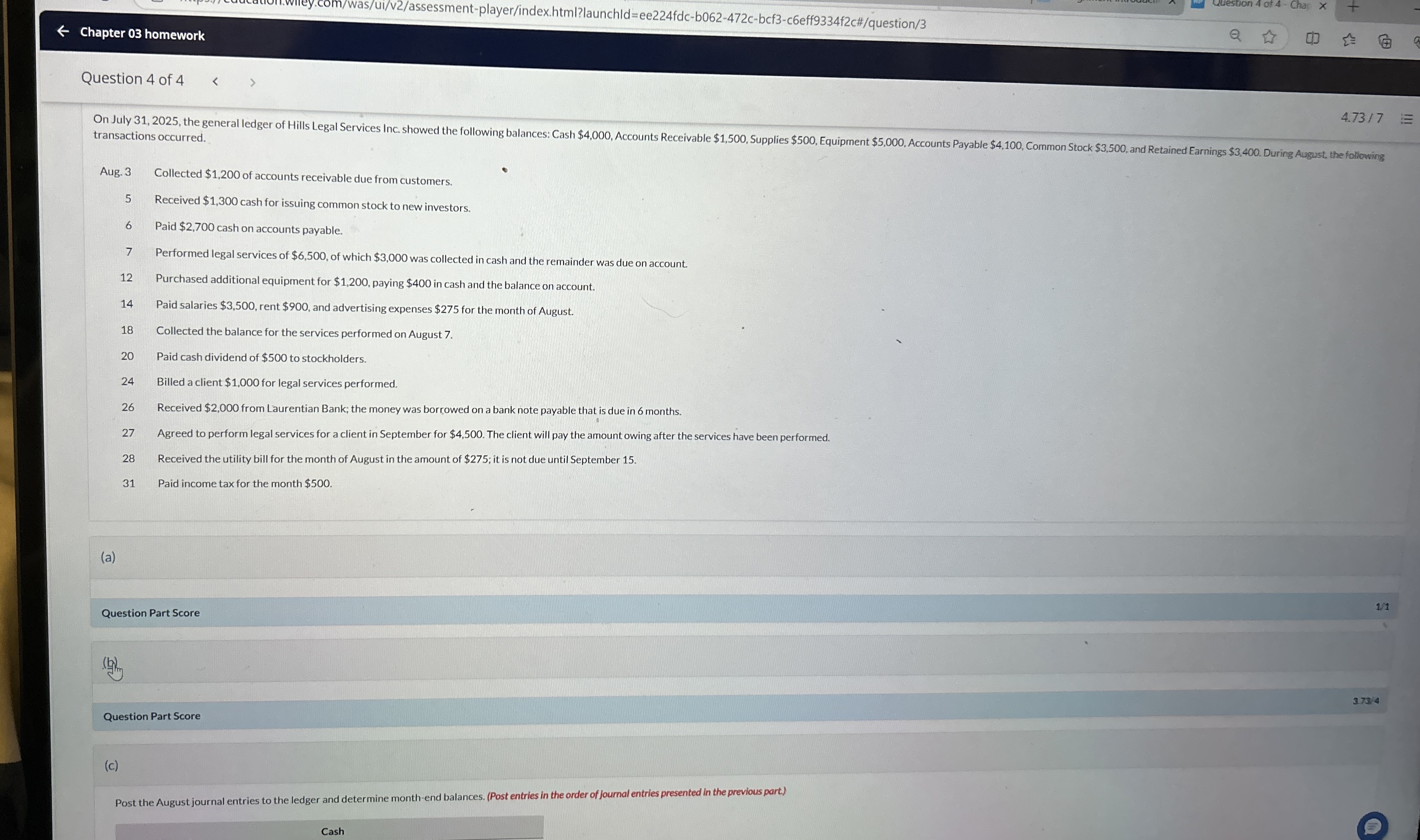

Question: transactions occurred. Aug. 3 Collected $ 1 , 2 0 0 of accounts receivable due from customers. 5 Received $ 1 , 3 0 0

transactions occurred.

Aug. Collected $ of accounts receivable due from customers.

Received $ cash for issuing common stock to new investors.

Paid $ cash on accounts payable.

Performed legal services of $ of which $ was collected in cash and the remainder was due on account.

Purchased additional equipment for $ paying $ in cash and the balance on account.

Paid salaries $ rent $ and advertising expenses $ for the month of August.

Collected the balance for the services performed on August

Paid cash dividend of $ to stockholders.

Billed a client $ for legal services performed.

Received $ from Laurentian Bank; the money was borrowed on a bank note payable that is due in months.

Agreed to perform legal services for a client in September for $ The client will pay the amount owing after the services have been performed.

Received the utility bill for the month of August in the amount of $; it is not due until September

Paid income tax for the month $

a

c

Post the August journal entries to the ledger and determine monthend balances. Post entries in the order of Journal entries presented in the previous part.

Make a journal on the ledger

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock