Question: Transactions: (use the transaction # as the date - if no entry is required, write No Entry) 1. Company A sells $1,000 of merchandise to

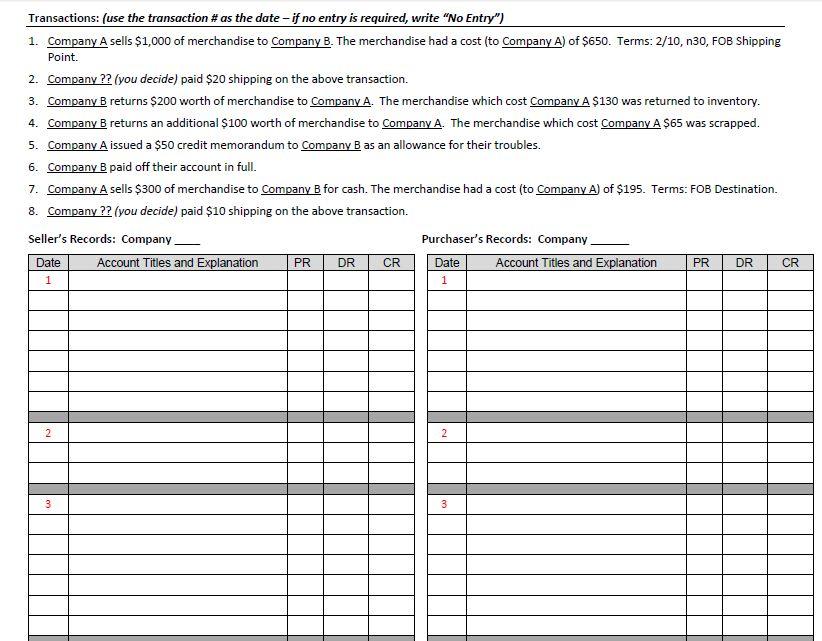

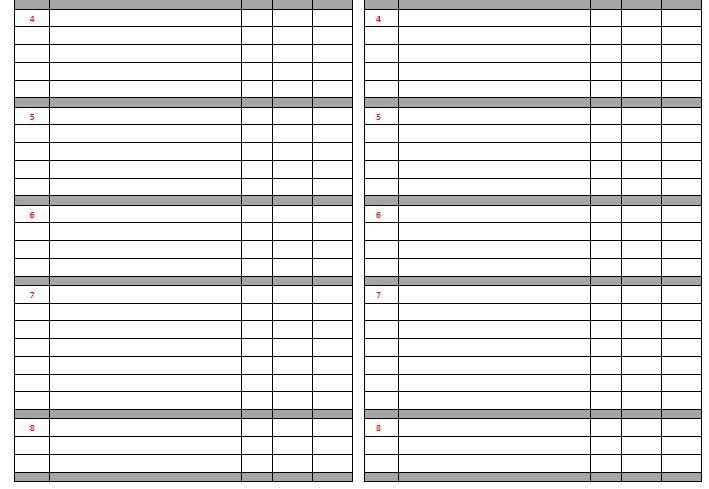

Transactions: (use the transaction # as the date - if no entry is required, write "No Entry") 1. Company A sells $1,000 of merchandise to Company B. The merchandise had a cost (to Company A) of $650. Terms: 2/10,n30, FOB Shipping Point. 2. Company ?? (you decide) paid $20 shipping on the above transaction. 3. Company B returns $200 worth of merchandise to Company A. The merchandise which cost Company A $130 was returned to inventory. 4. Company B returns an additional $100 worth of merchandise to Company A. The merchandise which cost Company A $65 was scrapped. 5. Company A issued a $50 credit memorandum to Company B as an allowance for their troubles. 6. Company B paid off their account in full. 7. Company A sells $300 of merchandise to Company B for cash. The merchandise had a cost (to Company A) of $195. Terms: FOB Destination. 8. Company ?? (you decide) paid $10 shipping on the above transaction. Seller's Records: Company Purchaser's Records: Company Date Account Titles and Explanation Date Account Titles and Explanation DR CR PR DR CR PR 1 1 2 3 3 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts