Question: 10. [6 marks] (a) Consider a 1-year American put option on a non-dividend paying stock when the stock price is $100, the strike price is

![10. [6 marks] (a) Consider a 1-year American put option on](https://s3.amazonaws.com/si.experts.images/answers/2024/07/66856d98704e2_37666856d98239c9.jpg)

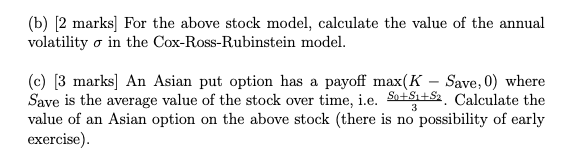

10. [6 marks] (a) Consider a 1-year American put option on a non-dividend paying stock when the stock price is $100, the strike price is $100, and the risk-free interest rate is 10% per annum. Calculate the value of the option using a two-step binomial tree with u = 1.1 and d=1/u for each period. (b) [2 marks] For the above stock model, calculate the value of the annual volatility o in the Cox-Ross-Rubinstein model. (c) [3 marks] An Asian put option has a payoff max(K Save, 0) where Save is the average value of the stock over time, i.e. So+Su+S2 Calculate the value of an Asian option on the above stock (there is no possibility of early exercise). 10. [6 marks] (a) Consider a 1-year American put option on a non-dividend paying stock when the stock price is $100, the strike price is $100, and the risk-free interest rate is 10% per annum. Calculate the value of the option using a two-step binomial tree with u = 1.1 and d=1/u for each period. (b) [2 marks] For the above stock model, calculate the value of the annual volatility o in the Cox-Ross-Rubinstein model. (c) [3 marks] An Asian put option has a payoff max(K Save, 0) where Save is the average value of the stock over time, i.e. So+Su+S2 Calculate the value of an Asian option on the above stock (there is no possibility of early exercise)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts