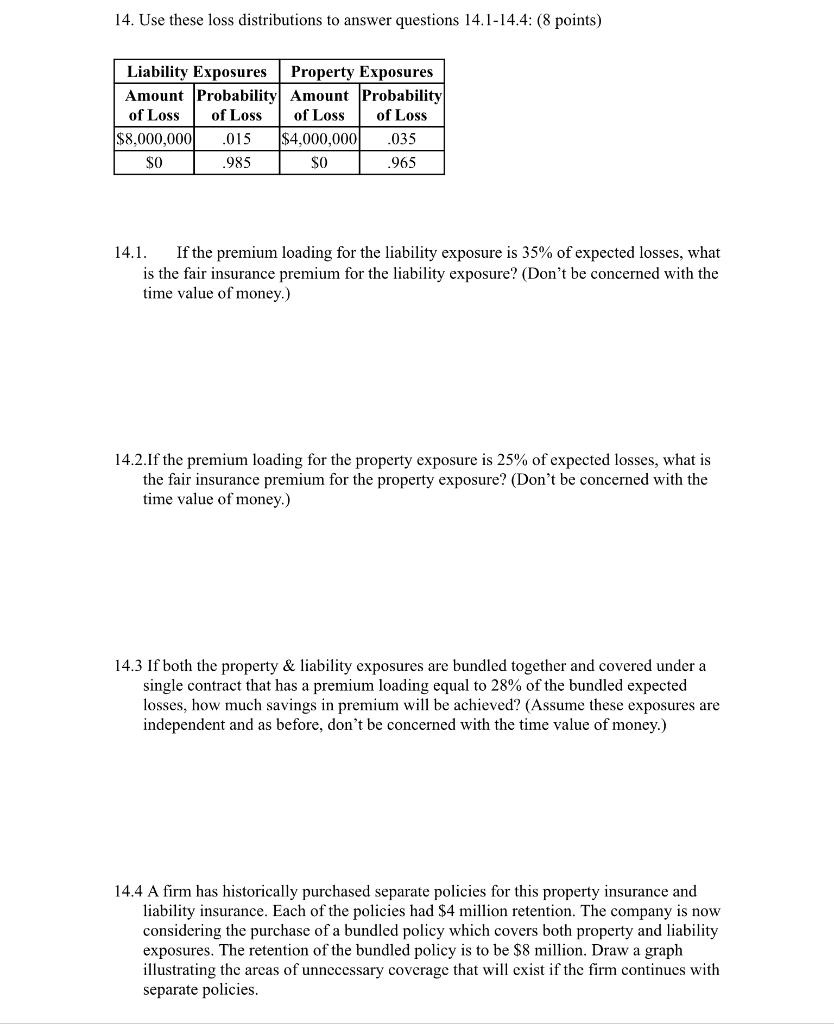

Question: 14. Use these loss distributions to answer questions 14.1-14.4: (8 points) Liability Exposures Property Exposures Amount Probability Amount Probability of Loss of Loss of Loss

14. Use these loss distributions to answer questions 14.1-14.4: (8 points) Liability Exposures Property Exposures Amount Probability Amount Probability of Loss of Loss of Loss of Loss $8,000,000 .015 $4,000,000 .035 SO 1985 SO .965 14.1. If the premium loading for the liability exposure is 35% of expected losses, what is the fair insurance premium for the liability exposure? (Don't be concerned with the time value of money.) 14.2.If the premium loading for the property exposure is 25% of expected losses, what is the fair insurance premium for the property exposure? (Don't be concerned with the time value of money.) 14.3 If both the property & liability exposures are bundled together and covered under a single contract that has a premium loading equal to 28% of the bundled expected losses, how much savings in premium will be achieved? (Assume these exposures are independent and as before, don't be concerned with the time value of money.) 14.4 A firm has historically purchased separate policies for this property insurance and liability insurance. Each of the policies had $4 million retention. The company is now considering the purchase of a bundled policy which covers both property and liability exposures. The retention of the bundled policy is to be $8 million. Draw a graph illustrating the areas of unnecessary coverage that will exist if the firm continues with separate policies. 14. Use these loss distributions to answer questions 14.1-14.4: (8 points) Liability Exposures Property Exposures Amount Probability Amount Probability of Loss of Loss of Loss of Loss $8,000,000 .015 $4,000,000 .035 SO 1985 SO .965 14.1. If the premium loading for the liability exposure is 35% of expected losses, what is the fair insurance premium for the liability exposure? (Don't be concerned with the time value of money.) 14.2.If the premium loading for the property exposure is 25% of expected losses, what is the fair insurance premium for the property exposure? (Don't be concerned with the time value of money.) 14.3 If both the property & liability exposures are bundled together and covered under a single contract that has a premium loading equal to 28% of the bundled expected losses, how much savings in premium will be achieved? (Assume these exposures are independent and as before, don't be concerned with the time value of money.) 14.4 A firm has historically purchased separate policies for this property insurance and liability insurance. Each of the policies had $4 million retention. The company is now considering the purchase of a bundled policy which covers both property and liability exposures. The retention of the bundled policy is to be $8 million. Draw a graph illustrating the areas of unnecessary coverage that will exist if the firm continues with separate policies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts