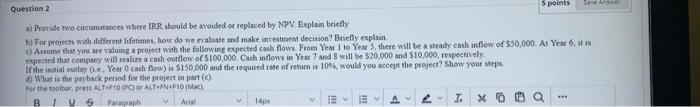

Question: 5 points SA Question 2 a) Provide two circumstances where IRR should be avoided or replaced by NPV Explain briefly b) For projects with different

5 points SA Question 2 a) Provide two circumstances where IRR should be avoided or replaced by NPV Explain briefly b) For projects with different lifetime, how do we evaluate and make investment decision Briefly explain. c) Asume that you are valuing a project with the following expected cash flow From Year 1 to Yen S, there will be a steady cash flow of $50,000. At Year 6 expected that company will realise a cash outflow of $100,000: Cash flows in Year 7 and 8 will be $20,000 and $10,000, respectively If the initial outlay (e. Year O cash flow) is $150,000 and the required rate of retum is 10%, would you accept the project? Show your Meps What is the payback period for the project in part (c) For the toolbar, pres ALTO POC ALTEN. 10 (Mac) B 9 Paragraph Aral 14ps I. X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts